The stock market has performed quite well since the Great Recession.

Despite intense volatility at times in 2025, the stock market continues to rocket higher and is now up 16.8% year to date (as of Dec. 5). This gives the benchmark S&P 500 (^GSPC 0.35%) index a chance of generating three straight years of returns of 20% or more, a feat that has rarely been achieved over the past century.

Falling interest rates, an economy that continues to avoid a recession, and the rise of artificial intelligence have combined to create a multiyear bull market that many Wall Street strategists expect to continue.

Image source: Getty Images.

The market remains fragile, however. Economic conditions are far from ideal with the cost of living extremely high and housing unaffordable for many, making saving for retirement a challenging process. However, interest rates have been extremely low for the majority of the years since the Great Recession, and the Federal Reserve has injected trillions into the economy, which has likely contributed to inflating asset values.

If you’d invested $5,000 in the S&P 500 15 years ago, here’s how much you’d have today.

The market has ripped

Amid inflating assets and the high cost of living, the stock market has generated very strong returns, lifting retirement accounts and disposable income for those who invested, although perhaps not as much as it appears when adjusting for real inflation.

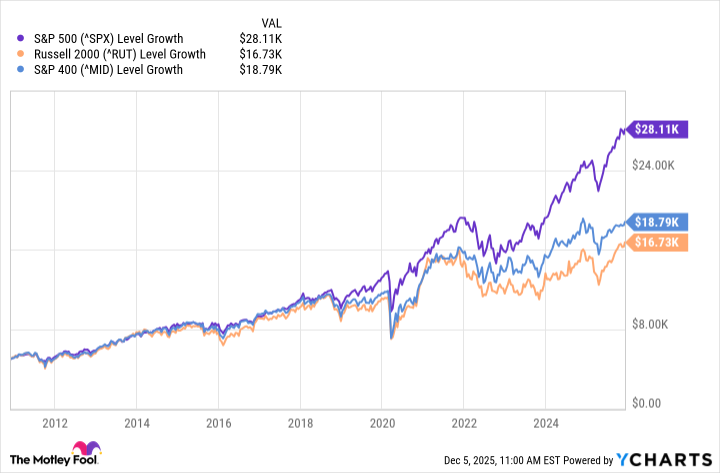

Data by YCharts.

As you can see above, $5,000 invested in the S&P 500 15 years ago is now worth over $28,000 today, a performance that has crushed the returns generated by the Russell 2000 and S&P 400, which represent mid-cap stocks. That $28,000 also represents a compound annual growth rate in excess of 12% over the past 15 years.

Bram Berkowitz has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.