What’s New

President Joe Biden has endorsed a ban on congressional stock trading—a move that could affect Nancy Pelosi, one of the wealthiest Democrats in Congress.

Biden discussed a ban during an interview with Faiz Shakir, a political adviser for Senator Bernie Sanders, released on Tuesday night by the More Perfect Union channel on YouTube.

“I think we should be changing the law…at the federal level [so] that nobody in the Congress should be able to make money in the stock market while they’re in the Congress,” Biden said.

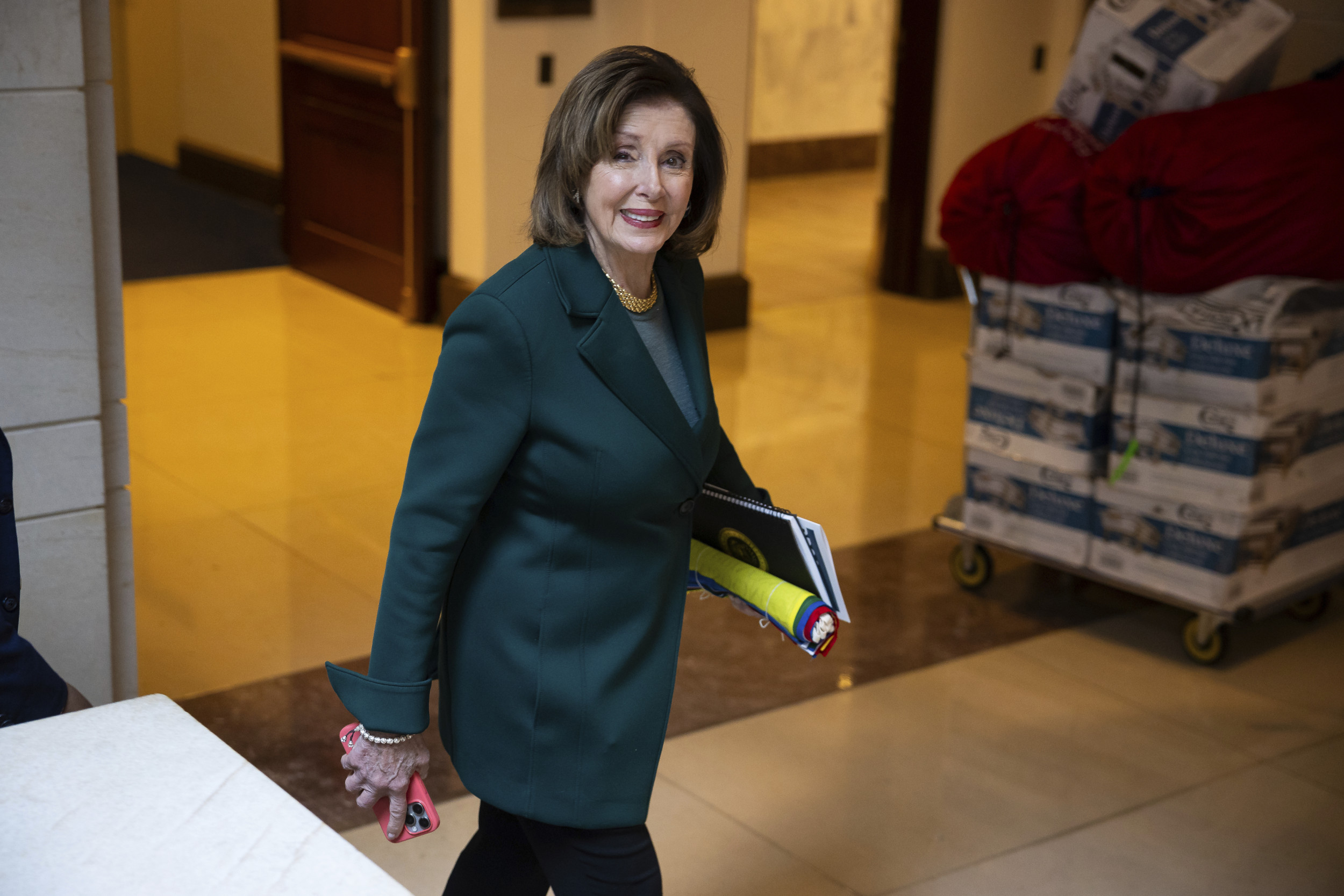

Francis Chung/AP

“I don’t know how you look your constituents in the eye and know, because the job they gave you, gave you an inside track to make more money,” he said.

Newsweek has reached out to the White House and representatives of Nancy Pelosi via email for comment.

Why It Matters

Former House Speaker Nancy Pelosi, whose husband Paul Pelosi is a wealthy investor, is one of the most prominent lawmakers who has benefited from stock trades.

She came under scrutiny in 2022 after her husband made $5.3 million off Alphabet options before a House panel considered antitrust actions against the Google parent company.

Nancy Pelosi—who is thought to have played a critical role in the behind-the-scenes effort to get Biden to end his reelection campaign this summer—denied at the time accusations that Paul Pelosi traded on information she gave to him and pointed out that her husband’s options were set to expire the same day he exercised them.

What To Know

Congressional stock trading is a controversial issue that has previously attracted the attention of lawmakers, but attempts to legislate against the practice have failed.

A bipartisan proposal to ban trading by members of Congress and their families has dozens of sponsors, including Democratic Representative Alexandria Ocasio-Cortez and former GOP Representative Matt Gaetz, but it has not received a vote, having stalled before reaching the House.

The bill, named the Bipartisan Restoring Faith in Government Act, would prohibit members of Congress and their spouses and dependents from purchasing or selling certain investments, such as individual stocks. If the bill passed, Congress members and their families would have to sell any shares they own within 90 days of the act’s effective date or place them in a blind trust. They would also have 90 days to release any shares they acquire in the future.

Unusual Whales, a financial services platform that focuses on congressional insider trading, said in June that Nancy Pelosi—who is currently in a hospital in Germany after hip replacement surgery following a fall during a congressional trip to Luxembourg—had nearly $4 million in gains from the Nvidia call options her husband purchased the previous November.

“She is up +210% in 197 days&still not sold her calls. Pelosi has made twenty times her salary,” Unusual Whales wrote on X. “Her portfolio is near all-time highs, up 93%.”

Nancy Pelosi, who has net worth of $114.7 million, according to Washington, D.C.-based nonprofit OpenSecrets, has previously declined to back a stock trading ban. “We are a free-market economy. They should be able to participate in that,” she told reporters in December 2021. But in February 2022, she appeared to backtrack on her position, telling reporters: “It’s complicated and members will figure it out. And then we’ll go forward with what the consensus is.”

While lawmakers are currently required to disclose stock transactions exceeding $1,000 under the STOCK Act and are prohibited from making trades based on insider information, some are late in filing notices and sometimes lawmakers may not file them at all. There are currently no public records of who has violated the act or received a fine, according to Business Insider.

In March 2020, when the COVID-19 pandemic was approaching, Senators Richard Burr and Kelly Loeffler were accused of buying and selling millions of dollars worth of stock after being briefed on the virus. Both denied the accusations. Meanwhile in 2022, at least 97 members of Congress traded stocks or other assets that intersected with their work or committees, according to The New York Times.

How Nancy Pelosi’s Net Worth Increased

Nancy Pelosi’s net worth has increased significantly since 2008, a year after she first became speaker, thanks in large part to the success of her husband, who is a venture capitalist and property investor.

In 2021 it was estimated to be as much as $171.4 million in an October 2022 report by The Washington Free Beacon, a conservative news outlet that arrived at that figure “by taking into account the ranges of all the individual assets and liabilities” in Nancy Pelosi’s financial disclosure statement.

The Washington Free Beacon also estimated then that her net worth had risen by $140 million since 2008.

OpenSecrets estimated Nancy Pelosi’s net worth at $115 million in 2020 from $41 million in 2004—the first year the organization began tracking members’ personal finances.

Meanwhile, the New York Post estimated that the Pelosis had made between $5.6 million and $30.4 million between 2007 and 2020 through capital gains and dividends from investments in five tech companies—Facebook, Google, Amazon, Apple and Microsoft—based on public disclosures.

What People Are Saying

Drew Hammill, Nancy Pelosi’s deputy chief of staff, said in a statement in July 2022 that the speaker “does not own any stocks.”

“As you can see from the required disclosures, with which the Speaker fully cooperates, these transactions are marked ‘SP’ for Spouse. The Speaker has no prior knowledge or subsequent involvement in any transactions,” Hamill said.

Meanwhile, in September 2022, Democratic Representative Abigail Spanberger slammed Pelosi for her apparent inaction on legislation that would require lawmakers’ investment assets to be placed in a blind trust.

“After first signaling her opposition to these reforms, the Speaker purportedly reversed her position. However, our bipartisan reform coalition was then subjected to repeated delay tactics, hand-waving gestures, and blatant instances of Lucy pulling the football,” Spanberger said in a statement.

“It’s yet another example of why I believe that the Democratic Party needs new leaders in the halls of Capitol Hill,” she said.

Shakir said in the interview that he admired Biden for having not “gone in early on Google, and Boeing, and Microsoft, and Nvidia, and, you know, Amazon” while he was a senator from Delaware, a position he held for 36 years. Biden has often talked about how he lived off only his salary while serving as a senator for Delaware rather than playing the stock market.

“Look, for 36 years I was listed as the poorest man in the Senate—not a joke,” the president said.

What Happens Next

President Biden’s comments mark his most hardline stance on congressional stock trading during his time in office. Former White House Press Secretary Jen Psaki said in 2022 that Biden would “let members of leadership in Congress and members of Congress determine what the rules should be.”

His latest remarks could prompt support for legislation that puts an end to congressional stock trading, or at least makes the regulations around it tighter. However, it is unclear what impact the president’s statement could have, coming only a month before his term ends.