We predict Google’s overall cloud business will reach $54 billion in revenue this year. Our models indicate that Google Cloud Platform will contribute to more than half of that revenue for the first time ever.

Despite this performance, Google faces criticism even with its advanced technology and double-digit growth. The reason? It’s still 2.5 to 3 times smaller than Amazon Web Services Inc.’s and Microsoft’s cloud businesses.

Regardless, Google has developed an artificial intelligence-optimized stack spanning from infrastructure to application-level agents. This stack includes custom hardware, integrated databases and a maturing development environment in Vertex AI that supports both proprietary and third-party models.

We believe this makes Google a leader in providing tools for building enterprise agentic systems. Additionally, Google’s transparent acknowledgment at its Next 2025 conference in Las Vegas this past week that enterprises won’t move all their data to the cloud demonstrates an understanding of the reality that enterprise information technology requires hybrid and multicloud capabilities. By allowing integration with existing data, applications and workflows, Google aims to speed up the time-to-value for AI initiatives by bringing AI to the data regardless of its location.

In this Breaking Analysis, we dig into Google’s cloud strategy and how the company is integrating AI across its infrastructure and application portfolio to accelerate growth. We’ll share our latest data on how Google Cloud is faring against leaders AWS and Microsoft Azure, including new survey data that suggests Google is closing the gap in AI adoption thanks to momentum in machine learning and AI. Google Cloud Platform’s growth is outpacing its rivals, and we believe its differentiated AI capabilities — demonstrated in its planned collaboration to bring and AI-driven version of “The Wizard of Oz” to the big screen at Las Vegas’ The Sphere (pictured) — are a key tailwind. We’ll also examine the broader cloud market outlook, Google Cloud’s improving financial metrics, and key areas to watch as the cloud wars evolve.

Big Three cloud providers poised to surpass $350B in 2025

To set the stage, the combined revenue of the “Big Three” U.S. cloud providers – AWS, Microsoft Azure and Google Cloud – is projected to reach $358 billion in 2025.

The graphic above compares the annual revenues of the three providers over the last two years with our 2025 projections. Microsoft and AWS remain substantially larger in cloud than Google — by roughly two-and-a-half to just over three times in terms of total revenue. Based on our CY 2025 estimates, Microsoft leads with approximately $178 billion, AWS follows at $126 billion, and Google ranks third at $54 billion. However, we believe it’s significant that Google’s cloud business already exceeds $50 billion and is still growing at a rate of around 30%. Imagine a company such as Cisco Systems Inc. simultaneously gaining share across multiple sectors and achieving 25% to 30% growth — that’s effectively what Google Cloud is doing today.

In our opinion, it’s also important to note that Google Cloud can leverage not only the substantial cash flows generated by Google’s advertising, search and YouTube businesses, but also the massive infrastructure underpinning those properties. We believe this integration of resources is one of Google’s core advantages in the cloud market.

SaaS powers Google Cloud but AI gives GCP new momentum

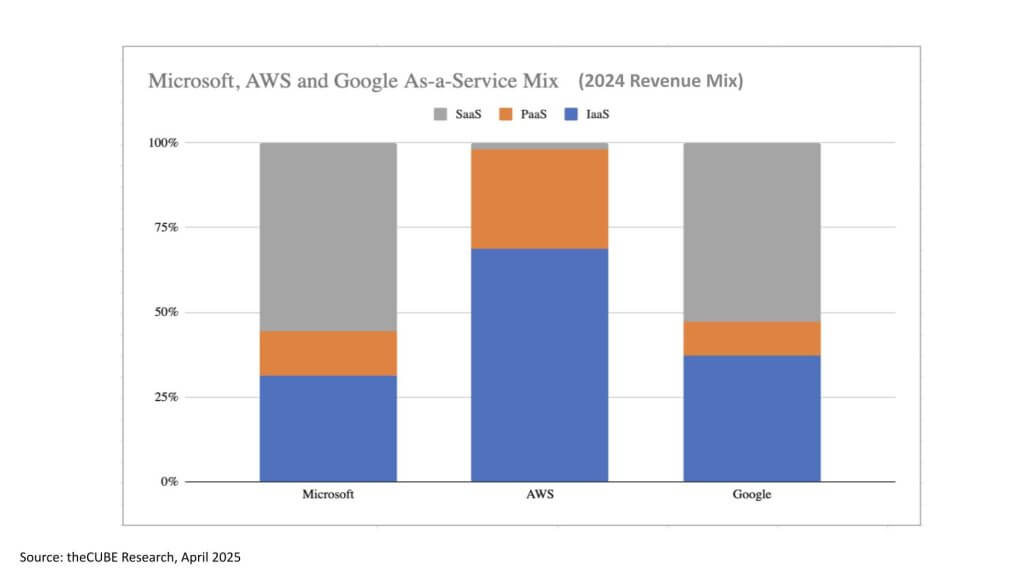

The chart below breaks down the percentage mix of infrastructure as a service, platform as a service, and software as a service for Microsoft, AWS and Google. Microsoft and Google currently derive most of their cloud business from SaaS, each with less than half of their revenue coming from IaaS and PaaS last year. Microsoft stands out as a dominant SaaS player. However, it’s important to note that the vertical axis in the chart measures percentages rather than absolute dollars — so we should not interpret Google’s IaaS and PaaS revenue as larger than Microsoft’s in raw terms.

Our models suggest that Google’s IaaS and PaaS business (GCP) will surpass 50% of its total cloud revenues this year, reflecting a shift toward infrastructure and platform offerings, driven in our view by Google’s AI prowess.

Notably, AWS is almost exclusively an IaaS/PaaS company, with only a small slice of SaaS (such as Amazon Connect for contact center). In our opinion, that composition can be viewed in two ways for AWS: either a missed opportunity in the SaaS arena or a point of differentiation, or an upside opportunity, especially since AWS remains highly profitable without significant SaaS contributions. We believe Microsoft’s higher margins stem from its longstanding software DNA, while Google, still early in its cloud profitability curve, is steadily moving toward a more profitable line of business. Despite their differing portfolio balances, all three providers continue to grow, and AWS’ ability to stay highly profitable while heavily focused on IaaS/PaaS is particularly noteworthy.

Spending data shows Google gaining share

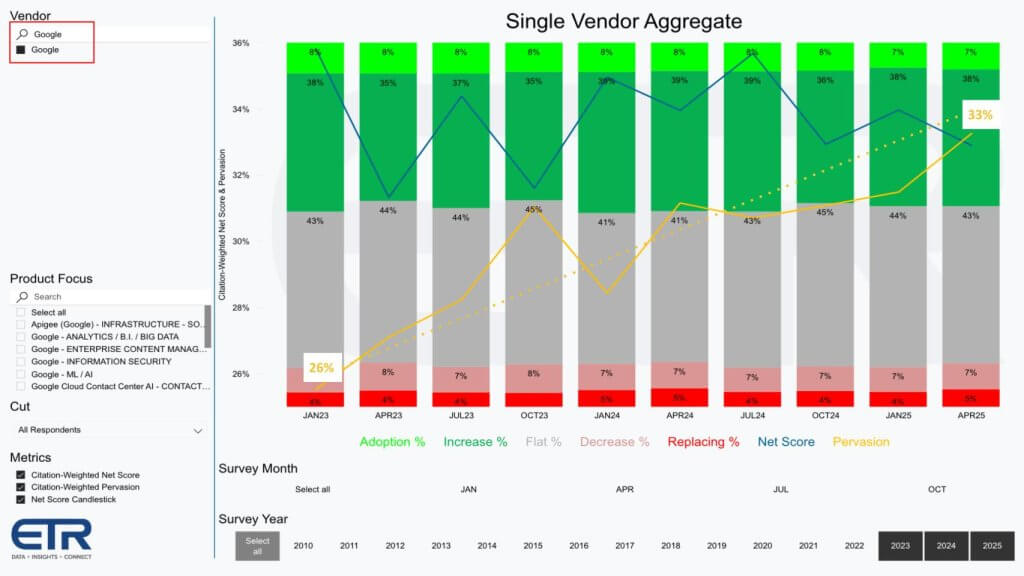

This next slide from Enterprise Technology Research illustrates the core methodology behind its quarterly surveys, highlighting what we refer to as Net Score granularity. The vertical axis represents Net Score, which is calculated by taking the percentage of respondents that are adding or significantly increasing spending (the greens) and subtracting those that are decreasing or completely discontinuing spending (the reds).

Specifically, the lime green portion (7% in the April survey for Google) is new customer adds; the forest green (38%) is the percentage of customers increasing their spend by more than 6% year over year; the gray indicates flat spending; the pink (7%) is spending down (6% or worse); and the red (5%) represents churn or isolation. When you net out the reds from the greens, you arrive at the Net Score, shown in blue line — solidly in the thirties, which we believe is a respectable figure (noting anything north of 40% is exceptionally high).

The yellow line in the chart, referred to as Pervasion, measures the level of penetration in the data set — that is, the percentage of survey respondents that identify as Google customers. According to ETR’s data, Pervasion for Google jumped from 26% in January 2023 — just after ChatGPT’s unveiling and the AI boom — up to 33% today, a substantial seven-point gain in only a couple of years. We believe this trend sets up and allows us to test the premise of today’s Breaking Analysis – that AI has provided a meaningful tailwind for Google Cloud, driving increased adoption and expansion within the ETR survey base and the broader market.

Spending data confirms Google’s ML/AI momentum

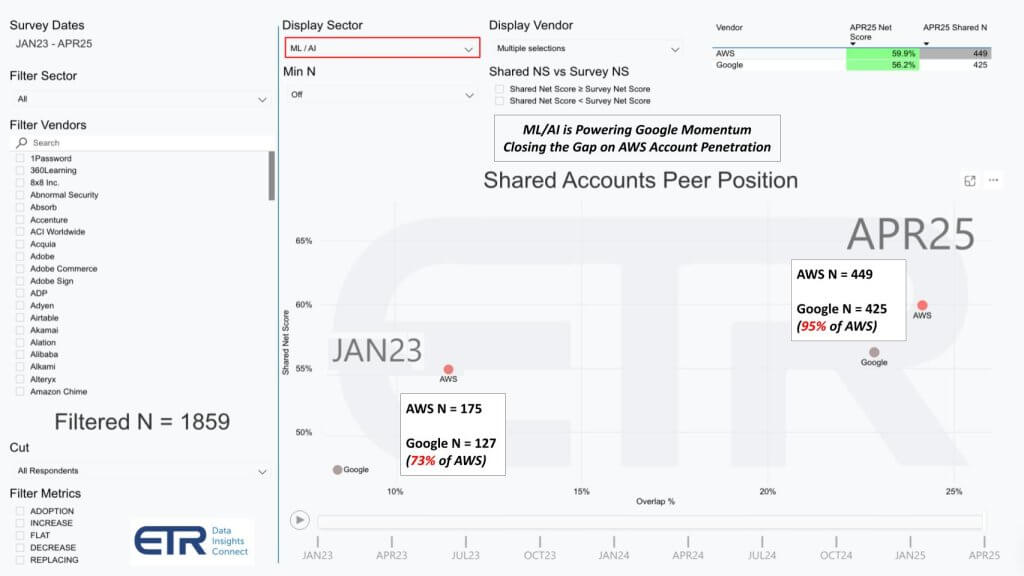

We believe Google is rapidly closing the gap with AWS in the critical domains of machine learning and AI, which we see as a prime driver of Google’s overall cloud growth — particularly for GCP. We witnessed this firsthand at Google Next 2025, where the company showcased its AI-led innovations.

The data below reflects ETR’s Shared Net Score in the April survey, which had a strong sample of 1,859 IT decision maker respondents. Focusing specifically on the ML/AI sector, we isolate AWS and Google. On the vertical axis is Net Score, or spending momentum, and on the horizontal axis is Pervasion or penetration in the data set (that is, how many of these 1,859 organizations use each platform). In January 2023, AWS’ N value was 175 respondents/accounts versus Google’s 127, making Google about 73% the size of AWS within that ML/AI cohort. Fast-forward roughly two years, and the Ns for both firms have skyrocketed: AWS is cited by 449 respondents, Google by 425 — now 95% of AWS’ footprint.

In the upper right corner of the chart, we see net scores for AWS and Google at 60% and 56%, respectively. Remember, anything north of 40% is already very strong; this data is extremely positive for both players. Because AWS is so dominant in the marketplace, Google’s jump often goes unnoticed, but the numbers tell a clear story: Google is gaining meaningful ground in ML/AI adoption. Our research suggests that GCP’s momentum in AI-centric workloads is a key contributor to this growth.

Cloud growth leaves traditional IT spending in the dust

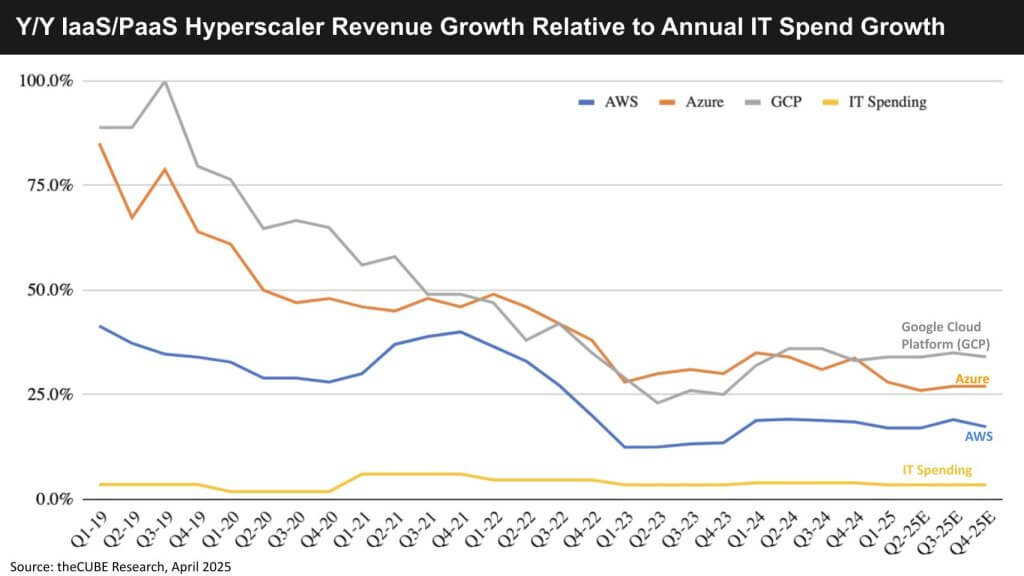

The chart below tracks year-over-year growth rates for the three major hyperscale providers — AWS, Azure and Google Cloud Platform — going back to 2019. Importantly, this view isolates IaaS and PaaS revenue, excluding the SaaS component that boosts Microsoft’s and Google’s overall cloud numbers. We believe the data makes clear that, although growth rates have naturally moderated from pre-pandemic levels, Google is still substantially outpacing its competitors, after falling behind Azure’s growth in 2023. Specifically, for 2025, we have GCP growing at about 34%, Azure at 27%, and AWS at 17%.

In our opinion, these figures may understate AWS’ potential upside — Amazon CEO Andy Jassy’s recent comments in his annual letter suggest some factors could push AWS’ growth higher, and we plan to revisit that possibility in a future Breaking Analysis. Nonetheless, the contrast remains stark when we compare these hyperscale growth rates to overall IT spending (the yellow line in the chart). Traditional IT budgets are only growing in the low-to-mid single digits, while IaaS/PaaS is consistently above the 20% range. Our research indicates this divergence underscores a powerful, long-term shift to cloud infrastructure, with Google in particular benefiting from faster acceleration off a smaller base.

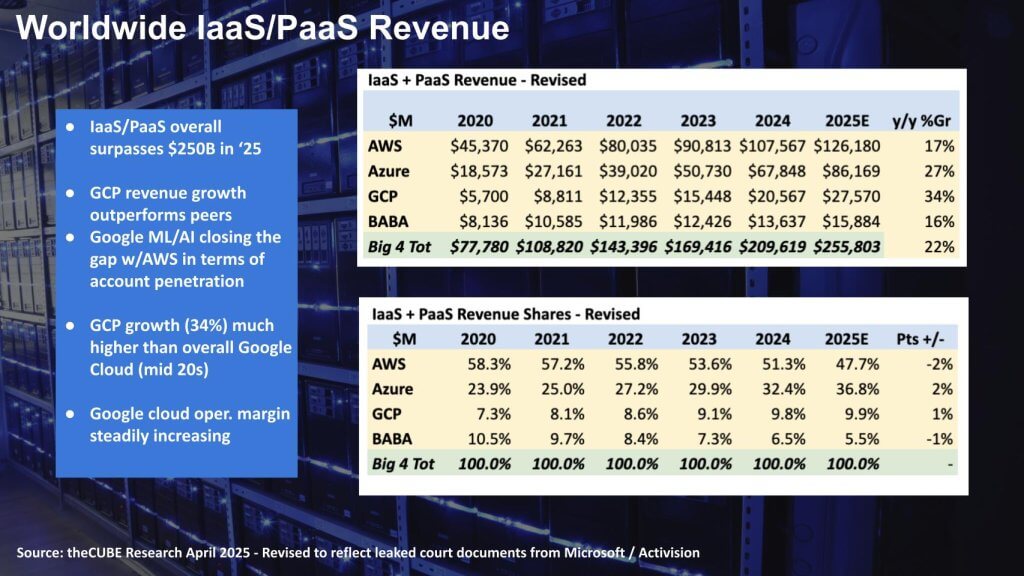

Hyperscale cloud market surpasses $250B – Google’s growth outpaces peers from a smaller base

This next slide focuses in on IaaS and PaaS revenue and provides a look at our 2025 estimates. The chart is labeled “Revised,” reflecting the adjustments we made after reviewing leaked Microsoft/Activision court documents tied to statements in Microsoft CEO Satya Nadella’s internal memos. Last year, Microsoft restated certain Azure definitions, swapping out slower-growing security and mobile solutions in favor of rapidly expanding AI and generative AI categories — effectively boosting Azure’s growth profile. In our opinion, those changes were largely immaterial to our existing models because we had already factored this into Microsoft’s Azure revenue.

Nonetheless, the above view shows AWS, Azure, GCP and Alibaba — the last we consider a quasi-hyperscaler, though opinions on that front differ. We estimate that the combined IaaS and PaaS market for these four will exceed $250 billion this year (roughly $255 billion to $256 billion). Within that landscape, Google Cloud Platform continues to outpace its peers in growth, powered by the ML/AI tailwinds we highlighted earlier. Notably, we see GCP’s IaaS/PaaS growth rate at roughly twice that of AWS — albeit at a smaller base. Still, this translates into a roughly $28 billion IaaS/PaaS business within Google Cloud, a figure that Alphabet does not formally report and we must estimate.

Because Google does not break out GCP revenue specifically, we rely on multiple data signals, including external surveys and market modeling. Another trend we’re watching is Google Cloud’s profitability, which recently turned positive, confirming Google’s progress despite still ranking third among the hyperscalers. In our view, the overall cloud market remains vast, extending well beyond these top three — into on-premises environments, edge deployments, global regions and new AI-driven or “agentic” services. The main takeaway is that though the Big Three command enormous revenues, there’s significant headroom for further expansion, and Google’s emergence into profitability marks a notable milestone in this multi-horse cloud race.

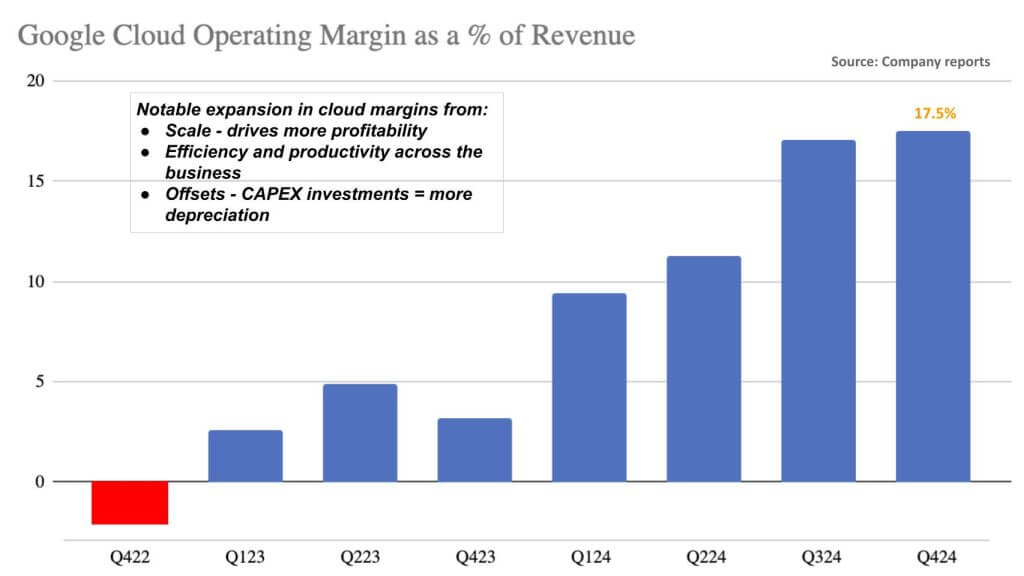

Google Cloud turns profitable as margins increase

This slide tracks the operating margin of Google Cloud as a percentage of revenue from Q4 2022 through the most recent quarters. At the end of 2022 — just as ChatGPT was making headlines — Google Cloud was running at an operating loss of around 2.5% or its cloud revenue. Since then, with the exception of a dip in Q4 2023, we’ve seen a steady improvement, with Google Cloud now achieving a positive operating margin of 17.5%.

Though that number doesn’t rival AWS or Microsoft yet, we believe it reflects meaningful progress. Google’s improving profitability is largely the result of scale efficiencies — as the business grows, fixed costs are spread across a larger revenue base — and operational discipline under Google Cloud CEO Thomas Kurian’s leadership. Kurian has driven an enterprise mindset, focusing on efficiency across engineering, go-to-market and support operations.

Of course, there are headwinds. Like its peers, Google is pouring capital into its infrastructure, and those capex investments must be depreciated over time. Depreciation flows through the income statement and can be a drag on operating profit, especially for businesses still building out their base. This creates a lag between the time Google spends the money and when it shows up as a cost, hitting operating margins even as growth accelerates.

Still, Google’s 17.5% margin remains well below AWS’ approximately 35% and what we estimate to be Microsoft Cloud’s high 30s to low 40s — with the caveat that Microsoft’s “Intelligent Cloud” includes more profitable elements such as on-premises software and SQL Server, which we have attempted to exclude from our cloud forecasts. That makes direct comparisons somewhat murky. Nonetheless, AWS has achieved industry-leading efficiency in IaaS/PaaS, driven by a mature business, global scale and high levels of automation.

In our view, Google’s margin expansion story is just beginning. But as long as capex continues to surge — and depreciation keeps pressure on the income statement — Google Cloud’s path to margin parity with AWS and Microsoft will take time. Still, the direction is clear, and the underlying fundamentals are strengthening.

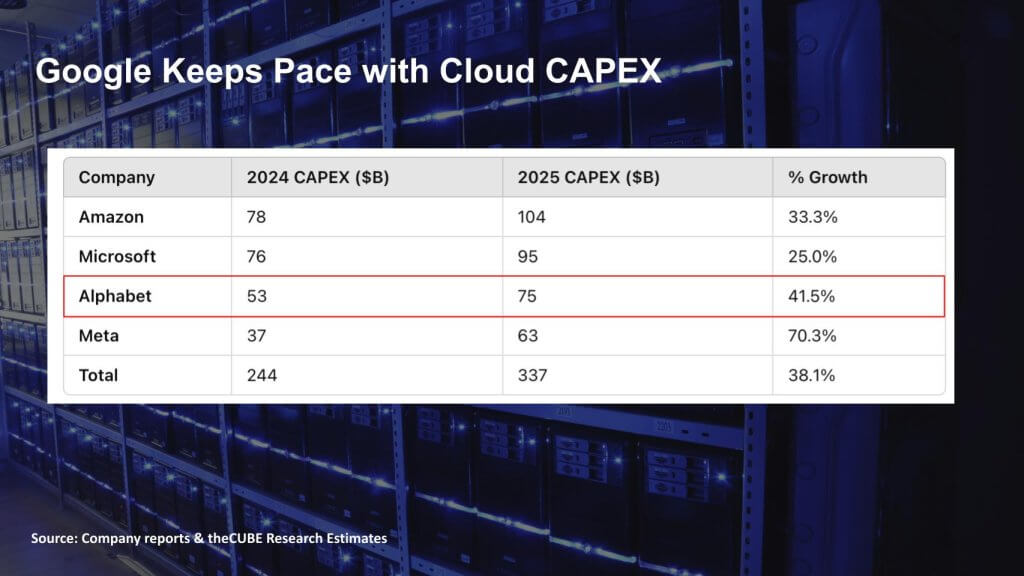

An arms race in cloud capex: Google more than holds its wwn

The slide below revisits a chart we’ve used before to visualize estimated capital expenditures for 2025 across the major tech platforms — Amazon, Microsoft, Alphabet (Google) and Meta Platforms. Our estimate for total capex among these four companies exceeds $300 billion for the year. Though some reporting in the financial press recently cited a lower number, we believe that reflects confusion between 2024 and 2025 projections, or perhaps a misunderstanding of fiscal versus calendar year reporting, which we mix here as well.

What’s particularly notable here is the significant uptick in Alphabet’s capex relative to its peers. Though Amazon continues to invest heavily, a substantial portion of its spending goes into its retail infrastructure, such as fulfillment centers and logistics. By contrast, Alphabet’s spending is focused squarely on data centers, custom silicon such as its tensor processing units, AI infrastructure and networking, all of which feed directly into its cloud and AI ambitions. Microsoft, we believe, has slightly moderated its pace of capex, with internal estimates showing roughly $85 billion this year — still a massive number, but lower than the trajectory it was previously on. Its calendar year 2025 spend will probably approximate that of Alphabet.

The key takeaway is that Google is aggressively scaling up its infrastructure investments, and it is doing so in parallel with a strategic push into AI and agentic computing. Though this level of spending creates a near-term drag on operating margin due to depreciation (as discussed in the prior slide), we see it as a necessary long-term play. In our view, these capex investments are not only sustaining Google’s competitive position, but actively powering innovation across the cloud and AI ecosystem. Far from being a drag on the industry, this wave of investment is helping define the next decade of computing.

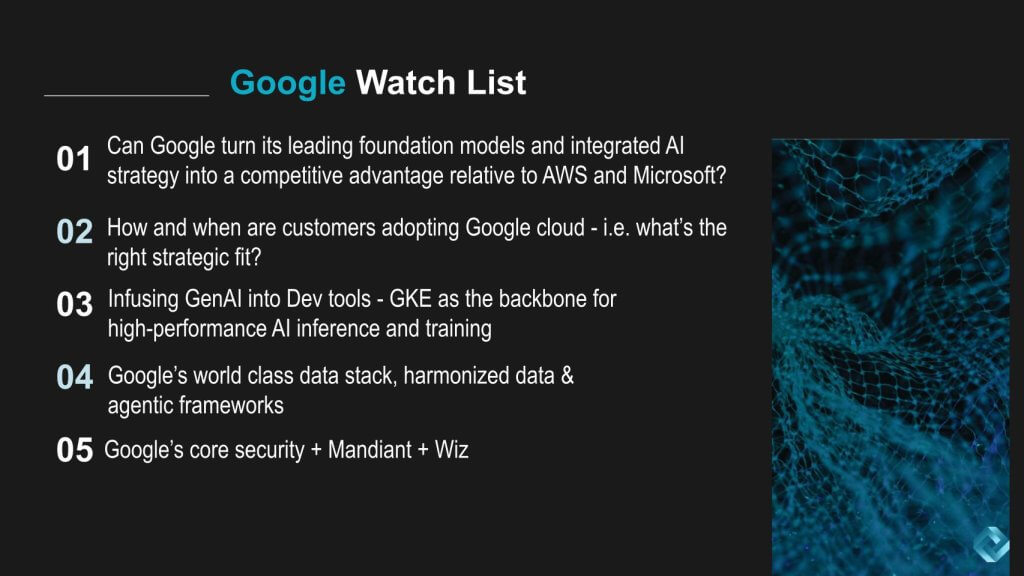

Google Cloud watch list: key questions going forward

As we wrap this analysis, there are several strategic dimensions we’ll be closely watching that could shape Google Cloud’s trajectory over the next 12 to 24 months.

At the center of the story is a key question: Can Google convert its leadership in foundation models and its deeply integrated AI stack into a lasting competitive advantage over AWS and Microsoft? The data suggests Google is gaining share — it’s growing faster than both competitors, particularly in IaaS and PaaS. But sustaining that growth will hinge on execution and differentiation.

One of Google’s assertions is that it is the only hyperscaler that owns a leading foundation model. Though Amazon might contest that with its proprietary large language model Nova, it remains unproven at this stage with respect to keeping pace with leading foundation models. Google’s view is that its longstanding investment in AI — through DeepMind and internally developed models such as Gemini — gives it a unique edge.

What sets Google apart, in its own words, is the tight integration of its foundation models across its entire stack. Much like Oracle Corp.’s longstanding advantage from integrating software with hardware, Google sees this vertical integration of AI as a moat that could define its value proposition.

Another area we’re watching is when and how customers choose Google Cloud, particularly in relation to data-centric and AI-priority use cases. Google clearly sees AI as its wedge — and partnerships with Nvidia Corp. and even mentions of Dell Technologies Inc. at the keynote reinforce this push to bring AI “to the data,” including in sovereign and hybrid contexts. That right strategic fit — where AI and data gravity converge — is critical to Google Cloud’s expansion.

From a developer perspective, Google is making aggressive moves to infuse generative AI into development workflows. TheCUBE Research’s George Gilbert posits that Google appears to be two years ahead of Microsoft in bringing gen AI to the developer toolchain. As theCUBE Research’s Paul Nashawaty has pointed out, GKE, short for Google Kubernetes Engine, is being positioned as the backbone for high-performance AI inference and training — effectively evolving into a next-gen AI supercomputing platform. This is an area where Google has a strong technical foundation, and if it can win developer mindshare, it could set itself apart in AI-native application development.

Then there’s the data layer. Google made a bold claim on stage that BigQuery has five times the customer count of the two leading competitors—a not-so-subtle reference to Snowflake Inc. and Databricks Inc. That figure raised eyebrows (and warranted some skepticism), but ETR data does suggest Google has greater account penetration than either Snowflake or Databricks, even if the 5X claim might reflect a long tail of small customers not captured in enterprise datasets. Regardless, it affirms that Google has a world-class data stack, built on native cloud principles, separation of compute and storage, and integrated AI.

Google is also making notable progress in what we’d call semantic alignment — harmonizing structured and unstructured data for agentic AI applications. We believe this will be critical in the next wave of enterprise intelligence, where AI agents require consistent, governed access to data. In that light, Google’s stack — anchored by Vertex AI and supported by Looker, BigQuery and open data formats — is positioning itself to power this next-gen intelligent enterprise.

Security is another frontier. Google acquired Mandiant to bolster its security capabilities, and there’s a lot of curiosity around its acquisition of Wiz, a cloud security posture management company. Google executives didn’t discuss Wiz on stage, but we view this as a highly strategic move. If Google can combine Mandiant’s incident response with Wiz’s cloud posture analytics and integrate that into its cloud platform, it could deliver a differentiated security model that rivals AWS’ native capabilities.

Bottom line: This year’s Google Cloud Next may have been the company’s most important yet. With a cloud business now exceeding $50 billion and growing at nearly 30% in 2025, Google has momentum, a differentiated stack and a strategy that appears well-aligned with where the market is heading — AI, data and developer-led growth. The next chapter will be about scaling, executing in go-to-market, and proving that its vision of integrated AI isn’t just technically elegant, but commercially winning.

We’ll be tracking all of it closely and as always appreciate your input.

Disclaimer: All statements made regarding companies or securities are strictly beliefs, points of view and opinions held by SiliconANGLE Media, Enterprise Technology Research, other guests on theCUBE and guest writers. Such statements are not recommendations by these individuals to buy, sell or hold any security. The content presented does not constitute investment advice and should not be used as the basis for any investment decision. You and only you are responsible for your investment decisions.

Disclosure: Many of the companies cited in Breaking Analysis are sponsors of theCUBE and/or clients of Wikibon. None of these firms or other companies have any editorial control over or advanced viewing of what’s published in Breaking Analysis.

Your vote of support is important to us and it helps us keep the content FREE.

One click below supports our mission to provide free, deep, and relevant content.

Join our community on YouTube

Join the community that includes more than 15,000 #CubeAlumni experts, including Amazon.com CEO Andy Jassy, Dell Technologies founder and CEO Michael Dell, Intel CEO Pat Gelsinger, and many more luminaries and experts.

THANK YOU