(Bloomberg) — In just three months, US stocks have swung from a dramatic April selloff to new heights. Now, traders are about to see if Corporate America’s report cards justify the optimism priced into equity markets.

Most Read from Bloomberg

Expectations aren’t high: Wall Street is bracing for the weakest earnings season since mid-2023. Analysts see second-quarter profits on the S&P 500 Index rising 2.5% year-on-year, Bloomberg Intelligence data show. Six of 11 sectors are projected to post profit declines, while the full-year growth forecast for the benchmark index has dropped to 7.1% from 9.4% in early April.

The S&P 500 is trading near a record high even as earnings forecasts wane and companies navigate President Donald Trump’s trade policies. However, lower estimates could be easier for companies to beat. Based on recent guidance, BI strategists Gina Martin Adams and Wendy Soong say companies could handily exceed those modest estimates.

“The bar is now so low,” said Kevin Gordon, senior investment strategist at Charles Schwab & Co. “That of course makes it easy for companies to beat, but I think the emphasis will be on gross margins, especially because that’s where we should see tariff pressure show up if it exists.”

Earnings season unofficially kicks off on Wednesday, led by financial giants JPMorgan Chase & Co., Citigroup Inc., and BlackRock Inc. Heavyweights like JB Hunt Transport Services Inc. and Netflix Inc. also report next week.

Here’s a look at five key themes to watch as the results roll in.

Trade War Impact Yet to Show

Tariffs are poised to disrupt supply chains and raise costs, which market watchers see weighing on America’s profit engine. However, those impacts may not be pronounced in second-quarter earnings just yet.

There is scant evidence of material demand destruction related to tariffs at this point, but also no big rebound in macroeconomic conditions since many of the harshest levies were announced and then paused, according to a recent industry survey led by Bank of America Corp. analyst Andrew Obin.

Earnings revision momentum — the difference between upward and downward adjustments to forecasts — turned positive for the second quarter after dropping in the last reporting cycle, according to BI data.

BI analysts expect S&P 500 net income margins to hit their lowest level since the first quarter of 2024 after climbing for five consecutive quarters. The decrease is likely to be fleeting, however, with margin calculations pointing to expansion next quarter and at least until the end of 2026, per BI. The forecast may require cost-cutting by firms or or AI implementation to pick up quickly in order to be realized.

Tech Giants Still Spend on AI

Trade and broader macroeconomic uncertainty hasn’t stopped American technology giants from big spending, especially on developing artificial intelligence products.

Microsoft Corp., Meta Platforms Inc., Amazon.com Inc. and Alphabet Inc. are projected to put about $337 billion into capital expenditures in their fiscal 2026, up from $311 billion in the current year, according to the average of analyst estimates compiled by Bloomberg.

The lion’s share of S&P 500 earnings continue to come from the Big Tech companies seen as major beneficiaries of advancements in AI. The so-called Magnificent Seven firms — Apple Inc., Microsoft, Alphabet, Amazon, Nvidia Corp., Meta and Tesla Inc. — are expected to post a 14% rise in profits in the second quarter. Excluding that group, S&P 500 profits are expected to slightly contract by 0.1% in the April-June period.

“AI is not just a buzz word, it’s the most enduring and dominant theme,” said Tony Kim, head of the Fundamental Equities Technology Group at BlackRock. “These stocks aren’t too expensive and the rally can go a heck of a lot further.”

AI hyperscalers such as Microsoft, Amazon, Alphabet and Meta spent more than $80 billion in the first quarter, and increased capex guidance to a collective $300 billion over 2025, according to BlackRock data.

Stock-Picker’s Market

Stocks are projected to trade out of sync at a rate seen few times in recent history. A measure of expected one-month correlation between S&P 500 companies is sitting at 0.12, data compiled by Bloomberg show. It was below that level just 3.2% of the time in the past 10 years. A reading of one means the securities are trading in sync.

“There’s good money to be made, but you gotta be a stock picker,” said Lisa Shalett, the chief investment officer of Morgan Stanley’s wealth management division.

She recommended clients seek firms with potential to surpass earnings and cash-flow estimates, pointing to stocks in sectors such as energy, financials, and parts of health-care that could benefit from Trump’s signature budget bill.

“Now is a time to keep one’s feet firmly on the ground,” she said in a note to clients. “It’s a good market for some but not all.”

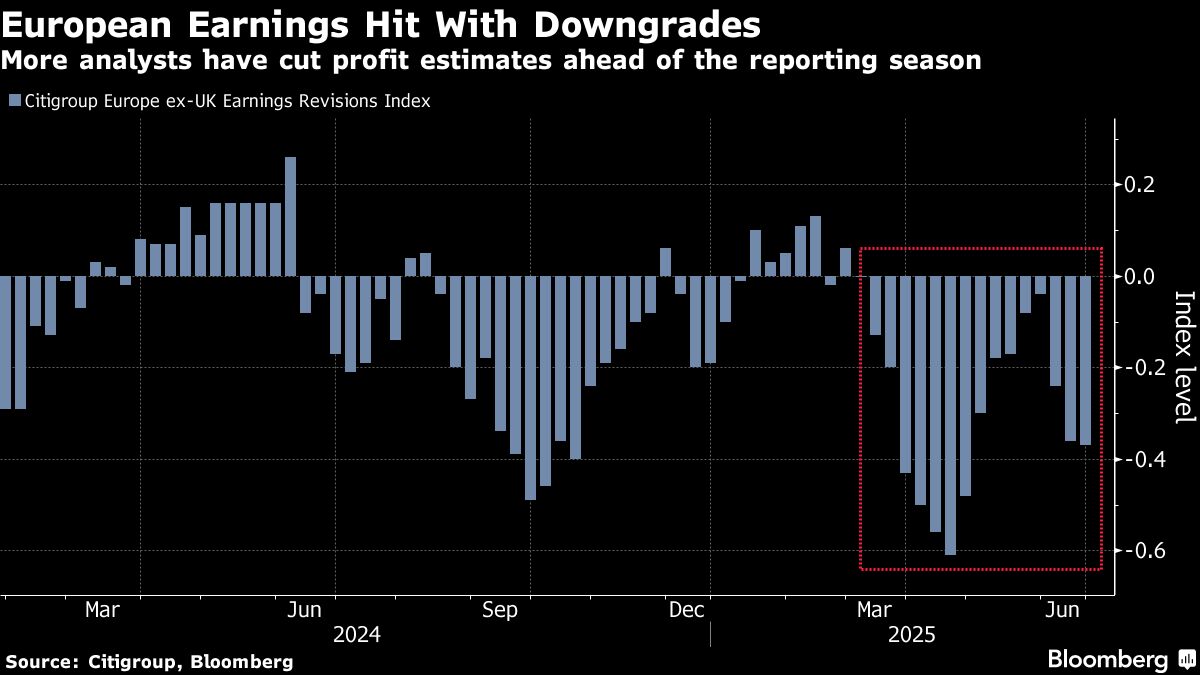

Downgrades in Europe

In Europe, analysts have slashed estimates on fears that Trump’s trade war would hurt margins. A Citigroup Inc. index shows profit downgrades have consistently outnumbered upgrades since mid-March.

The reductions have hit tariff-exposed automakers and miners, as well as defense stocks, according to Goldman Sachs Group Inc. strategists. Their analysis shows margin compression was the biggest driver of the negative revisions.

“The drop in analysts’ estimates means the bar is quite low for companies to beat,” said Georges Debbas, head of European equity derivatives strategy at BNP Paribas Markets 360. “As long as we don’t have companies flagging a horrendous second half, the earnings season should bode well for stocks.”

Focus will also be on the impact of a stronger euro, which tends to crimp earnings at European firms that are major exporters. The common currency has strengthened 13% against the dollar this year, on track for the biggest relative gain since 2017.

Bearish Dollar

Uncertainty over Trump’s trade policies and his push for Federal Reserve interest-rate cuts has put a dent in the dollar. That’s a welcome development for US exporters.

Morgan Stanley strategist David Adams called the weaker dollar “a substantial, underappreciated tailwind” for US earnings, particularly large-cap companies, which have a greater portion of overseas earnings than smaller firms.

The dollar is down 10% this year and posted its worst first-half since 1973, according to data from BlackRock, which sees more room for the currency to fall.

Companies including Meta and Microsoft said last quarter that they expect foreign exchange to boost revenue by hundreds of millions of dollars.

–With assistance from Jeran Wittenstein, Jan-Patrick Barnert and Anya Andrianova.

Most Read from Bloomberg Businessweek

©2025 Bloomberg L.P.