Wall Street analysts are maintaining their bullish stances on Nvidia NVDA ahead of its fourth-quarter earnings report for fiscal 2025. They expect record-breaking results driven by sustained AI chip demand.

Analysts expect Nvidia to report quarterly revenue of $38.32 billion, a 73% surge year-over-year, while net income is forecast to reach $21.08 billion in its fiscal Q4. The chipmaker will report its quarterly results on Wednesday, Feb. 26.

According to a TipRanks report, KeyBanc Capital Markets’ John Vinh recently raised his price target to $190 from $180, suggesting Nvidia will beat consensus estimates despite some manufacturing constraints.

Maintaining a $185 target, UBS analysts nearly doubled their revenue estimate for Nvidia’s new Blackwell line to $9 billion. Oppenheimer’s Rick Schafer, reiterating a $175 price target, sees “upside” potential in both Q4 results and next quarter’s outlook, driven by sustained data center demand. The firm views recent competition from China’s DeepSeek as potentially positive, likely pushing American tech giants to accelerate their AI investments.

However, some reasons for caution are emerging. According to an article in The Street, analysts note that investor expectations have “crept up” recently. At the same time, NVDA stock has lagged broader market benchmarks over the past six months amid concerns about chip capacity and emerging alternatives.

Can Nvidia Stock Surge to Record Highs in 2025?

During a recent JPMorgan fireside chat, Nvidia CFO Colette Kress confirmed that demand continues to exceed supply for Nvidia’s latest AI chips, although the company is increasing production capacity each quarter.

“When you look back at what size of compute we were able to bring to market seven quarters ago and where we are today, that has all been the case of our suppliers working with us,” Kress said.

Nvidia has begun shipping its next-generation Blackwell GB200 systems, though a tight supply of advanced components like packaging, memory, and networking equipment remains a constraint in the near term.

Looking ahead, Kress emphasized that the AI transition represents a “decade and more” opportunity. Over the next three years, enterprises will increase AI spending from 5% to 15%-20% of IT budgets. Cloud providers currently account for about 50% of Nvidia’s data center revenue, with enterprises and vertical markets making up the other half.

Despite concerns about cloud companies developing their AI chips, Kress noted that Nvidia’s full-stack solution with optimized software and systems gives it key advantages: “A custom silicon, a custom ASIC is not what we do. It’s very, very different from what we do.”

Nvidia Continues to Expand Its Product Portfolio

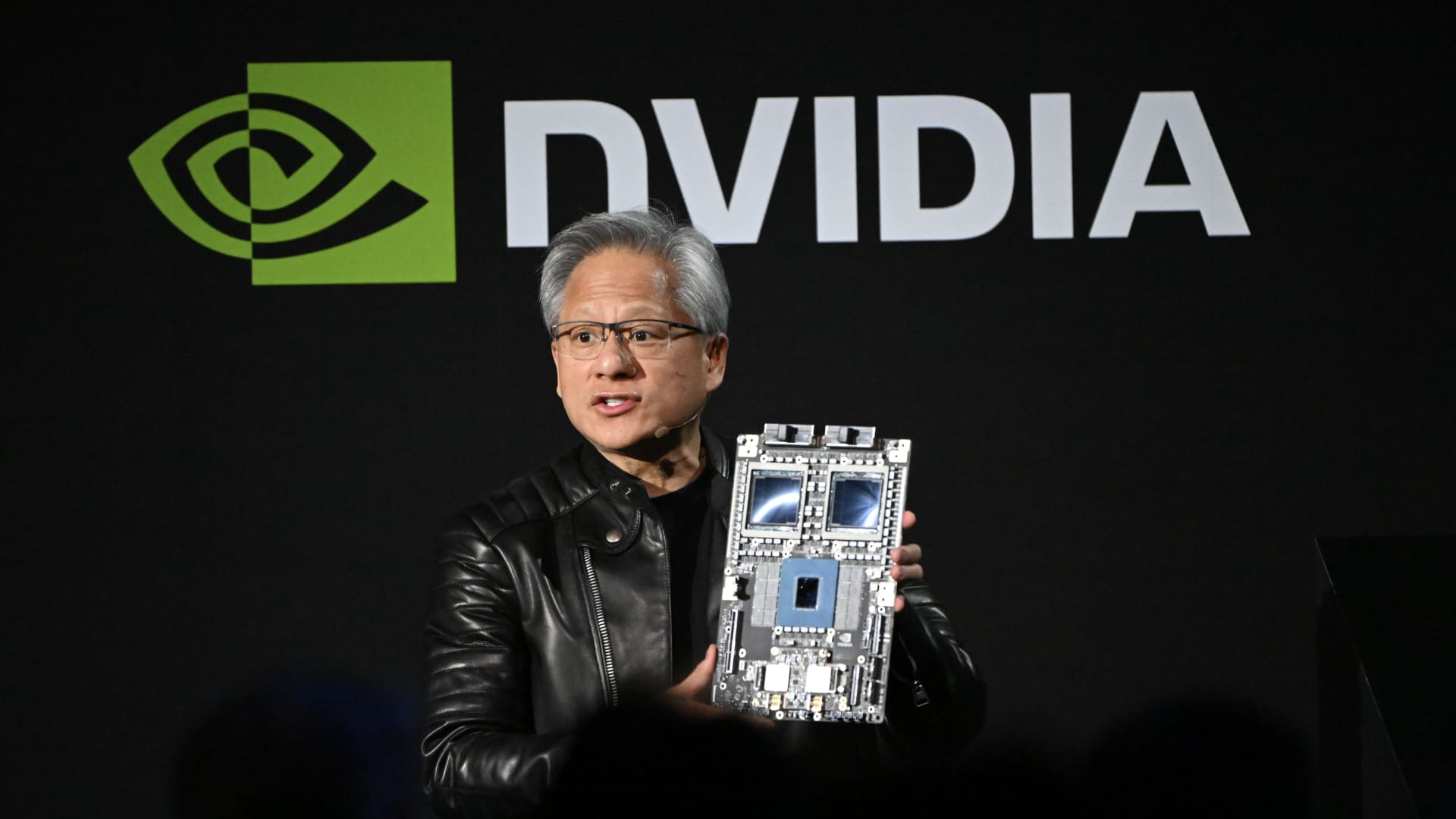

Nvidia CEO Jensen Huang unveiled a suite of new products at CES 2025, highlighting the company’s expansion beyond gaming into artificial intelligence and robotics. The chipmaker announced its next-generation RTX 50 Series gaming cards, which are based on the new Blackwell architecture, and promise twice the performance of current models.

In a significant AI development, Nvidia introduced Cosmos, a series of AI models trained to help robots better understand physical environments. The platform is designed to accelerate the development of autonomous vehicles and industrial robotics.

Huang also revealed Project Digits, a compact AI supercomputer for developers and creators that packs Nvidia’s AI capabilities into a desktop form factor. The device, expected to launch in May, uses a new GB110 chip developed in partnership with MediaTek.

Nvidia also announced a major automotive partnership with Toyota TM to develop next-generation autonomous vehicles. The company’s automotive business has grown to a $5 billion annual run rate, and it introduced Thor, a new processor offering 20 times more processing power than its previous generation.

What Is the Target Price for NVDA Stock?

Analysts tracking Nvidia expect its sales to rise from $61 billion in fiscal 2024 to $196 billion in 2026. Comparatively, adjusted earnings are forecast to expand from $1.30 per share in 2024 to $4.43 in 2026. So, priced at 30.2x forward earnings, NVDA stock is reasonably valued, given its growth estimates.

Out of the 43 analysts covering NVDA stock, 37 recommend “Strong Buy,” two recommend “Moderate Buy,” and four recommend “Hold.” The average target price for NVDA stock is $176.95, almost 30% above the current trading price.

On the date of publication, Aditya Raghunath did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- PayPal Stock Price Prediction: Can PYPL Hit $125 in 2025?

- This ‘Strong Buy’ Self-Driving Driving Car Stock Just Got a Major Nvidia Boost

- 3 Highest-Yielding Dividend Stocks Under $20 Ready to Soar

- Cautious Investors Should Wait for THIS Entry Point Before Buying Nvidia Stock