Report Overview

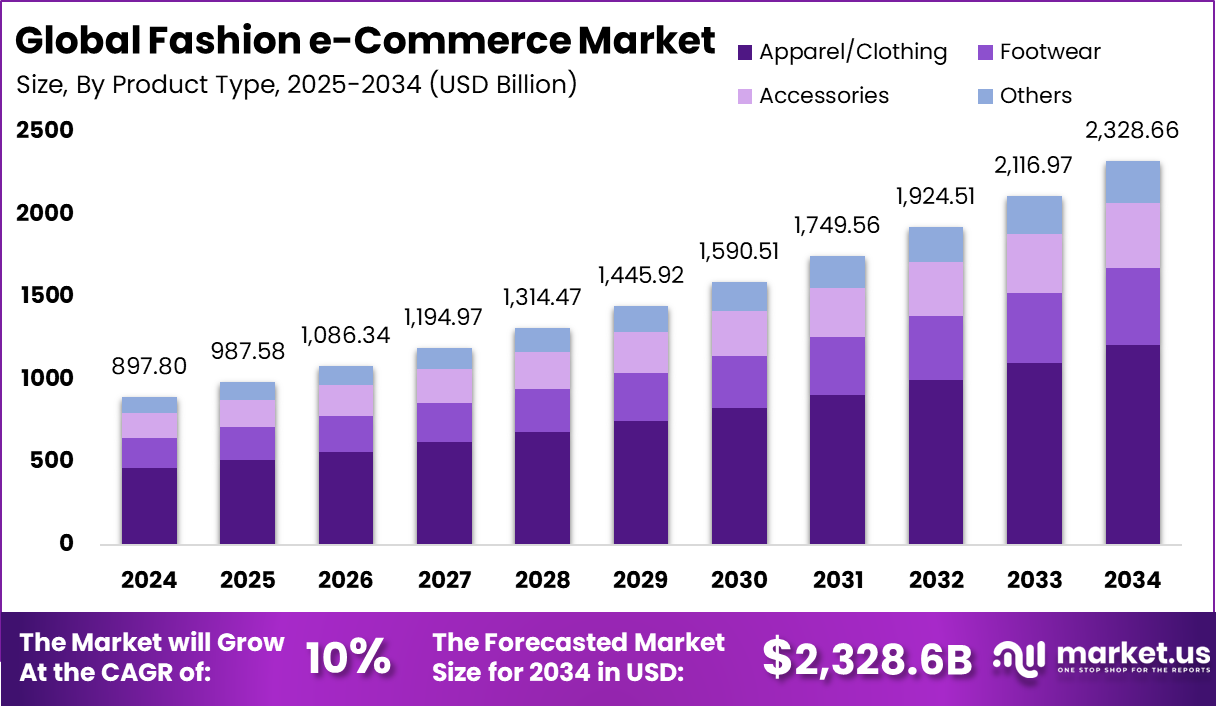

The Global Fashion e-commerce Market size is expected to be worth around USD 2,328.6 billion by 2034, from USD 897.8 billion in 2024, growing at a CAGR of 10% during the forecast period from 2025 to 2034. In 2024, Asia Pacific held a dominant market position, capturing more than a 38% share, holding USD 341.1 Billion in revenue.

The global fashion e-commerce market is experiencing significant growth due to a fusion of technological development, changing consumer behavior, and enhanced digital infrastructure. Key drivers for growth are increasing internet and smartphone penetration, especially in emerging markets which makes online shopping more convenient.

In addition, growing mobile commerce and social media influence, along with AI and data analytics-powered personalized shopping experiences, are engaging consumers more than ever. Also, trends like sustainable fashion, fast delivery systems, and flexible payment provisions such as buy now and pay later are further driving the market by making fashion more convenient and attractive to an extensive global audience.

![]()

Key Takeaway

- In 2024, the Apparel/Clothing segment held a dominant market position, capturing a 52% share of the Fashion e-commerce Market.

- In 2024, the Mid-Range segment held a dominant market position, capturing a 46% share of the Global Fashion e-commerce Market.

- In 2024, the business-to-consumer (B2C) segment held a dominant market position, capturing an 80% share of the Global Fashion e-commerce Market.

- In 2024, the Women segment held a dominant market position, capturing a 52% share of the Global Fashion e-commerce Market.

- In 2024, the Online segment held a dominant market position, capturing a 75% share of the Global Fashion e-commerce Market.

- TheChina Fashion eCommerce Market was valued at USD 110.8 billion in 2024, with a robust CAGR of 8%.

- In 2024, Asia Pacific held a dominant market position in the Global Fashion e-commerce Market, capturing more than a 38% share.

China Fashion eCommerce Market Size

The market for Fashion eCommerce within China is growing tremendously and is currently valued at USD 110.8 billion, the market has a projected CAGR of 7.8%.

The fashion e-commerce in China is significantly driven by key elements such as advanced manufacturing infrastructure enabling fast production cycles, which allow brands to notice fashion trends and quickly adapt the use of artificial intelligence and data analytics to get a real-time forecast and more personalized shopping experience.

China’s substantial reliance on mobile commerce, in which consumers conduct a significant portion of their online business via mobile phones, improves consumer access and convenience. The adoption of digital payment systems such as Alipay and WeChat Pay can easily simplify purchases and add to the seamless online shopping experience.

For instance, In April 2025, JD.com, one of the biggest e-commerce platforms in China, announced a major step to improve domestic sales, announced that the company would be investing about 200 billion yuan (around $27 billion) in one year to help Chinese exporters turn their focus to the domestic economy.

![]()

![]()

This announcement is coming against the background of high tariffs recently between the United States and China. Beijing boosted tariffs on its imports from the U.S. to 125% and American President Donald Trump made duties raised on Chinese goods up to 145%. The market for Fashion e-commerce within the ASIA-PACIFIC is growing tremendously and is currently valued at USD 341.1 billion, the market has a projected CAGR of 38%.

In 2024, APAC held a dominant market position, capturing more than a 38% share, holding USD 341.1 Billion revenue. The Fashion e-commerce sector holds a dominant position in the Asia-Pacific region due to the increased adoption of mobile e-commerce, the rise of social e-commerce platforms, and the growing demand for personalized shopping experiences.

![]()

![]()

All these aspects are pushing the fashion e-commerce sector forward and creating an opportunity for domestic and international retailers. Such markets as Australia, China, India, Malaysia, and Thailand show that online shoppers in the region are utilizing social media platforms a lot for shopping. More than 90% of respondents have made purchases via social media platforms like TikTok, Instagram, Douyin, and Facebook.

For instance, On September 18, 2024, YouTube and Shopee announced a partnership to better the e-commerce sector in Southeast Asia. This collaboration will embed Shopee’s online retail platform into YouTube’s video content so that users can buy products directly from YouTube videos, shorts, or live streams.

Product Type Analysis

In 2024, the Apparel/Clothing segment maintained a dominant position within the fashion e-commerce market, capturing more than 52% of the market share. This segment’s substantial share can be attributed to several key drivers enhancing its growth and appeal to consumers globally.

Firstly, the ongoing shift towards online shopping has significantly benefited the Apparel/Clothing segment. The ease of purchasing through online platforms, supported by the widespread use of mobile devices and improvements in e-commerce technology, allows consumers to shop conveniently from anywhere.

This shift is further bolstered by the integration of advanced technologies like augmented reality (AR) and virtual reality (VR), which enhance the online shopping experience by allowing consumers to visualize products more effectively before making a purchase

For Instance, in February 2025, ASOS – the global market shaper in fashion retail, collaborated with Microsoft to generate an artificial intelligence-powered virtual stylist. Virtual stylist engages consumers with personalized conversations to get their shopping insights and product recommendations.

Moreover, the influence of social media cannot be understated. Platforms such as Instagram, Facebook, and Pinterest have become pivotal in the fashion industry, especially in driving trends and sales in the Apparel/Clothing segment. Influencers and fashion brands leverage these platforms to showcase their latest offerings, engage with a broad audience, and drive traffic to their online stores.

Price Range Analysis

In 2024, the Mid-Range segment of the fashion e-commerce market held a commanding lead, securing more than 46% of the market share. This dominance is primarily attributed to several strategic factors that align well with consumer preferences and market dynamics.

The Mid-Range fashion segment effectively bridges the gap between premium and economy sectors, offering consumers high-quality products at relatively affordable prices. This balance appeals to a wide demographic that seeks both value and quality in their purchases. The accessibility of mid-range products encourages higher volume sales as they meet the budgetary constraints of the average consumer while still providing the perception of luxury or higher quality

For instance, In April 2025, Capri Holdings is strategically repositioning its Michael Kors brand towards mid-tier pricing and expanding its online presence, highlighted by the launch of an official Amazon storefront. This shift comes after the sale of Versace to Prada and the failed Tapestry acquisition. The company seeks to increase accessibility by offering products on Amazon at prices between $59 and $400 Aiming to revive Michael Kors.

Additionally, the growth of this segment is fueled by the global increase in disposable incomes, particularly in emerging markets where consumers are looking for products that offer more than just basic utility without the premium price tag. This demographic shift is supported by enhanced digital marketing strategies, which have broadened consumer access to fashion e-commerce platforms, further amplifying the reach and attractiveness of mid-range fashion items

Mode Type Analysis

In 2025, the Business To Consumer(b2C) segment held a dominant market position, capturing an 80% share of the Global Fashion e-commerce Market. This dominance is driven due to Convenience and accessibility to online shopping, the huge product variety available online, and the competitive pricing offered by numerous online retailers are key factors driving these dominant services.

The universal power of e-commerce and social media shopping is significantly benefiting the B2C experience, where consumers can easily get lovely brands and make room for easy browsing and purchasing. The established infrastructure of big trademark e-commerce sites, together with effective marketing, is individually targeting a consumer’s interest placing the B2C segment in a leading position of Global Fashion E-Commerce Market.

For instance, In December 2024 in Europe, Zalando began strengthening its B2C model by completing the acquisition of ABOUT YOU and enhancing its offering across the European fashion market. It is anticipated that the merger will produce collaborations and expand Zalando’s customer base to solidify its position as a leading online fashion retailer in that area.

Distribution Channel Analysis

In 2024, the Online segment in the fashion e-commerce market held a dominant market position, capturing more than 75% share. This considerable market share is supported by several pivotal factors that have shaped the retail landscape over recent years.

The surge in the Online segment’s dominance can primarily be attributed to the widespread adoption of internet and smartphone usage. This technological integration has made online shopping a more accessible and convenient option for consumers worldwide.

The ability to shop anytime and anywhere, without the constraints of store hours and geographic location, appeals greatly to today’s consumer base, driving significant traffic to online platforms. Additionally, the role of digital marketing and social media has been instrumental in propelling the growth of the online segment.

Platforms such as Instagram and Facebook have become vital for fashion brands to engage with customers, enhance brand visibility, and directly drive sales through innovative advertising strategies and influencer partnerships. Furthermore, the evolution of e-commerce technologies, such as AI-driven personalization and AR for virtual try-ons, has enriched the online shopping experience, making it more interactive and personalized.

End User Segment Analysis

In 2024, the Women segment in the fashion e-commerce market maintained a dominant position, securing over 52% of the market share. This leadership can be largely attributed to several factors that resonate with shifting consumer preferences and market dynamics.

Primarily, the women’s segment benefits from the broad spectrum of products available that cater specifically to women, ranging from everyday wear to luxury items, which continuously evolve to meet the changing fashion trends and personal tastes. This segment is driven by a high demand for trendy and affordable clothing, often influenced by the latest fashion trends showcased across various digital platforms.

Furthermore, the digital savviness of the female demographic plays a significant role. With increasing internet penetration and the proliferation of smartphones, women have become avid online shoppers. They utilize e-commerce platforms not only for buying fashion but also as a means to explore new styles and follow fashion influences, which significantly contributes to the high transaction volumes in this segment.

For instance, Myntra has launched a specific program “MynShakti” for women sellers. A program dedicated to empowering and strengthening women entrepreneurs all over India contributing to the online marketplace. This program would enable women-led businesses in the fashion, beauty, and home categories to set courses with essential tools, resources, and mentorships to scale their online businesses.

![]()

![]()

Key Market Segments

By Product Type

- Apparel/Clothing

- Footwear

- Accessories

- Others

By Price Range

- Premium/Luxury

- Mid-Range

- Economy/Fast Fashion

By Model Type

- Business to Business (B2B)

- Business to Consumer (B2C)

By End-User

By Distribution Channel

Drivers

Growing Consumer Preference for Online Shopping

Online shopping is preferred by consumers constantly because of the benefits of convenience and flexibility it provides to a shopper. Online shopping allows a consumer to check products with their corresponding prices and purchase them from home even without visiting the physical retail shops.

Live fine store sites offer a wide choice of offerings for greater numbers of fashions, price-based comparisons, customer reviews, and individual product recommendations that would make an instant, informed, and user-friendly shopping experience.

For instance, in 2021, The Bain & Company survey in China found that 35% of consumers chose to buy using the e-commerce landscape from the livestream and short-video shopping formats, while only 5% preferred direct brand websites and 19% used mini-apps.

Furthermore, social community shopping has become another important channel, with 22% of consumers engaging in it. Such trends showcase the constantly changing preferences of online shoppers and the growing significance of mobile interactive formats.

Restraint

Counterfeit and Low-Quality Products

Counterfeits and low-grade products are major constraints for the fashion e-commerce market. As online shopping increases, it has grown to become one of the biggest problems for consumers as well as legitimate brands. As buyers tend to see it very difficult to distinguish original products from the cheapest dollar-store-type imitations, it probably leads to their disappointment and lack of trust in online retailers.

These counterfeit items harm the reputation of genuine brands and also challenge e-commerce platforms to combat fraud and ensure the quality of the products they sell. Negative comments affect customer trust and loyalty. Hence, fashion e-commerce platforms are always under constant pressure. And is necessary to step up product verification controls, introduce trusted suppliers, and use AI to prevent counterfeiting.

For instance, In January 2025, Amazon’s vulnerability to counterfeit and low-quality products posed a serious problem for almost all e-commerce platforms. Fraudsters manipulate the system and use fake reviews to slightly increase the quality perception of their products, deceiving consumers to purchase items that are very low quality or entirely counterfeit products.

Opportunities

Personalization and Customization

Customers increasingly prefer unique shopping experiences, eCommerce platforms can utilize data and AI capabilities to customize recommendations based on individual preferences, browsing history, and buying patterns. Such hyper-personalization and customization lead to customer satisfaction and engagement, making shoppers feel valued and appreciated, thus fostering brand loyalty and fostering business.

Customization options such as personalized clothes and accessories enable fashion brands to stand out in a crowded market. By offering a choice to build or personalize the product, these companies create a deeper bond with their customers, giving them a more relatable shopping experience.

For instance, in November 2024, Myntra is an incredible example of how personalized and customized shopping experiences can take place in the setting of online retail. Their site itself goes beyond just listing products to include features developed personally for every user according to individual preferences.

Challenges

Regulatory and Cross-Border Trade Barriers

Global expansion is extremely difficult for fashion e-commerce with regulatory and cross-border trade barriers. Each country has its own import duties, tariffs, and customs regulations, which may increase costs and delay deliveries. There are generally complex documentation requirements along with compliance standards.

For instance, in April 2025, 2025, the tariffs on clothing imports from certain important trade partners were dramatically raised in the U.S., and this brought considerable hardship for the global fashion eCommerce industry. Currently, imports from China are facing an effective tariff rate of 145%, the highest for all trading partners, affecting Chinese apparel exporters severely. Vietnam is a significant clothing supplier to the U.S. with a 46% tariff;

however, negotiations to reduce it may occur between 22% and 28%. Canada was exempted from these tariffs with an initial universal 10% tariff under the USMCA. Other Asia-Pacific countries have also been affected: Cambodia (49%), Bangladesh (37%), Indonesia (32%), India (26%), Thailand (36%), Taiwan (32%), Japan (24%), and South Korea (25%).

These tariff hikes, instigated under the U.S. administration’s new trade policy outlook, are increasing costs for U.S. fashion retailers and are changing global supply chain dynamics. For instance, Vietnam was able to benefit from the EVFTA, allowing for the elimination or reduction of tariffs on many textile and apparel products exported to the EU.

Latest Trends

Live shopping a rapidly emerging blend of e-commerce and entertainment is alive to change the scenarios of online retail. The process involves demonstrations and sales of products conducted live in real-time through streamed video on social platforms or dedicated e-commerce sites.

As an eCommerce giant, Shopify certainly touts the various benefits of live shopping to businesses including engaging customers, increasing conversions, and building a strong community around brands. The directness of live shopping permits interactions between vendors and customers to occur in real time, allowing answers to immediate questions and the demonstration of the product.

Ultimately, it is a more personalized shopping experience. Shopify would also tout the provided tools and integrations to help merchants offer their customers a seamless live shopping experience. For Instance, In Jan 2025, Social commerce capitalizes on the vast reach of platforms like Instagram, Facebook, Pinterest, and TikTok, using them as outlets for selling products directly.

Surprisingly 94.5% of internet users engage with social media within a month, and the average user is active on almost seven platforms, giving businesses a unique opportunity to reach and convert prospects. Key drivers of this growth include compelling video content, strategic influencer marketing, and engaging live shopping experiences redefining the face of social commerce.

Key Regions and Countries

- North America

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

In February 2025, the United Kingdom-based online fashion retailer ASOS PLC launched a strategic plan to enhance customer focus and growth. The renewed plan aims to infuse energy into the understanding and provision of the fashion website to the ever-changing needs of its customers.

The strategy is making further good treads in optimizing operational efficiency, concentrating on customer experience improvements, and adjusting its product line. All these are happening while ASOS puts more effort into penetrating the fiercely competitive space of online fashion. Which would allow them to firmly position themselves within the industry. This is one of the great pillars of customer centricity as part of the new strategy.

In February 2025, Flipkart laid off some of its employees and closed its ANS Commerce business. ANS Commerce’s entire workforce was laid off as part of this venture. The shutdown of ANS Commerce indicates a strategic transformation for Flipkart. Aiming towards rationalizing its outflows and focusing on core e-commerce activities.

Top Key Players in the Market

- Amazon

- Alibaba

- Shein

- Zalando

- ASOS

- Boohoo

- Flipkart

- H&M

- eBay

- Ajio

- Farfetch

- Global Fashion Group

- Myntra

- Shopclues

- Other Key Players

Recent Developments

- In February 2025, Reliance Retail, owned by the Ambani family, announced its association with Shein to boost the fast-fashion app in the Indian market. Shein was banned in India in 2020 over data security concerns and this partnership will see Reliance Retail manage Shein’s operations within India with the help of its robust retail infrastructure and market knowledge.

- In December 2024, Alibaba Group made a significant investment in the South Korean fashion platform, Ably. The investment of 100 billion won (approximately $71 million) by Alibaba gives a 5% stake in Ably Corporation to the firm. Such investment activity is expected to bolster Alibaba’s aspirations in the Korean e-commerce market and lay the grounds for exploiting Ably’s focus on K-fashion for entry into European and other global markets.