September marked a third consecutive strong month for the electric vehicle (EV) market, helping push Q3 sales to a record high. As buyers rushed to take advantage of the final days of the federal EV tax credit, demand remained elevated, inventory tightened sharply, and incentives continued to shape sales across both new and used segments.

New and Used EV Sales – September

New EV Sales: Estimated September new EV sales totaled 147,716 units, down slightly – 0.6% from August – but up 44.4% from a year earlier. EV share of total sales in September reached a record of 11.7%. Several brands posted their highest monthly volumes of 2025, including Tesla, Ford, Hyundai, Cadillac, Kia, GMC, and Rivian. The top five market leaders by unit volume were Tesla (62,834), Chevrolet (11,402), Ford (11,057), Hyundai (10,556) and Cadillac (7,570). Estimates show Tesla sales grew 6.1% month over month, lifting its share of total EV sales to 42.5%, up 2.7 points. Among luxury brands, Cadillac posted the strongest growth, up 25.5% to 7,570 units, gaining 1.1 points of share. GMC also surged 48%, driven by strong demand for utility EVs, while Kia climbed 15.6%, reinforcing its position in the non-luxury segment.

Used EV Sales: Used EV sales reached 40,569 units in September, up 4.8% month over month and 75.6% year over year, pushing market share to a new high of 2.8%. The top five makes by unit volume were Tesla (16,494, up 2.1%), Chevrolet (3,541, down 2.3%), Ford (2,566, up 11.3%), Audi (2,135, up 26.0%) and Volkswagen (1,980, up 21.8%). While Tesla remained dominant, its share of the used EV market dipped to 40.7%, down 1 point from August. Audi and Volkswagen posted the largest share gains, up 0.9 and 0.7 points, respectively.

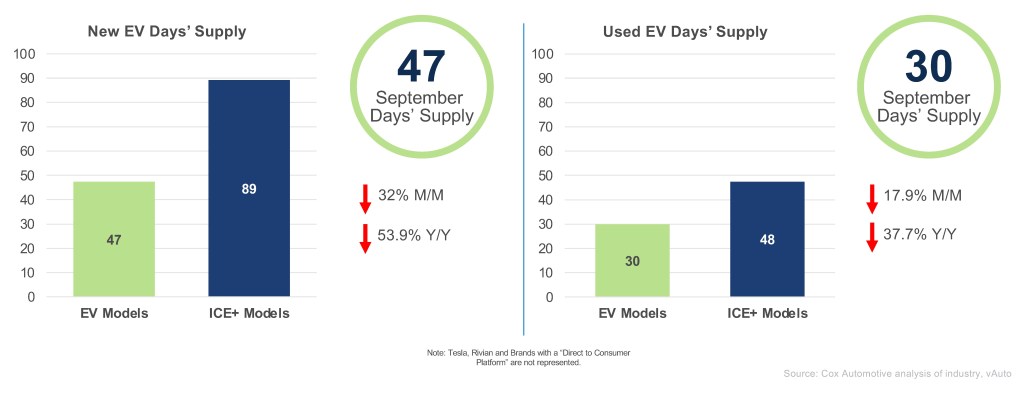

New and Used EV Days’ Supply – September

New EV Days’ Supply: In September, EV days’ supply fell to 47 days – the lowest level in three years – down 32% month over month and 53.9% year over year. EV supply now trails ICE+ inventory by 45 days – the widest gap on record since 2021. The average decline across all makes was 26 days, signaling broad tightening in EV availability. The brands with the largest declines were Porsche, down 65 days; Ford down 50 days; and Genesis, down 45 days. GMC had the highest EV supply at 123 days, while Toyota had the lowest at just 10 days.

The average decline across all makes was 26.2 days, signaling broad tightening in EV availability. The brands with the largest declines were Porsche, down 65 days; Ford down 50 days; and Genesis, down 45 days. GMC had the highest EV supply at 123 days, while Toyota had the lowest at just 10 days.

Used EV Days’ Supply: In September, used EV days’ supply dropped to 30 days, the lowest level since March 2022, and remained below ICE+ levels for the seventh time this year. Supply levels varied across makes. Tesla (22 days), Chevrolet (26) and Nissan (28) had the lowest availability, while Ford (53) and GMC (62) had the highest, hovering near or above a two-month supply. Toyota, down 18 days, and Volkswagen, down 16 days, posted the steepest month-over-month declines. Genesis, down 17 days, and Rivian, down 16 days, saw the largest drops in the luxury segment. Note: Tesla and Rivian figures reflect only vehicles available through traditional dealerships, excluding direct-to-consumer models.

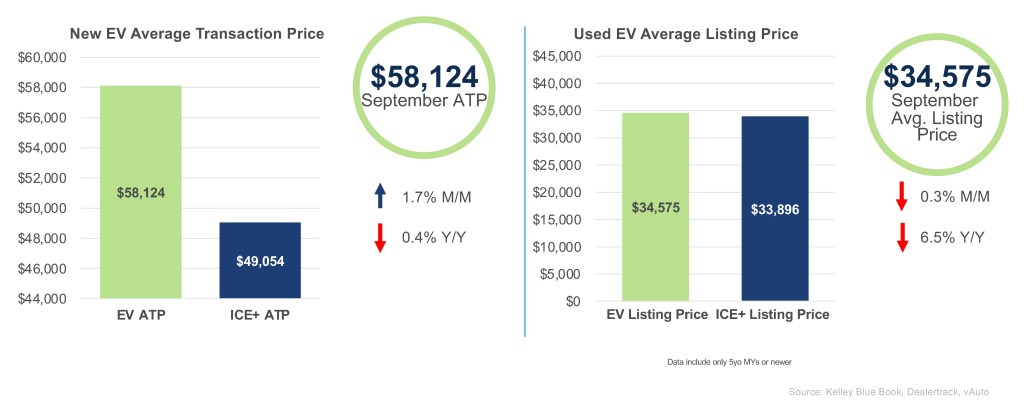

New and Used EV Prices – September

New EV ATP: In September, the average transaction price (ATP) for new electric vehicles rose to $58,124, up 1.7% from August and down 0.4% year over year. The price premium over internal combustion engine (ICE+) vehicles held steady at $9,070, while incentives eased to 15.3% of ATP, or roughly $8,890. Luxury EVs accounted for 62% of total EV volume, and the increased volume of full-size electric trucks and SUVs pushed higher-priced models into the mix. Toyota led all brands in month-over-month ATP gains with an 8.6% increase, followed by luxury brands Volvo, up 6.4%, and Audi, up 4.8%. While Tesla’s ATP slipped 0.6%, its dominant sales volume pulled down the overall average. Among the top five EVs by sales – Tesla Model Y, Model 3, Hyundai Ioniq 5, Ford Mustang Mach-E and Chevrolet Equinox EV – the Equinox EV had the lowest ATP, averaging just $40,096.

Used EV Listing Price: In September, the average listing price for used electric vehicles declined to $34,575, down 0.3% from August and 6.5% year over year. The price premium over used ICE+ vehicles narrowed further to just $679, continuing the trend toward price parity. Fourteen makes had a lower average EV price than their ICE+ counterparts, and 15 makes were priced below $30,000, with Nissan among the lowest at $20,000. The top-selling models – Tesla Model 3, Tesla Model Y, Ford Mustang Mach-E, Volkswagen ID.4, and Tesla Model S – were all listed under $30,000, with the ID.4 the lowest at $22,919.

Looking Ahead

With the federal EV tax credits now expired, the market enters a new phase driven by fundamentals. Continued electric vehicle adoption will hinge on how effectively the industry addresses cost, confidence and convenience. Affordability remains a key hurdle exacerbated by the lack of federal incentives. Battery health transparency is essential to building trust, and charging infrastructure will shape regional momentum. As used EV prices approach parity and consumer interest holds steady, long-term success will depend on delivering value and access – without relying on subsidies.

The EV Market Monitor gauges the health of the new and used electric vehicle (EV) markets by monitoring sales volume, days’ supply and average pricing. Each metric will be measured month over month and year over year. For a detailed new-EV sales report, see the Q3 Electric Vehicle Report, the official quarterly report of EV data.