Sign up for daily news updates from CleanTechnica on email. Or follow us on Google News!

My colleague Jose Pontes reported recently that there have been storm clouds when it comes to EV sales in Europe lately, but the trend is not uniform across all nations. Sales of conventional cars are also taking some lumps as well. The Center for Automotive Management in Germany has put the data into its own chart that shows at a glance what is going on with EV sales in European countries, and it shows some bright spots among the gloom.

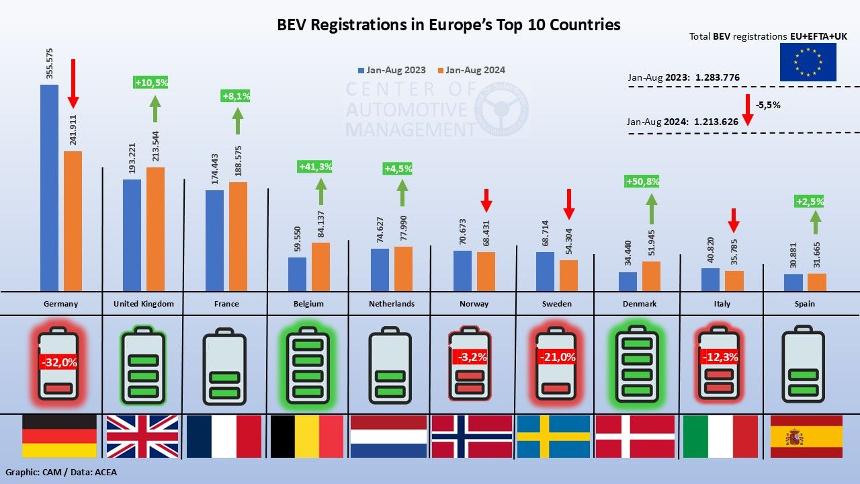

From January 1 through August 31, 2024, a total of 1,213,262 new EV sales were recorded in Europe, according to CAM Director Stefan Bratzel. In the same period in 2023, there were 1,283,776 new electric cars. CAM collects data on the EU states and the four EFTA countries — Iceland, Liechtenstein, Norway, and Switzerland. That is important because the EFTA markets are included in the calculation of the manufacturers’ carbon dioxide fleet limits. The situation is different for the UK, which has its own CO2 regulation since leaving the EU.

Bratzel sees “significant shifts in the European market.” In essence, while EV sales are down sharply in Germany, they are up significantly in other countries. “While total BEV registrations across the EU, EFTA, and the United Kingdom declined by 5.5% compared to the previous year, there are opposing developments in key markets,” he says.

In the first 8 months of this year, new EV sales in Germany — Europe’s largest new car market — fell by a whopping 32%. In part, that decline was caused by an increase in sales the prior year to take advantage of a German environmental bonus subsidy for commercial owners before it expired. Then, in December 2023, Germany riled the marked by abruptly ending the environmental bonus for all EV sales. The result was that 355,575 new EV registrations occurred in Germany in the first 8 months of 2023 but only 241,911 were recorded in the same period this year.

In contrast, “the United Kingdom exhibited strong growth of 10.5%, reaching 213,544 EV registrations. With this momentum, the UK is closing the gap with Germany and could soon take the leading position in the European market,” says Bratzel. If the situation in Germany does not change soon, the UK could become Europe’s largest electric car market. France, now in third place with 188,575 new EV registrations, is also catching up. However, manufacturers in all European markets are likely to step up their EV efforts soon in order to comply with EU emissions regulations. The recent price reduction for the VW ID.3 is probably an example of what can be expected.

Contrary to what one might expect, it was not Norway or the Netherlands that took fourth place. Belgium now occupies that position after overtaking Sweden with an increase of 41.3% and a total of 84,137 electric vehicles sold, which Bratzel calls an “impressive increase.” Among the top ten countries, Denmark recorded the highest growth at 50.8%. So far this year, Denmark has registered 51,945 new electric cars, compared to just 34,440 units a year ago.

That means the country is just behind Sweden, where 54,304 new EV sales have taken place this year. Sweden — like Germany — has refined its EV subsidy policy, which sent new EV sales down 21% from last year. The top ten is rounded out by Italy, with 35,785 EV sales — down 12.3% — and Spain, with 31,665 EV sales — up 2.5%.

The key question now is how things will develop in the coming months. Automakers will focus their attention on meeting the carbon dioxide fleet targets set by the European Union. He expects EV sales will be roughly the same next year as they were this year. Peter Mock, the head of the International Council on Clean Transportation, tells electrive that he estimates EV sales in Europe will be “25 per cent battery vehicles” — perhaps a little less, perhaps a little more — “and this figure will remain unchanged until 2029.” Those of us who know about new technologies and the S curve might find Mock’s medium-term estimate too conservative, but opinions are like noses — everybody has one.

Ford Starts Capri EV Production

With Volkswagen taking its lumps lately amid declining sales of its ID. branded electric cars — and lower sales of its conventional cars as well — we might be forgiven for thinking other automakers might be backing away from focusing on EV production. But Ford has gone ahead with the start of production for its new Capri battery electric cars at its factory in Köln (Cologne), Germany. The Cologne EV Center is set to become Ford’s first carbon neutral assembly plant worldwide — part of the company’s commitment to achieve carbon neutrality across its entire European network of facilities, logistics, and direct suppliers by 2035.

The battery electric Capri pays homage to a car of the same name that was imported into the US 50 years ago. With its V-6 engine and 4-speed transmission, it was known as the “poor man’s XK-E” and was quite popular among sports car enthusiasts. The new Capri EV takes some of its styling cues from the original car. The difference is today’s car is a 4-door with SUV pretensions whereas the original was a 2-door coupe with a rudimentary rear seat.

Ford once had plans to go all electric by the turn of the century, but, like most of its peers, it has recalibrated those plans in light of market realities. Recently Marin Gjaja, CEO of the Model E electric car division at Ford, told Autocar the company’s plan to go all-electric by 2030 in Europe was “too ambitious.” Ford is no longer planning to stop selling combustion engine cars in Europe within the next six years, as it said it would in 2021, because of the “uncertainty” around EV demand and legislation. Instead it will continue to offer a range of hybrid options in its Puma, Focus, and Kuga offerings.

“I don’t think we can go all in on anything until our customers decide they’re all in, and that’s progressing at different rates around the world,” he said. “I think customers have voted, and they told us that was too ambitious, is what I would say. I think everyone in the industry has found that out the hard way. I would also say reality has a way of making you adjust your plans. We don’t see that going all-electric by 2030 is a good choice for our business or, especially, for our customers,” he added.

The new Capri will be the second EV manufactured at the Cologne EV Center, where the new Europe-only Explorer is also assembled. Both cars use the Volkswagen MEB platform and both are vital to Ford’s future plans. Works Council Chairman Benjamin Gruschka told local media recently, “This is an important milestone for the Cologne plant and its employees in what are generally difficult times in the industry.”

The Takeaway

People got mesmerized by the teachings of Elon Musk 5 years ago when he spoke of Tesla doubling its production capacity every year or two and producing 20 million electric cars a year by 2030. Since then, Tesla has trimmed its forecast significantly and the rest of the industry has learned there is often a gap between theory and reality. Despite the gloom in Germany, EV sales are doing pretty well in the rest of Europe and seem on pace for steady growth even if at a slower rate than originally expected.

Much of the responsibility for the current malaise in the world of electric cars can be attributed to customers getting whipsawed by abrupt changes in government policies. Markets like stability, but, unfortunately, governments often make policy adjustments on the fly, which rocks the market until a new equilibrium is found. The best approach for EV advocates today may be “Keep calm and charge on.” The EV revolution is just getting started.

Have a tip for CleanTechnica? Want to advertise? Want to suggest a guest for our CleanTech Talk podcast? Contact us here.

Latest CleanTechnica.TV Videos

CleanTechnica uses affiliate links. See our policy here.

CleanTechnica’s Comment Policy