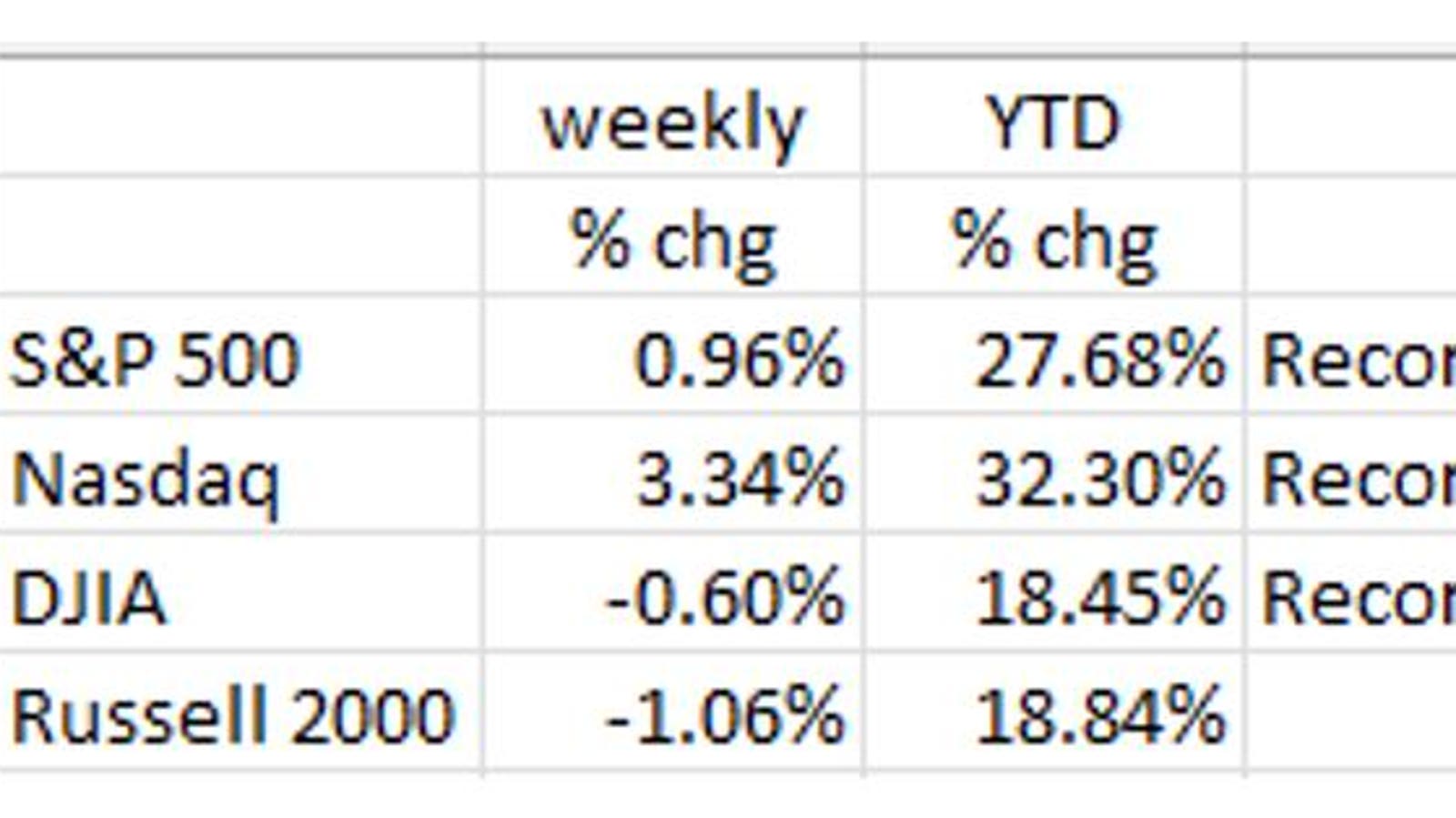

Financial markets waited all week for the jobs data, and that data did not disappoint. Like in the Goldilocks tale, the jobs numbers weren’t too hot, nor too cold. They were just right! As a result, the S&P 500 and the Nasdaq both closed a record high on Friday (December 6th). The S&P 500 was up almost 1% for the week and the Nasdaq by a whopping 3.3% (see table).

Equity Markets

While the DJIA was off slightly for the week, it too hit a record high during the week (on Wednesday (December 4th)). Only the small cap Russell 2000 was the week’s laggard, falling just over -1% for the week.

As noted, Nasdaq’s performance was outsized, led by four of the Magnificent 7 stocks. As shown in the table below, all seven were up significantly for the week with Tesla up double digits and with Amazon and Meta not far behind. The table shows that three of the seven (AMZN, META, TSLA) made new highs on Friday and one (AAPL) hit a new high on Thursday.

Magnificent 7

Jobs Jobs Jobs!

On Wednesday, ADP reported that, by their count, job growth was +146K in November, somewhat less than October’s +184K (which was originally reported as +233K). Of significance is the breakdown by business size: Large: +120K; Medium: +81K, Small: -17K). We note that for small businesses (<50 employees), this was the fourth decline in the last five months. Small business health is normally a reliable leading indicator for the future health of the labor market, so some caution here.

Then, on Friday, Non-Farm Payrolls came in at +227K, nearly right on Wall Street’s +220K consensus estimate. Part of this was, undoubtedly, recovery from the Hurricanes and labor strikes of October. From the headline number, it would appear that the economy remains in expansion mode. However, not all of the underlying data tell the same tale.

- As we have mentioned many times in this blog, Non-Farm Payrolls (the “Establishment Survey” which comes from surveys of businesses) get a monthly positive kick from the Birth/Death add-in; it was +101K for November. Because the Bureau of Labor Statistics (BLS) does not survey small businesses, they use a long-term seasonally adjusted trend line to account for the small guys. That means that the counted number was only +126K. As we have noted in the past, small business bankruptcies have risen significantly in 2024, thus, in our view, throwing doubt on the Birth/Death add-on.

- The financial markets normally take the Establishment Survey number as gospel and run with it. Thus, the rise in the equity markets on Friday after the release of the Establishment Survey numbers. The sister survey, the Household Survey, comes from calls to households. That survey, which is much more accurate at forecasting business cycle turning points, showed up as -355K for November after a -368K showing in October. This was the worst back-to-back number since the Covid shutdown in the Spring of 2020. Yet, as usual, it was ignored by Wall Street.

- Looking further into the Household Survey, we find that the all-important 24-54 year-old breadwinners saw a loss of -204K jobs in November after October’s much more devastating -401K. Of that -204K in job losses, -111K were full-time jobs in November (and -164K in October). These numbers tell us that not all is well in the labor markets.

- The left side of the next chart shows the job changes by economic sector. The top three were the usual suspects (Health Care and Social Assistance, Leisure/Hospitality, and Government). Note that Retail (at the bottom of the chart) shed -28K jobs. This alone is an important insight into retailers’ expectations for the holiday gift buying season which is shown on the right-hand side of the chart – the slowest expected growth in six years.

November Jobs One-Month Net Change & U.S. Holiday Sales Set for Slowest Growth in Six Years

- On a weekly basis, the Department of Labor puts out a news release on new and continuing unemployment claims. In the December 5th release, there were 10 states where initial unemployment claims rose by more than 1,000, and there were no states where such claims fell by that number. Yet more cautionary data.

JOLTS

Earlier in the week the JOLTS (Job Openings and Labor turnover Survey) was released by the BLS. Note the rapid downtrend in job openings. That number peaked in March 2022. Then it began a steep decline in 2023 which has continued to present day. Note that current job openings are back to where they were pre-Covid (2019). In the last year, hirings are down -501K while job openings have fallen -941K. Looked at from this viewpoint, the labor market is rapidly cooling.

JOLTS (Job Openings)

Challenger Gray & Christmas

The Challenger placement firm follows layoff announcements. The following chart shows those layoff announcements for every November since 2008 and ranks the year from most to least. Of the 17 years shown for the November month, the current year (2024) ranks fourth highest. Recession years are shown in red. Note that this past November, layoff announcements were not far off those of November 2020, a Recession year.

November Job Cut Announcements

All in, the labor market appears to be cooling at a rapid pace.

Health of the Consumer

In their Q3 shareholder reports, we have seen the major retailers lament about the mood of the consumer who has become price conscious and resistant to price increases. We’ve noted some of these in past blogs. Footlocker is the latest in the group. They cut full-year revenue and earnings guidance noting: “The consumer is being choosy, picky and smart, trying to find the best deals they can find.” (Mary Dillon, CEO). As noted earlier, Retail employment was negative in November, and sales growth expectations are the lowest in six years.

Black Friday, the day after Thanksgiving, has traditionally been the kick off to the holiday buying season. So far, we’ve shown a negative number in the Retail hiring space for November and the expectation from the National Retailers’ Association that 2024 will be a low sales growth year. So, is it any wonder that Black Friday sales began a month ago and continue unabated?

While the economy has grown at a nearly 3% clip for much of 2024, Retail hiring and expectations of growth along with a month of Black Friday sales indicate that the economy is slowing. And the following charts of credit card and auto loan delinquencies, which are on rapid upward paths, may indicate that the consumer is running out of gas.

All in, it doesn’t look too promising for a continuation of 3% GDP growth as we enter 2025!

Credit Card Delinquencies & Auto Loan Delinquencies (90+ Days)

Inflation

The latest QCEW (Quarterly Census of Employment and Wages) show wages growing at a 4% rate. Productivity growth appears to be 2%. That adds up to a net inflation pressure from the wages side right at the Fed’s 2% goal.

As noted in past blogs, BLS uses lagged rent data in calculating the CPI. Economist David Rosenberg notes that, ex-rents, the year/year CPI would be +1.7%, now below the Fed’s 2% goal. Note from the chart below that real time rents continue to show up as negative and, as of November, are down -0.6% year/year. As a result, we look forward to much lower CPI prints in 2025, and believe that, despite the hawkishness coming out of some Fed FOMC members, the weakening consumer and slowing labor market will push the Fed to lower the Fed Funds rate to its neutral level (3%). Currently that rate is in the 4.75-5.00% range. We expect the Fed to lower the Fed Funds rate at its December 17-18 conclave by 25 basis points to the 4.50%-4.75% range and continue to lower throughout 2025 until they reach their “neutral” (3.0%) level, and to rapidly go below neutral if a Recession develops.

Yearly Change & Monthly Change in National Rent Index (2019- Present)

Final Thoughts

Equities continue to march higher led by the tech heavy Nasdaq. In fact, all three major indexes (S&P 500, Nasdaq, and the DJIA) hit all-time closing record highs this past week (ending December 6th). That was also true for four of the Magnificent 7. Equity markets, by all historic measurements, appear to be frothy.

The much-anticipated Non-Farm Payroll numbers (Establishment Survey) at +227K came in almost dead on the consensus +220K forecast. That would appear to solidify the “soft” and/or “no landing” scenario. Just some minor non-confirmations: The sister Household Survey showed large job losses (-355K) for the second consecutive month, much of which was centered in the important 25-54 breadwinner age group. As a result, the unemployment rate ticked up to 4.2% (was 4.1% in October).

A look at the breakdown of jobs by sector shows that most of November’s increase came from Government, Health Care and Social Assistance, and Leisure/Hospitality. What caught our eye was the -28K job loss in the Retail sector. Not a wonder why Black Friday discounting has been going on for over a month. Apparently, the consumer has become picky about price increases and has gone into “deal seeking” mode. In addition, from the rise in the delinquency charts, the consumer, at least at the margin, appears to be tapped out.

The inflation picture, itself, continues to improve. And we expect to see a continuation of good inflation news in 2025. Despite Fed rhetoric continuing on the hawkish side, it is our view that the slowdown in the labor market and easing inflation numbers will cause the Fed to lower rates by 25 basis points at its December 17-18 conclave to 4.50%-4.75% on their way to their 3.0% neutral zone. Good news for bonds.

(Joshua Barone and Eugene Hoover contributed to this blog.)