U.S. stock markets needed some reassurance and Federal Reserve Chair Jerome Powell looks to have given it. Futures pointed to a continued rally early on Thursday after Powell suggested the central bank didn’t necessarily view tariffs as an obstacle to rate cuts.

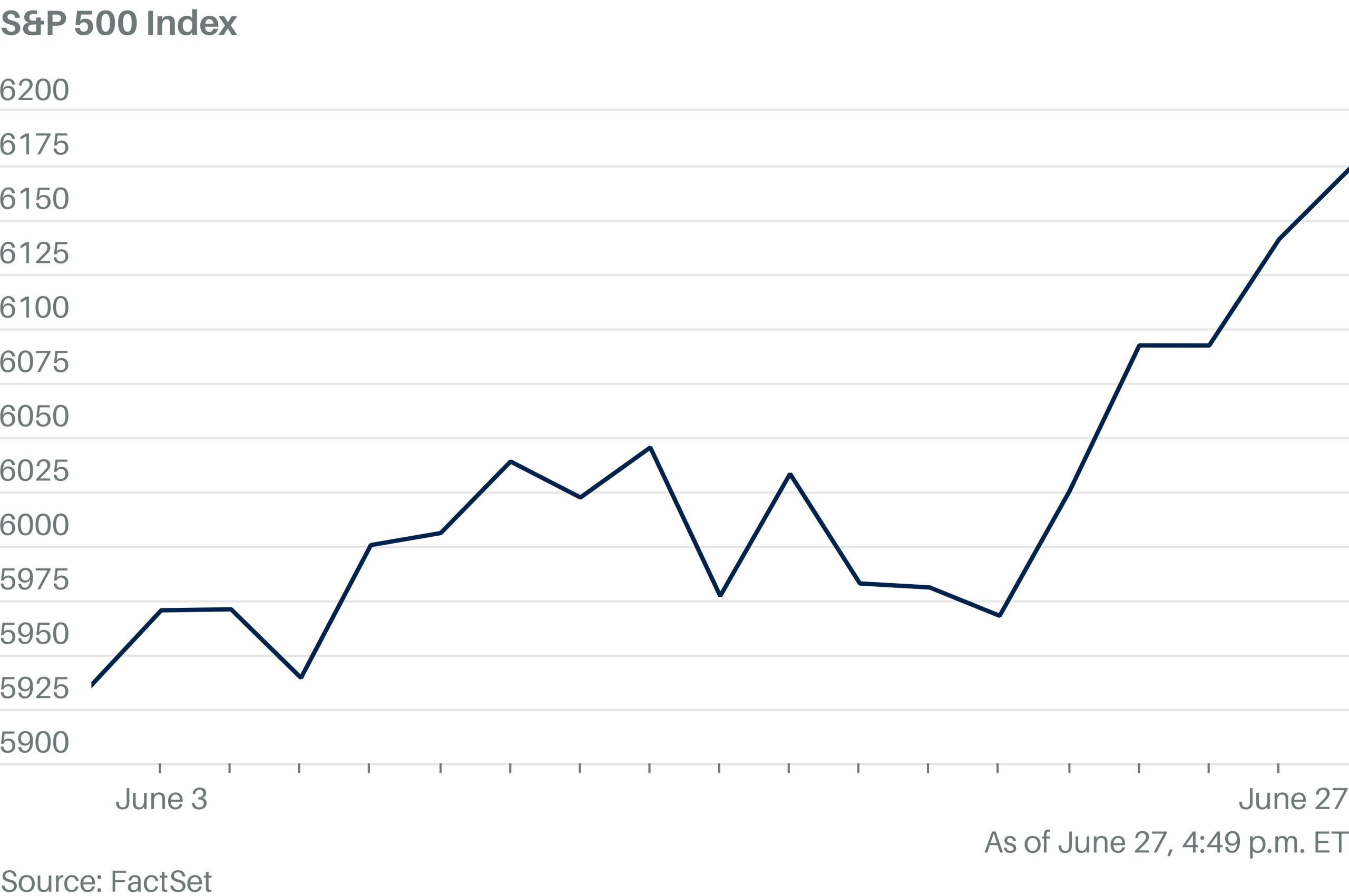

Dow Jones Industrial Average futures were up 138 points, or 0.3%. S&P 500 futures were climbing 0.5% and Nasdaq 100 futures were gaining 0.6%.

Stocks were looking to build on gains made the previous day when the Fed kept rates steady at its March policy meeting and officials maintained a forecast for two interest-rate cuts through to the end of the year, with Fed Chair Powell suggesting inflation brought on by tariffs could prove to be transitory.

“Jerome Powell’s press conference was the steady hand that the markets needed right now… Even though Powell acknowledged that tariffs can add to inflation and that it might take longer for the Fed to meet its inflation target, the market appreciated his clarity and confirmation that economic conditions remain solid, despite the recent volatility,” said Clark Bellin, president and chief investment officer of Bellwether Wealth

The yield on the benchmark 10-year Treasury bond stood at 4.237% early on Thursday, ticking down further from the previous day when it fell from above 4.3%. The Fed also approved plans to slow the reduction of its $6.8 trillion asset portfolio.

“The Federal Reserve’s move to slow quantitative tightening is another key development, which should aid the stock market and quell some of the volatility,” Bellin said.

However it wasn’t all good news as policymakers also said they expect gross domestic product growth of 1.7% in 2025, down from their December projections of 2.1%.