1:30pm: Small businesses continue to struggle with inflation: index

The NFIB Small Business Optimism Index fell 2.3 points in January after gains in November and December but remains well above its three-year average, according to Wells Fargo.

The recent boost, linked to the 2024 election outcome, was driven by improved economic expectations and credit conditions. However, key indicators like job creation plans, job openings, and capital expenditures remain below pre-pandemic levels.

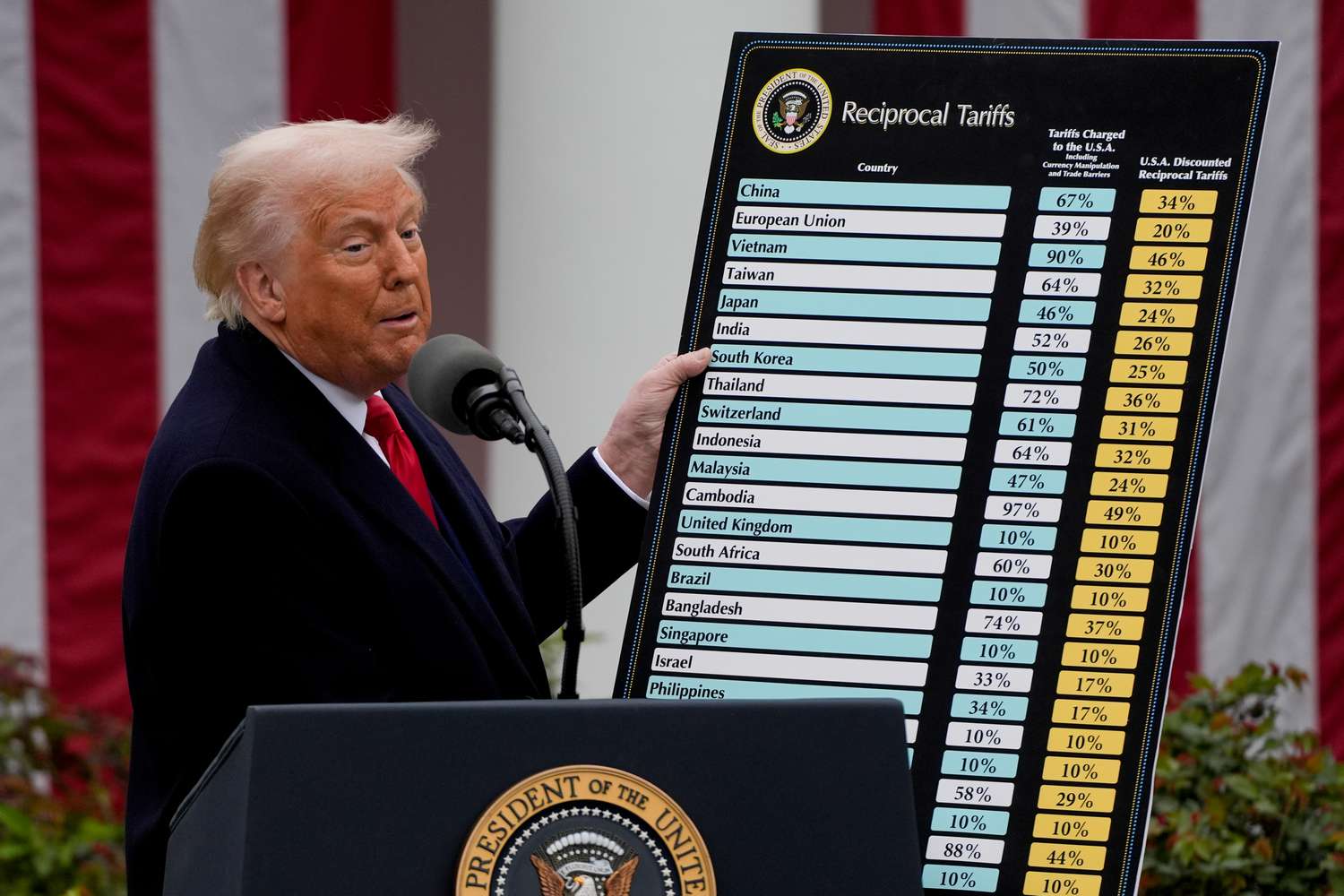

While labor market deterioration has stabilized, small businesses continue to struggle with inflation pressures and rising uncertainty, possibly due to tariff volatility.

“Owners also expressed a pickup in general uncertainty, possibly driven by recent volatility in tariff announcements,” Wells Fargo noted.

12:30pm: Treasury yields push equities down

The Dow is up 0.1% in midday trading, showing slight gains amid mixed market performance. The S&P 500 is down 0.1%, while the tech-heavy Nasdaq has slipped 0.4%.

Higher US treasury yields are pushing equities down, according to Axel Rudolph, Senior Technical Analyst at online trading platform IG.

“The US 10-year Treasury yield rising to 4.54% and small business optimism falling from 2018-highs weighed on US stock indices,” said Rudolph.

“These halted their losses after Fed President Jerome Powell’s speech in which he stated that the central bank is in no hurry to adjust policy as the US economy remains strong overall.”

11:25am: Investors take profits

Gold prices saw some profit-taking today as markets awaited Federal Reserve Chairman Powell’s testimony.

This followed a recent surge to record highs, fueled by strong safe-haven demand amid rising trade tensions and economic uncertainty.

“Powell is expected to emphasize the economy’s resilience as a key factor in the central bank’s cautious approach to interest rate cuts,” said Ruben Ferreira, Head of Portuguese Operations at FlowCommunity.

“Additionally, upcoming inflation data this week will be crucial for market expectations regarding the Fed’s rate cut timeline, which could introduce some volatility in gold prices over the next few days.”

9.57am: Russell leads way as stocks sold off

US small caps were the worst-hit as Wall Street stocks saw a shallow sell-off on Tuesday morning.

The S&P 500, Nasdaq Composite and Dow Jones all were down around 0.2%, while the small- and mid-cap Russell 2000 fell 0.7%

Fallers on the S&P index included finance giant Fidelity National Information Services Inc (NYSE:FIS), down 15%, hotel operator Marriott International Inc (NYSE:MAR), down 4.8%, and Super Micro Computer, down 3.3%.

Ecolab, the water purification group, topped the leaderboard, up 7%, ahead of the likes of DuPont, S&P Global and Coca-Cola, all of which were boosted by earnings.

Phillips 66 was another riser, as activist Elliott Investment Management disclosed a stake in the oil refiner and called for operational changes.

7.35am: Nasdaq to fall as Wall Street gives back some gains

Wall Street stocks are seen giving back some of their previous gains on Tuesday, led by the same tech sector that had driven a positive start to the week.

US futures were in the red ahead of the opening bell, with the Nasdaq 100 down 0.5%, the S&P 500 by 0.3% and Dow Jones 0.2%.

The fourth quarter earnings season continues, with updates come from Coca-Cola, Humana, Lyft, Shopify and Super Micro Computer.

Investors will also hear from Federal Reserve chair Jerome Powell, with his first day of testimony in Washington to the Senate Banking Committee.

“Investors will be very interested to hear what Mr Powell has to say about tariffs, particularly how they may affect inflation. It seems likely that the Fed Chair will be quite circumspect, preferring to ‘wait and see’ rather than rushing to judgement,” says market analyst David Morrison at Trade Nation.

He added that the US central bank has “made it clear that it’s in no hurry to loosen monetary policy further”, following the 100 basis points of rate cuts over the last four months of 2024, and with markets currently forecasting a 50 bps more this year.

“The yield on the 10-year Treasury note is up this morning, and that is weighing on stock index futures to some extent,” Morrison says.

Even though the companies involved are not listed, investors will also be eyeing developments at OpenAI, where a group led by Elon Musk launched a $97.4 billion takeover offer.

Musk, who co-founded OpenAI in 2015 but left in 2018, was turned down by OpenAI boss Sam Altman, who tweeted: “no thank you, but we will buy Twitter for $9.74 billion if you want.”

Elsewhere, cybersecurity outfit SailPoint and its private equity owner Thoma Bravo have upped the pricing of its IPO, with a validation of up to $12.6 billion now sought.

As one of the first toes to be dipped into the IPO waters this year, investors seem to be keen, with the issue of 50 million shares to be priced between $21 and $23, up from its previous proposed $19-21 range.