MILWAUKEE – It’s kind of like carrying digital cash on your phone, but are apps like Venmo and Zelle really worth it?

Digital dilemma

Local perspective:

Inside the Milwaukee Academy of Science, senior Kyrie Moss finds an outlet in music.

“I’m on a money run, can’t nobody stop me,” Moss rapped.

Like the song she wrote and performed in her school’s recording studio, money is almost always on her mind.

“It’s a lot on your plate. Especially when you’re working and trying to get through school,” Moss said.

Instead of a wallet, Moss said she pays for everything through her phone.

“It showed that I sent her $5, and then she’ll receive it in a couple of seconds,” Moss said as she used Cash App on her phone.

What is P2P?

What we know:

Cash App is one of many popular peer-to-peer, or P2P, payment services like Venmo, Zelle and PayPal.

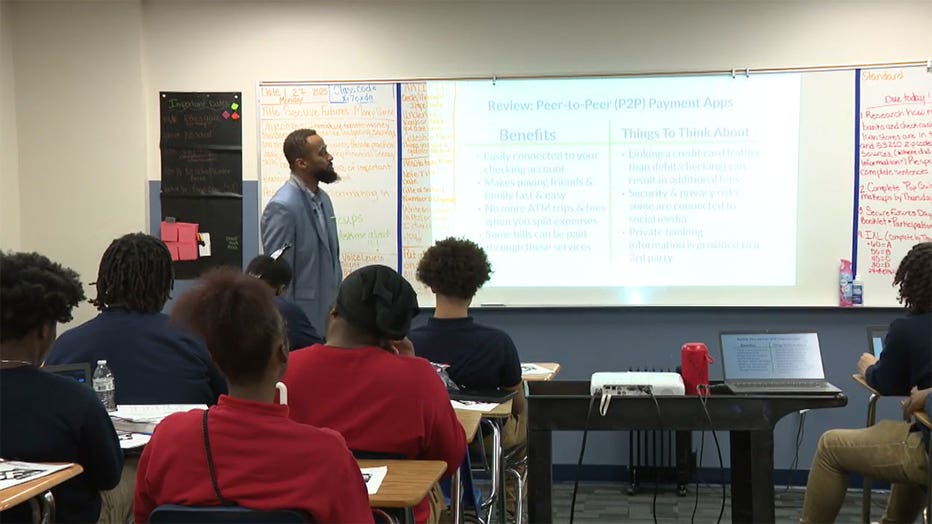

Across the hall from Moss’ music class, Charles Clark has a cautionary tale for students who download these apps.

“Just be more informed of how you are using it and the ways you’re using it,” Clark said.

FREE DOWNLOAD: Get breaking news alerts in the FOX LOCAL Mobile app for iOS or Android

Clark is a volunteer with the group, SecureFutures and a Milwaukee real estate investor. He describes P2Ps as apps that allow people to quickly send money to someone else using their telephone number, email or username.

“I shouldn’t have to tell the bank that I’m handing my friend some money,” Clark said.

There is risk

What we know:

But these apps are not without risks.

“Make sure your card is locked when you’re not using it,” warned Milwaukee Academy of Science senior Zarkayvion Worthington.

For starters, Clark said the money you put into the app is not insured like it is in a bank. If it’s hacked, stolen or if you send your money to the wrong person, Clark said it is gone for good.

“Is there any way to get that money back?” asked FOX6 News reporter Bret Lemoine.

“Nope,” Clark said. “That’s why the banks are insured up to $250,000 and some of these cash apps are just a service. They are just handing off money and charging you to hand that money off.”

“What happens if you send money to the wrong person?” Lemoine asked Moss.

“Um, that – you can ask for it back. But they might not send it back,” Moss said, speaking from experience.

SIGN UP TODAY: Get daily headlines, breaking news emails from FOX6 News

That brings us to the other downside of P2P apps.

Clark asked the classroom how many students have a bank account. Only five people raised their hand.

“I was very surprised,” Clark reflected. “We’re in a different era.”

The future, Clark said, is sending money with taps and swipes. But convenience cannot always match your neighborhood bank.

“Having your money in a savings account – it gains interest,” Clark explained. “Even if you keep it in there for a money, you’re gaining interest on it. Where if you have it in your pocket or Venmo for a month – it’s the same amount.”

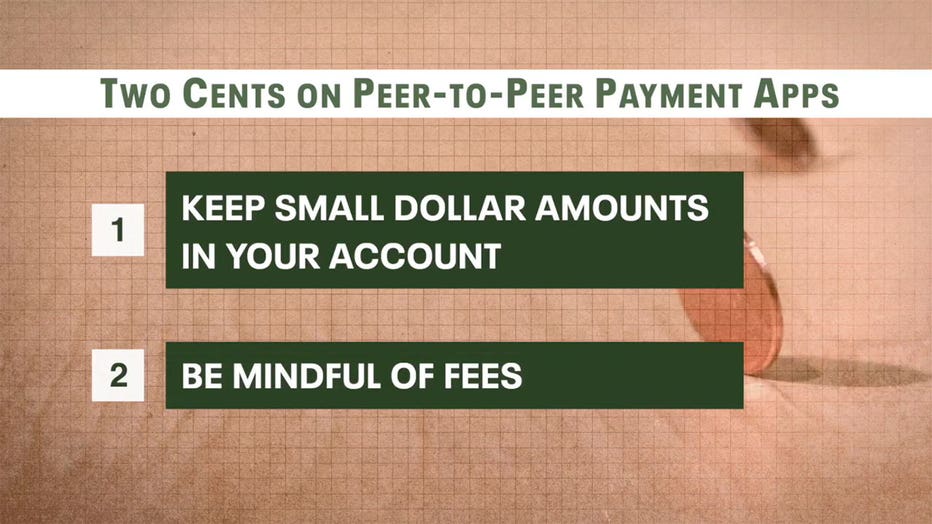

Advice for cash app users

Why you should care:

Only keep small dollar amounts in your P2P account. That way, if you lose the money, you’re not out a lot.

And be mindful of fees. Most payment apps are free but some carry transaction or processing fees — like if you’re sending money from a linked credit card.

“I didn’t know that you could open a bank account at such a young age,” Moss said. “I didn’t even know it was that easy to open a bank account until I got that class.”

Moss said she went to the bank later that week and opened an account. A different tune now for a cash-conscious teen.

The Source: The information in this post was produced with help from SecureFutures, a Milwaukee real estate investor and students at the Milwaukee Academy of Science.