A variety of negative connotations likely come to mind when college students think of the stock market. One of the most common is that it’s little more than a high-risk casino exclusively for rich people: the province of Gordon Gekko-like arbitrageurs where money changes hands without creating long-term societal value or the place where the elderly lose their life savings to scams, fraud and simple market volatility. It’s no wonder that fear of losing money and lack of confidence are prominent factors keeping students out of the market.

To most college students, the stock market is something to avoid rather than engage with. But, this perception does considerable harm to these students and young people more generally. It also obscures what the market really is: one of the most effective vehicles for creating wealth currently accessible to young people. In order to combat rising affordability issues, promote financial literacy and improve standards of living, University of Michigan students should open their own investment accounts.

Financial crises and their aftermaths likely contribute to the perception that investing your money in the stock market is a risky venture, but this belief largely applies to the day traders and crypto connoisseurs who knowingly engage in high-risk investing. Day traders buy and sell assets rapidly, trying to generate small profits by exploiting short-term price fluctuations, and crypto is known to be particularly volatile in its price swings. But buying and holding shares of the S&P 500 — essentially a weighted basket of the 500 leading publicly traded U.S. companies — over a long time horizon is remarkably safe and easy.

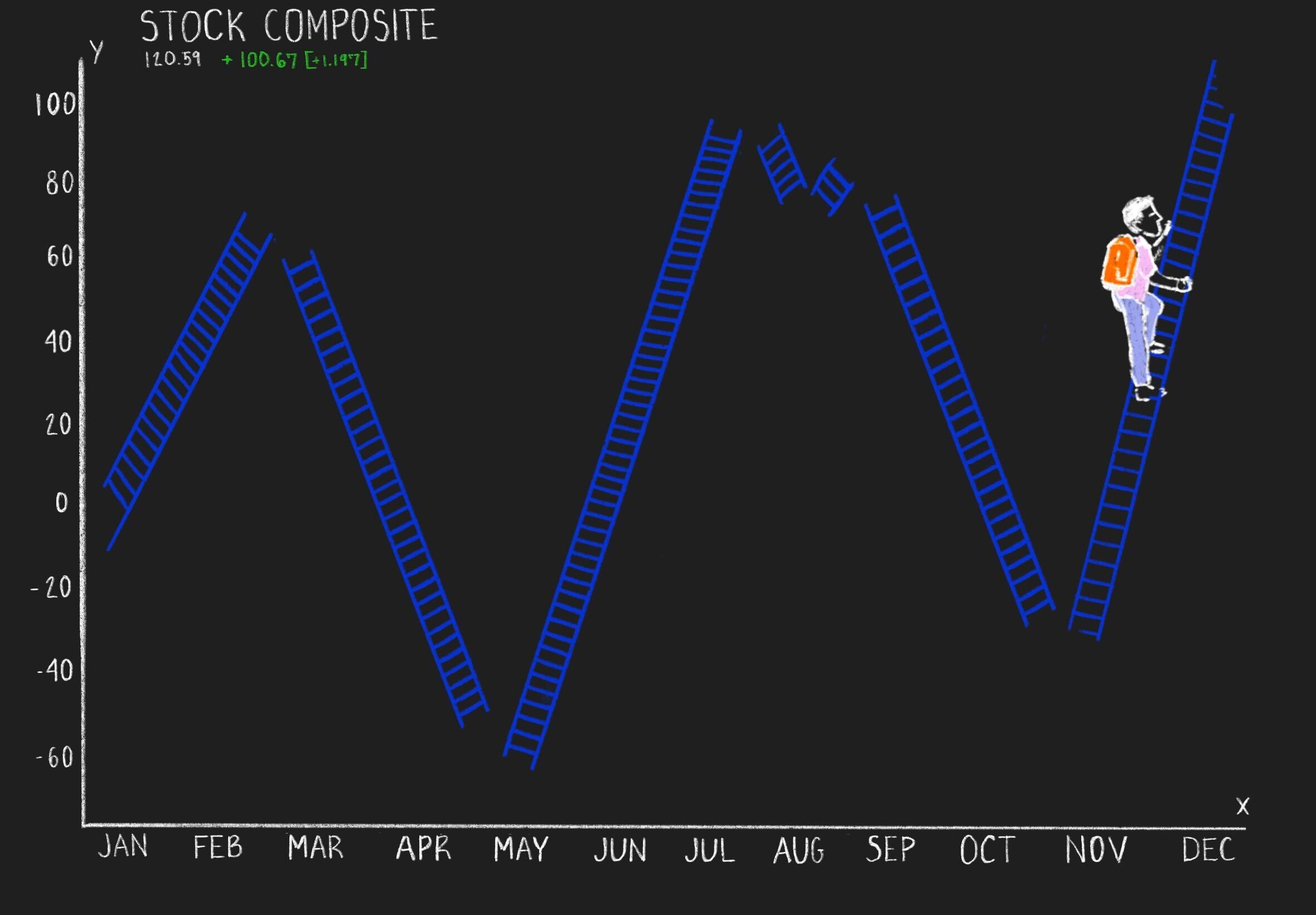

Investing in the S&P has historically provided positive and substantial real returns — the amount earned after accounting for taxes and inflation — and the odds of someone losing money after any 10-year period stand at just 6%. Yes, the market can go up or down on any given day and even suffers the occasional crash, but the consistent expansion of corporate earnings, investor sentiment and the American economy leads to a seemingly inexorable rise in the S&P. Being an index of 500 companies also diversifies the S&P relative to an individual stock — its performance isn’t tied to the fortunes of any one company.

Buying and holding the S&P is also relatively easy compared to active trading. Fidelity lets you set up an investment account without any fees, and you can trade without paying commission to a broker. All you need is a bank account, a social security number and a government-issued photo ID. Once you set up your account, you just have to find the relevant stock, buy it and wait.

Practical investing can provide a source of income for college students at a time when rising housing costs are contributing to an affordability crisis. Young people are justifiably upset at this state of affairs, but that anger should be directed toward solutions, however temporary or inconsistent they might be. Investing in the S&P is a viable stream of potential wealth for the students willing to overcome their preconceptions about investing and the stock market.

Historically, the difficulty with promoting investing among young people is that many don’t have money to spare. Prioritizing basic needs like food, housing and health care often leaves them with little money. For students, balancing tuition costs with studying and job applications leaves little time for monitoring the ups and downs of the market to make informed investing decisions. Not only that, but the S&P only generates a return of about 10% per year. Making an actual impact on rent payments will require a more substantial initial investment than many students are able to make.

There isn’t a one size fits all solution to this, but everyone should do what’s feasible for them. SPY — the primary S&P 500 index fund — allows you to trade as little as $1, and investing more money over time can lead to real returns. If you work, take out a small percentage of each paycheck to invest. If you don’t, consider using a percentage of disposable income. Over time, this strategy can lead to a sum considerable enough to make life more affordable.

Furthermore, the entire point of buying shares of the S&P is that it doesn’t demand a substantial time commitment. You just buy and wait.

Beyond the financial returns, every student will eventually have to manage their own finances. Checking and savings accounts, 401(k)s and tax returns are going to constitute an important part of your life, and having some basic financial literacy will make these tasks infinitely easier. People between the ages of 18 and 34 report the highest levels of financial anxiety, which can paralyze college students as they transition from higher education to the job market. Having some experience with investing — even if that experience is only buying and holding shares of the S&P 500 — can make young adults less intimidated by the other aspects of financial management.

With student anxiety related to stock trading so high, this argument alone is insufficient to get U-M students on board with investing. The University should thus make a serious effort to encourage its students to develop financial literacy. Our financial aid office should encourage students to consider low-risk investment, and the economics department should offer basic financial literacy courses to students as early as freshman year.

The fears associated with the stock market — that it is high risk, exclusively for the affluent and ridden with scams — keep college students from accessing an untapped source of sorely needed wealth. Those fears are powerful, but far from insurmountable. Students can invest easily at low cost and without substantial time commitment. With a time horizon long enough, they can also do so at low risk. Getting started is the only barrier left.

Lucas Feller is an Opinion Columnist who writes about politics, economics and campus culture, sometimes all at once. His column, “Contrarian’s Corner,” runs biweekly on Thursdays. He can be reached at lucasfel@umich.edu.