Rivian’s stock took off this year as EV subsidies disappeared and Ford bowed out of the electric trucks market.

Rivian Automotive (RIVN +15.03%) stock is on a roll — although the roll is kind of rocky.

Shares of the electric truck maker have been trading publicly for more than four years now. Since their late 2021 initial public offering (IPO), however, they’ve mostly been trading down. As a result, Rivian stock has lost 81% of its valuation at IPO — versus a 47% gain for the S&P 500.

Image source: Rivian.

Have you driven a Rivian lately?

And yet, Rivian stock seems to have caught its second wind lately.

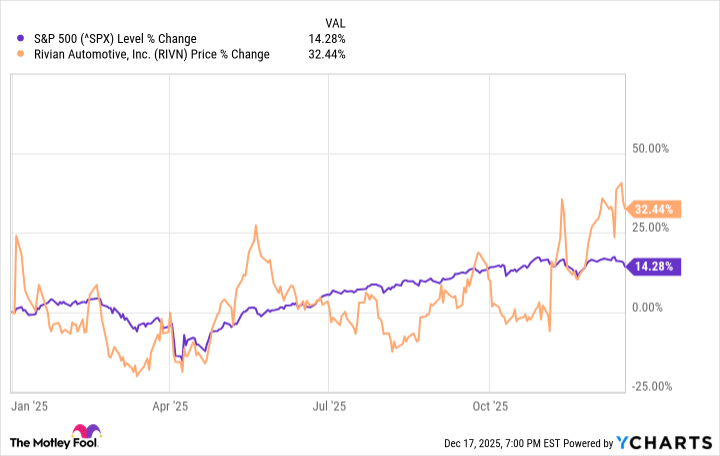

2025 was an odd year for this to happen, what with Rivian being an electric vehicle company, and Congress having just repealed the $7,500 electric vehicle (EV) tax credit this year. Regardless, in 2025, Rivian shares have outperformed the S&P 500 by a factor of 2, producing returns exceeding 32% for shareholders, compared to 14.2% for the S&P.

Admittedly, the scale of the above chart makes it hard to notice. Zoom in on the performance over the last 12 months, though, and it’s much clearer how Rivian has outperformed the S&P 500 this year:

Data by YCharts.

Rivian in 2025

How did Rivian do this, and what are the chances the electric truck company can maintain its momentum in the absence of tax credits — and in the presence of competition from Tesla and Cybertruck?

That’s hard to say. In the company’s third-quarter earnings report last month, Rivian reported impressive sales growth of 78% year over year and positive gross profits on its sales. Rivian produced only 10,720 trucks in the quarter, but sold 13,201 — meaning the company successfully sold down inventory that had been cluttering up its parking lot.

Rivian still ended up losing $1.2 billion for the quarter, however, and burning through $421 million in negative free cash flow. And this was in the last ever quarter to include federal tax incentives encouraging sales, which drove a lot of business Rivian’s way.

Today’s Change

(15.03%) $2.65

Current Price

$20.28

Key Data Points

Market Cap

$25B

Day’s Range

$18.26 – $20.33

52wk Range

$10.36 – $20.33

Volume

1.1M

Avg Vol

49M

Gross Margin

-159.38%

Rivian in 2026 and beyond

Rivian may not be so lucky in Q4 and subsequent quarters. Management has high hopes as it prepares to begin selling its new R2 electric SUV in early 2026, noting that its new paint shop will have a “total annual capacity to [paint] 215,000 units” — versus the approximately 42,500 Rivians the company hopes to sell this year.

But while Rivian may be able to continue scaling its business even without government support, this isn’t guaranteed. The fact that Ford Motor Company just removed itself from the electric truck market comes as an unexpected bit of good fortune that could help Rivian succeed — unless it’s a sign from above that the electric truck market isn’t a good place to be right now!

Even analysts who believe Rivian might be worth owning don’t expect the company to report its first profit according to generally accepted accounting principles (GAAP) before 2032 at the earliest. There’s a long road between now and then, however, and with Rivian’s cash dwindling fast, I’d place the odds of Rivian completing the trip at less than 50-50.