In the global BEV market, Tesla ranked first with an 18.5 percent share, BYD was second with 17.5 percent, and Nio was eighth with 2.4 percent.

BYD (HKG: 1211, OTCMKTS: BYDDY) is the dominant player in the global plug-in hybrid electric vehicle (PHEV) market, as sales of its hybrid models continued to rise.

In the third quarter, global sales of NEVs (NEVs), which include PHEVs, battery electric vehicles (BEVs), and hydrogen fuel-cell vehicles, amounted to 4.12 million units, an increase of 19.3 percent from the same period last year, market research firm TrendForce said in a report today.

PHEVs sold 1.61 million units in the third quarter, up 55.3 percent from a year earlier. The Chinese market contributed 80 percent of global PHEV sales, with several local brands occupying the top 10 spots, according to the report.

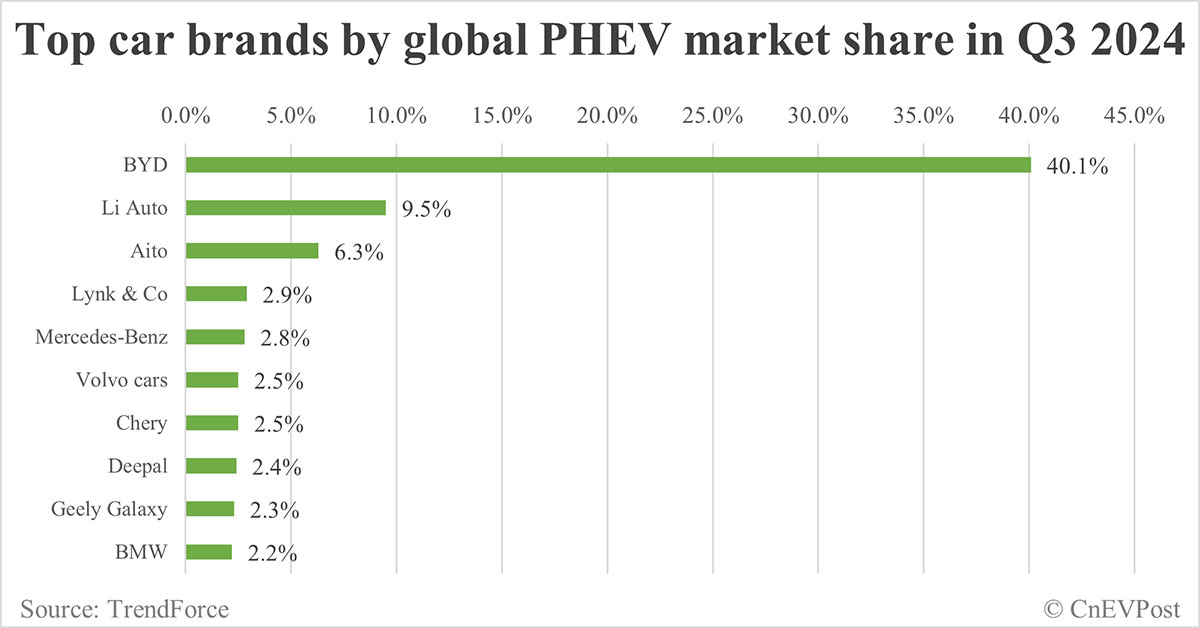

BYD remained in the lead, with its third-quarter sales and market share both hitting new highs, with a market share of 40.1 percent, according to TrendForce.

Li Auto (NASDAQ: LI) and Huawei-backed Aito came in second and third, respectively, with record quarterly sales, but their market share has yet to break 10 percent.

Due to fierce competition in China, the fourth through tenth places are all very close in terms of sales and market share, making it difficult for brands to maintain market share, TrendForce said.

BYD previously released figures showing it sold 1,129,256 passenger NEVs in the third quarter, of which 685,830 were PHEVs, contributing 60.73 percent, and 443,426 were BEVs, contributing 39.27 percent.

This is the first time BYD has seen BEVs account for less than 40 percent of the group’s sales across all power types of vehicles, TrendForce noted.

Global BEV sales in the third quarter were 2.51 million units, up 3.9 percent year-on-year. Tesla came in first with an 18.5 percent market share, and BYD ranked second with 17.5 percent, according to the report.

The third through fifth places in the BEV market were SAIC-GM-Wuling, Volkswagen and GAC Aion, with only SAIC-GM-Wuling seeing year-on-year growth, according to TrendForce.

Leapmotor (HKG: 9863) was a standout performer in the third quarter, becoming the No. 7 seller of BEVs, TrendForce said, adding that the Chinese carmaker’s local assembly with the help of Stellantis’s European plant will help it expand into new markets.

Nio ranked eighth in the global BEV market in the third quarter with a 2.4 percent share, according to TrendForce.

Nio delivered a record 61,855 vehicles in the third quarter, up 11.59 percent year-on-year and up 7.81 percent from the second quarter, according to data it previously released.

The company delivered 20,575 vehicles in November, up 28.92 percent from 15,959 a year earlier, but down 1.91 percent from 20,976 in October, according to data released yesterday.

TrendForce expects global NEV sales for the full year 2024 to be 16.26 million units, an annual growth rate of 24.8 percent.

Automakers’ share of China NEV market in Oct: BYD tops with 36.1%, Tesla 7th with 3.4%