Market snapshot

Australian dollar: Flat at 63.02 US cents

ASX 200 futures: +0.9% to 7,944 points

S&P 500: +0.6% to 5,611 points

Nasdaq: -0.1% to 17,299 points

Dow Jones: +1% to 42,001 points

FTSE: -0.8% to 8,582 points

EuroStoxx: -1.5% to 533 points

Spot gold: +1.4% to $US3,157/ounce

Brent crude: +1.1% to $US74.74/barrel

Iron ore: -1.7% to $US105.00/tonne

Bitcoin: +0.3% to $US83,825

Prices current around 7:30am AEDT.

Live updates on the major ASX indices:

Rate cut boosts property market sentiment

We’re not expecting another interest rate cut when the RBA board releases its decision at 2:30pm AEDT today, if you’re relying on market pricing at least.

But the February cut is having an impact, with property prices recovering for a second month in March, after a short-lived dip.

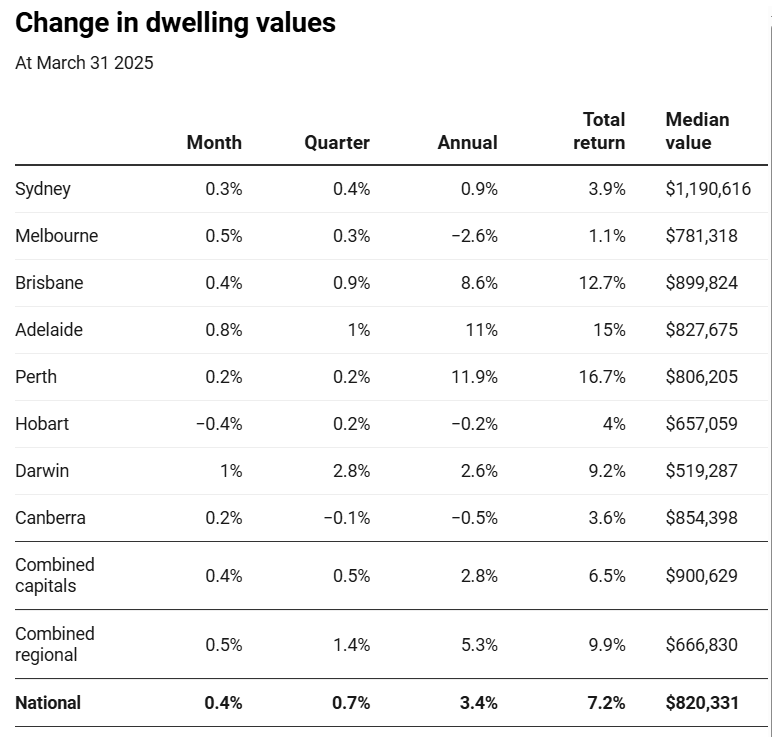

Data from CoreLogic showed dwelling values rose in all capital cities except Hobart last month, with the national median value of a home now over $820,000.

Here’s how prices performed across the country:

CoreLogic research director Tim Lawless said March’s price rise was due to a “confidence boost” in the market following the Reserve Bank’s decision to cut interest rates in mid-February.

He added that it was “probably more about the sentiment lift rather than any real uplift in serviceability or borrowing capacity.”

Read more from business reporter Nadia Daly here:

Worst month and quarter for S&P 500 in more than two years

The S&P 500 may have finished in positive territory today, but March was not a good month for the major US index.

The S&P 500 had its biggest quarterly decline since the third quarter of 2022, and its biggest monthly percentage loss since December 2022.

It was a similar monthly milestone for the Nasdaq, which had its worst quarter since Q2 2022.

Petrol slides 3.7 cents in a week

The national average price of a litre of unleaded petrol has fallen 3.7 cents to 179.2 cents in the week to Sunday.

Weekly data from the Australian Institute of Petroleum details the shift, which still puts the average 7 cents the 12-month average figure of 186.2 cents.

April Fool’s Day: let’s get to it

Good morning!

Hello, I’m Daniel Ziffer from the ABC business team and I’ll be taking you through the morning on our business, finance and economics blog.

It’s April Fool’s Day, so we’ll be sure to bring you the best corporate pranks and attempts to ingratiate themselves with the populace.

Overnight, overseas indices were will.

On Wall Street the blue-chip Dow Jones of 30 mega-companies like Boeing and Visa was +1% to 42,001 points. But earlier in trading had been down almost -2%

The broader S&P 500 that covers 500 of the largest listed companies in the US +0.6% to 5,611 points.

The tech-heavy Nasdaq was -0.1% to 17,299 points, but had also been as much as -2% lower in early trading.

These numbers are live, and trading is continuing, we’ll update you when there’s a firm closing price.

In Germany the DAX was -1.3%, in the UK the FTSE was -0.9% and France’s CAC was -1.6% lower as everyone awaits the revelations of tariffs and trade barriers as part of US President Trump’s so-called ‘Liberation Day’.

There’s lots to get to, all of it news, analysis and information and none of it financial advice.

Let’s get started!

Loading