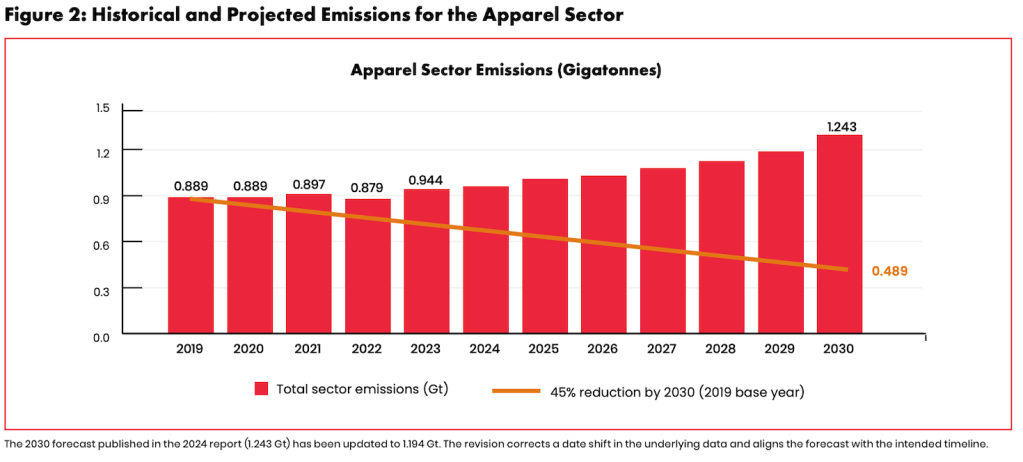

Climate emissions leaped by 7.5 percent in a single year in the fashion industry, which now contributes nearly 2 percent of global climate pollution, according to a new report. The jump in greenhouse gases in 2023 — the most recent year for which full data is available — follows a slight decline of 1.17 percent in 2022, after several flat years.

It’s the first time that the annual Taking Stock of the Roadmap to Net Zero report found an emissions spike since its began four years ago with a focus on 2019. Increased use of virgin polyester was a central culprit in the June 23 report from the Apparel Impact Institute (AII) of Oakland, California.

“You read about brands phasing out coal, investing in renewables and working to decarbonize supply chains – and then you see emissions still went up,” said Ryan Gaines, AII’s chief financial officer. “That disconnect is what is most alarming. It shows that even as individual players make progress, the overall system is still geared toward volume, speed and fragmentation.”

“This does not surprise me at all, as the industry has known for some time that the greatest volume of carbon emissions are generated in the making of new goods,” said Lynda Grose, who teaches fashion design at the California College of the Arts. She added that the industry should make fewer new items, especially from fossil fuels, create incentives to cap new product production and boost other revenue-generating means: “Resale of old goods vastly reduces carbon emissions and upfront development costs.”

However, polyester makes up 57 percent of all fibers in fashion, according to the Taking Stock report. Companies used 71.1 million metric tons in 2023, up from 63.3 million in 2022. At the same time, the share of recycled among all polyester fell from 13.6 percent to 12.5 percent. Polyester recycling startups including Ambercycle, Circ, Samsara Eco and Syre are attracting investors and partnering with fashion brands, but they’re still young.

Synthetics drive the rise

Brands should dial up the use of preferable materials, according to the report. And not only must businesses stop knowingly producing more clothes than they can sell, they must also get serious about removing the fossil fuels from their supply chains.

The nonprofit is not alone in its conclusions. In June, the New Climate Institute and Carbon Market Watch determined that no big brands are adequately addressing overproduction. The World Resources Institute, the Boston Consulting Group, Planet Tracker and all manner of sustainability consultants have said as much over the past few years. Instead, fashion brands treat sustainability like it’s out of style, according to the McKinsey State of Fashion report for 2025. It warned that the industry’s emissions could make up 25 percent of the world’s total by 2050.

Producing materials, including textiles and trims, accounts for 55 percent of the industry’s emissions footprint, the AII report noted. Next, at 22 percent, is extracting the raw materials, such as cotton, animal hides and fossil fuels. Processing those materials follows, at 15 percent, and finished production accounts for just 8 percent.

“Sustainability professionals need to stop working on incremental improvements on products in businesses dependent on growth, and start to work on other ways to generate revenue,” Grose said.

Ultra fast and polluting

However, circular business models make up a tiny slice of most companies’ overall sales. Despite the many startups ramping up recycled and innovative materials in fashion — with some support from brands — inefficient business practices and ever-faster fashion are severely hampering sustainability progress, the report noted.

Shein, the ultra-fast brand that has come to epitomize industry excess, enjoyed $30 billion in revenues in 2023 compared with less than $1 billion in 2016. A somewhat less-pilloried example is Lululemon. Despite its investments in recycled synthetics, and reaching 61 percent recycled polyester, the yoga pants leader has drawn attacks from activists because its climate impacts have risen with its popularity. The company’s climate emissions doubled, apace with net revenues, over a three-year period.

Nobody ever said it would be easy to shrink fashion’s climate footprint, even if many express an aim to try. The number of apparel companies with net zero targets approved by the Science-Based Targets initiative has mushroomed from about a dozen in 2019 to 600 this April.

Moving forward

Corporate sustainability professionals should collaborate across procurement, product design, finance and other teams to develop and implement climate transition action plans that seize urgent, near-term action on emissions, according to Tamera Manzanares, the communications manager for the water team at Boston-based Ceres.

“Companies tell us that developing and publishing a climate transition action plan is invaluable for building internal alignment and support for an organization-wide emissions reduction strategy that mitigates risk and builds long-term business resilience,” she said.

Points for “cautious optimism” in the AII report included efforts by more brands to reduce their Scope 3 supply chain emissions. The AII wants brands to pool their efforts to provide direct financial support to suppliers for that purpose, including through its Fashion Climate Fund.

The report also praised the rise of regulations in states including California as well as the European Union, and the growth of non-competitive sustainability collaborations.