(Bloomberg) — Asian stocks rose Thursday after US equities snapped a two-day slide on benign inflation data that supported expectations of a Federal Reserve interest-rate cut this month.

Most Read from Bloomberg

Japanese stocks led gains in the region, with equities in China, Hong Kong and South Korea also rising. The rally was driven by technology names after the Nasdaq 100 surged to a record high on Wednesday. US stock futures edged lower.

“Little surprises on the inflation front have paved the way for a more supportive risk environment across the region,” said Jun Rong Yeap, market strategist at IG Asia Pte. “The broader theme around a US soft landing, Fed’s easing and positive year-end seasonality may continue to see the equities markets squeezing out gains to end the year well, coupled with less over-bought conditions.”

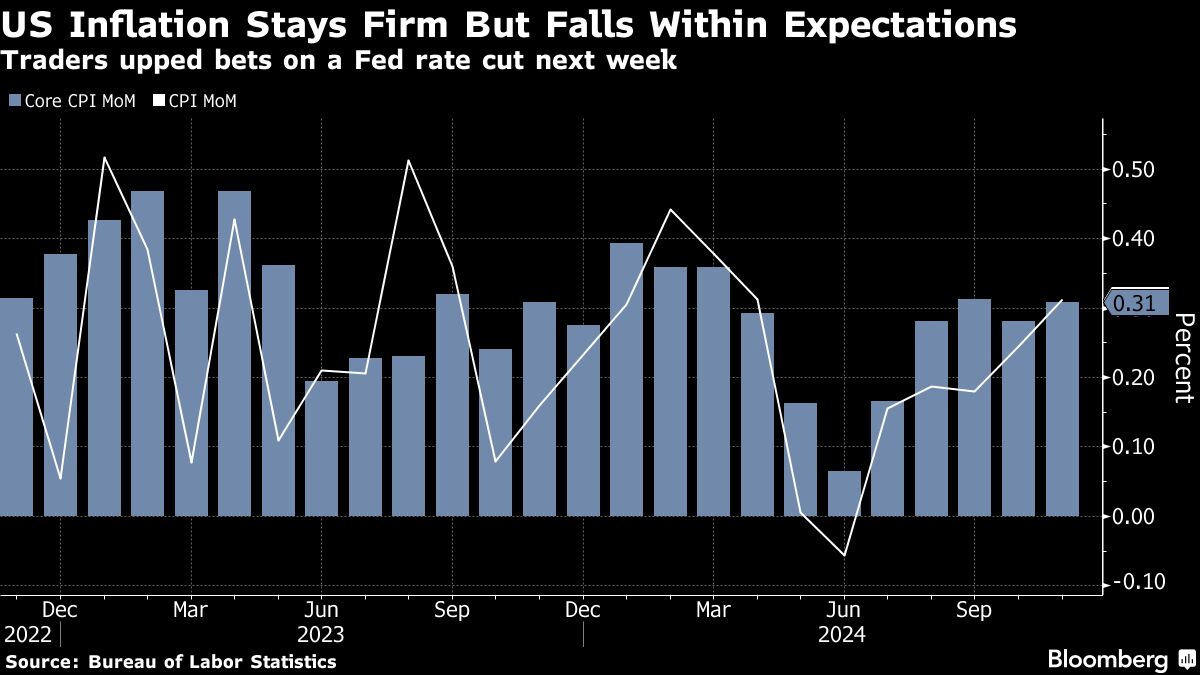

US consumer price index data released on Wednesday was in line with expectations, cementing forecasts for the Fed to cut rates by 25 basis points later in December. Swaps traders have now virtually priced in such a move, compared with a 75% chance a week ago. An index of dollar strength fell Thursday, moderating a gain on Wednesday that was helped along by the higher Treasury yields.

Yields for Australian government debt jumped and the Australian dollar strengthened on Thursday after data showed more jobs were added to the economy than anticipated and unemployment unexpectedly fell. Treasury yields edged higher.

In the foreign-exchange market, the won slipped as South Korea’s political troubles persisted. President Yoon Suk Yeol accused the opposition of trying to paralyze his administration and siding with North Korea in a defiant speech as the chief of his own party called for his impeachment.

Over in China, authorities set a stronger-than-expected yuan fixing on Thursday, extending their support for the currency after it slid on a Reuters report that the nation is considering FX depreciation next year.

Meanwhile, China’s two-day Central Economic Work Conference is expected to map out policies for next year, following stimulus signals from top leaders.

Officials must focus on “how will they deliver fiscal stimulus more directly to consumers so the economy can more directly shift to consumption-led rather than investment led,” Amy Xie Patrick, head of income strategies for Pendal Group, said on Bloomberg Television.