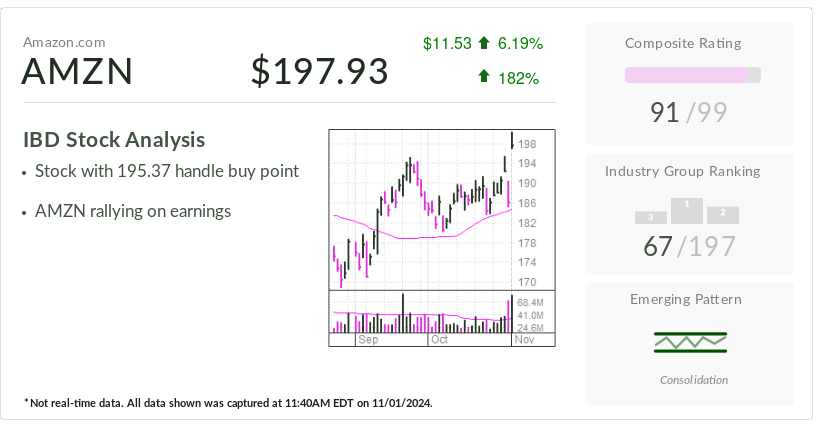

Amazon.com

Amazon.com

AMZN

$11.53

6.19%

182%

IBD Stock Analysis

- Stock with 195.37 handle buy point

- AMZN rallying on earnings

![]()

Industry Group Ranking

![]()

Emerging Pattern

![]()

Consolidation

* Not real-time data. All data shown was captured at

11:40AM EDT on

11/01/2024.

Amazon (AMZN) is the IBD Stock of the Day for Friday. Shares jumped after the tech behemoth published stronger-than-expected earnings and revenue for the third quarter late Thursday.

↑

X

Why Amazon Is Expanding Into Everything From AI To Auto

Amazon stock rallied 6.2% to close at 197.93 on the stock market today. Shares gapped above a 195.37 handle buy point in huge volume on Friday following earnings. Investors also could use the consolidation peak of 201.20 from early July, which also was the tech giant’s high-water mark, according to MarketSurge.

Amazon stock has gained 31% this year and 50% over the past 12 months. The company’s market capitalization is back above $2 trillion, rejoining Apple (AAPL), Microsoft (MSFT), Nvidia (NVDA) and Alphabet (GOOGL) in the rare club.

Q3 Reassures On Metric ‘Everyone Worried About’

Amazon beat expectations with earnings of $1.43 per share and sales of $158.9 billion, as reported late Thursday. But it wasn’t necessarily a perfect report. The tech giant’s revenue forecast for its holiday quarter was slightly lower than expected, while third quarter sales for its closely-watched Amazon Web Services cloud division also came in slightly lower than anticipated.

The positive reaction comes because Amazon operating income came in strong, analysts said.

Operating income was the “main metric everyone was worried about,” Stifel analyst Mark Kelley said in a client note. Analysts had been debating how long Amazon could continue the steady profitability boost seen under Chief Executive Andy Jassy. The company is spending billions on chips and new data centers to power its AI ambitions. It is also ramping up spending on its Project Kuiper satellite internet initiative.

But Amazon’s Q3 operating income of $17.4 billion cruised past Wall Street estimates of $14.7 billion, according to FactSet.

“Amazon delivered a very solid 3Q with GAAP operating income dollars outperforming by a wide, roughly 18% margin vs. the Street,” Kelley wrote. “Operating margins improved across all three reporting segments, which was the main concern most investors had heading into the print, mostly due to expectations for Kuiper costs to work their way into the P&L (profit and loss statement) in a fairly meaningful way.”

Further, Amazon guided for operating income of $18 billion for the fourth quarter, ahead of the $17.3 billion analysts were looking for, according to FactSet consensus.

“Investors were delighted to see Amazon oozing green this Halloween as overall earnings before interest and taxes margin hit a new record 11.0%, driven by new records at AWS (38.1%) and International (3.6%),” Jefferies analyst Brent Thill wrote late Thursday.

Amazon Stock: Jassy Touts Retail Efficiency

On a call with analysts Thursday, Jassy said the tech giant remains focused on lowering “cost to serve,” or the money it spends getting products to customers. That includes effort to streamline its fulfillment network and integrate automation into its operations.

“At a time when consumers are being careful about how much they spend, we’re continuing to lower prices and ship even more quickly, and we can see this resonating with customers, as our unit growth continues to be strong and outpace even our revenue growth,” Jassy told analysts.

Stock Market Falls Amid Election Jitters; Here’s What To Do

AI A ‘Once In Lifetime’ Opportunity

Even with AWS sales growth coming in slightly lower than expected, Jassy said the business is seeing strong demand powered by generative AI. Jassy said AI is a “multibillion-dollar revenue run rate business that continues to grow at a triple-digit” rate for AWS.

The company is spending big on AI-capable data centers and other costs to meet demand. Amazon expects $75 billion in capital expenditures this year, up from about $50 billion in 2023. Jassy says he expects capex to increase further next year, mostly to support AWS.

“I think we’ve proven over time that we can drive enough operating income and free cash flow to make this a very successful return on invested capital business,” Jassy told analysts. “And we expect the same thing will happen here with generative AI. It is a really unusually large, maybe once-in-a-lifetime type of opportunity.”

Analysts appeared to support that view.

“Amazon’s capex investment to build its next-gen growth drivers is coming ($75 billion of estimated FY24 capex was 12%, or $8 billion, higher than expected), but we think investors should be willing to digest this investment given the current growth and long-term opportunity for AWS,” wrote Morgan Stanley analyst Brian Nowak Friday.

Amazon Stock Approaching Breakout

Amazon stock bounced well above its 21-day moving average with Friday’s action. Shares had slipped below the short-term support level on Thursday with a 3% loss that came within a broader Halloween-day sell-off.

Meanwhile, Amazon’s Relative Strength Rating sits at 68 out of a best-possible 99. That means Amazon has outperformed 68% of stocks in IBD’s database over the past 12 months. IBD recommends focusing on stocks with at least an 80 RS Rating.

The IBD Stock Checkup tool shows Amazon stock holds an IBD Composite Rating of 91 out of a best-possible 99. The score combines five separate proprietary ratings into one rating. The best growth stocks have a Composite Rating of 90 or better.

YOU MAY ALSO LIKE:

Amazon Stock Jumps As Cloud Business Powers Earnings Beat

Learn How To Time The Market With IBD’s ETF Market Strategy

Get Free IBD Newsletters: Market Prep | Tech Report | How To Invest

IBD Live: A New Tool For Daily Stock Market Analysis

Want To Get Quick Profits And Avoid Big Losses? Try SwingTrader