- Geopolitics, trade politics, and inflation have once again been prominently featured topics throughout the week. The new leadership in Syria suspended constitution this week as the country battles with the legacy of the Assad regime.

- The hotter than expected CPI and PPI figured from the US won’t deter the Federal Reserve from cutting interest rates by 25 basis points next week. However, they are setting us up for some hawkish surprises going into 2025.

- The European Central Bank cut interest rates by 25 basis points but was outdoved by Swiss policy makers lowering their benchmark rate by half a percentage point. The Fed will follow suit, leaving the Bank of England as the last standing hawk.

- Spiking SME sentiment in the US following the election shows that smaller companies are willing to ignore the planed increase in tariffs and are focusing on the promised cutting of red tape and deregulation initiatives that were announced.

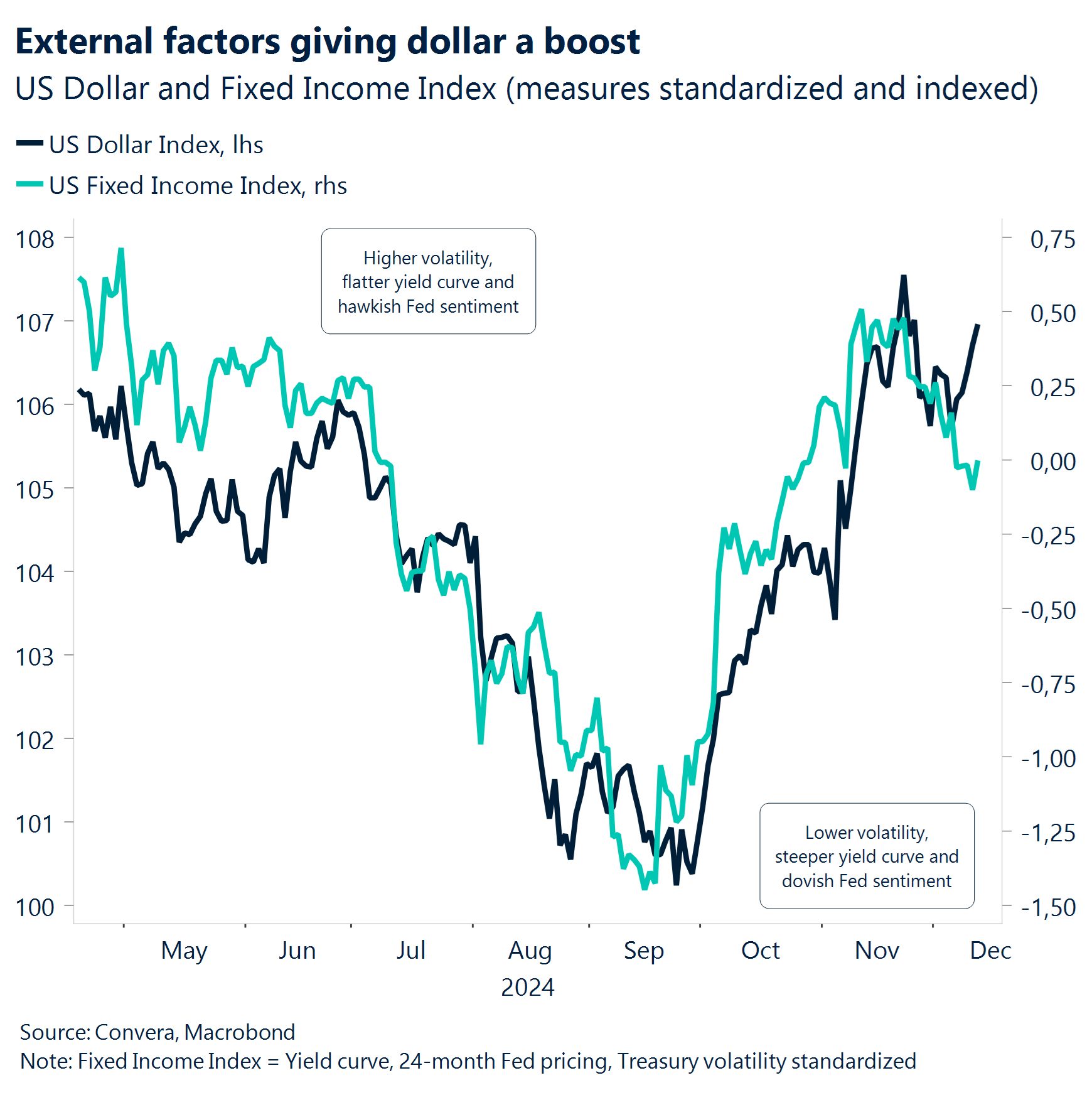

- The US dollar continues to outperform fundamentals and has decoupled from US macro and its bond yields. This is mainly due to politics taking over sentiment in FX markets. Geopolitics and trade politics are working in the Greenback’s favor.

- Next week will conclude the macro year of 2024 with the Fed and BoE decisions and some important consumption data from the US.

Global Macro

Market movers across the world

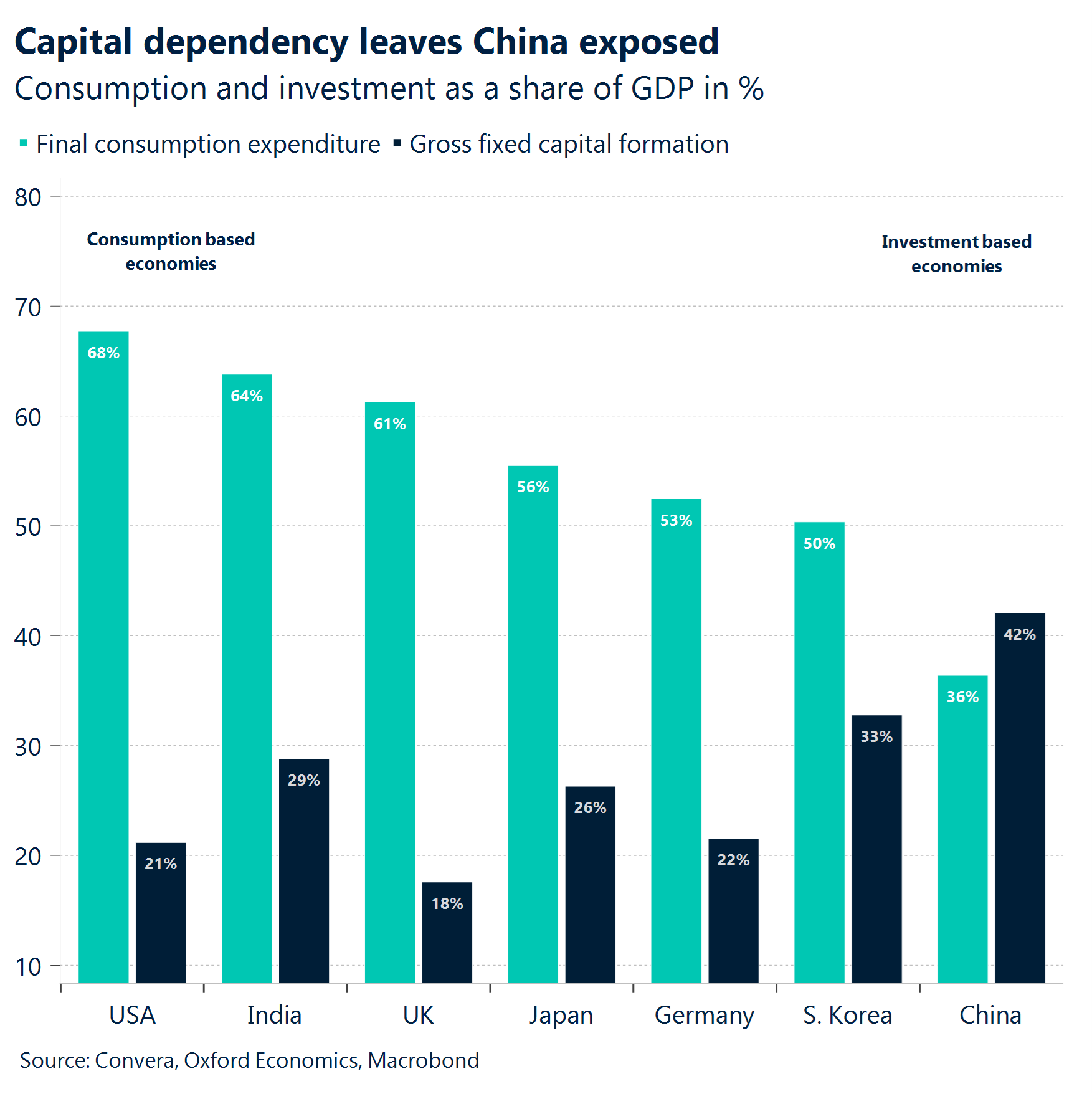

Skepticism. Chinese equity markets gave up most of their gains for the week as policy makers disappointed expectations with a lack of details from the economic conference that began on Wednesday. Markets continue to be skeptical about Beijing reaching its 5% growth goal next year.

Cut. As widely expected, the European Central Bank (ECB) cut rates by 25 basis points yesterday, bringing the deposit rate to 3%, its lowest level since March 2023, and bringing the cumulative reduction in this cutting cycle to 100 basis point.

Easing. Central banks across the globe have cut interest rates this week in an attempt to put a bottom under the economic growth slowdown. Inflation rates in Switzerland, Canada, and the Eurozone have eased enough to justify the continuation of the easing cycle. However, reflation in the US and the upcoming tariff hikes could spell trouble.

Reflation. Bond yields will go into the weekend with a strong bounce as inflationary data seems to suggest limited room for the Fed to cut next year. Earlier this week, both core consumer and producer prices came in hotter than expected. While neither the reflationary trend nor the potential tariff hikes under Trump will be taken into consideration by the Fed’s meeting next week as a rate cut seems almost certain, the January meeting is shaping up to be a potential pause in the easing cycle.

Shrinking. Data this morning revealed the UK economy shrank 0.1% in October on a monthly basis compared with estimated growth of 0.1%. The unexpected fall was driven by construction and production, while the dominant services sector stagnated.

Global Macro

Sketching out the Trump tariffs

The big elephant in the room going into 2025 is the upcoming intensification of the global trade war that is likely to be kicked off by the rollout of new tariffs by US President-elect Donald Trump. The US does not operate in a vacuum and trade volumes clear globally, not bilaterally.

This was clearly highlighted by the first US-China trade war that started in 2017. While the Chinese share of US imports decreased over the following five years, the US’ dependence on the rest of the world did not. Trade volumes just shifted from China to regions like Vietnam, Mexico, Canada, and the Eurozone.

The extent to which tariffs will impact markets will depend on the 1) rollout timeframe, 2) size of the tariffs, 3) actual tariff scheme, and 4) retaliatory measures taken against the US by other countries. The good thing for now: Even the most bearish scenarios don’t envision a large impact of tariffs on growth or inflation next year. Most of the impact will likely be felt in 2026.

Coming back to development this week but staying at the topic of tariffs, one heading that moved markets yesterday came out of China. According to reports from Reuters, China is considering allowing the yuan to weaken in 2025 as a defense mechanism against higher tariffs under Trump 2.0. This led to a wave of weakness across EM FX and equities. The dollar benefited from the insider news headline and gives us a good template of what to expect next year.

Week ahead

Ending the year with a bang

Hawkish cut? All eyes are turning to the United States as the Federal Reserve meets for its final rate decision of the year. The communication from policy makers and market pricing are clear: The Fed is ending 2024 with a third rate cut and about 100 basis points of cuts in total. However, the Summary of Economic Projections could show FOMC members raising their forecasts for inflation and growth for this year. The recent development on growth and inflation would not indicate that a cut is the most sensible outcome. However, given the expectation of policy easing, the Fed will likely not fight market pricing. The Fed could instead signal that January will be a pause.

Strong US consumer. Staying in the US, retail sales and industrial production figures are up as well. The regional PMIs signaled a potential recovery in demand for manufactured goods. Retail sales likely grew 0.6%, a strong bounce versus the 0.4% increase the month prior. Consumption data is still not indicating a slowdown in the consumer. Personal incomes likely grew 0.6% as well in November, supported by higher wages and longer workweeks.

All at once. UK in focus. It’s a massive week for the British macro as well. Labor market data, inflation figures, retail sales, and the Bank of England rate decision are all up. Both inflation and wage growth are expected to have picked up in October. The reflation in core goods due to unfavorable base effects could push the headline inflation figure to 2.6%. Regular pay growth could bounce higher by 20 basis points to 5%. Overall, this should give policy makers the confidence to leave rates unchanged at 4.75%.

FX Views

Another week, another strong dollar

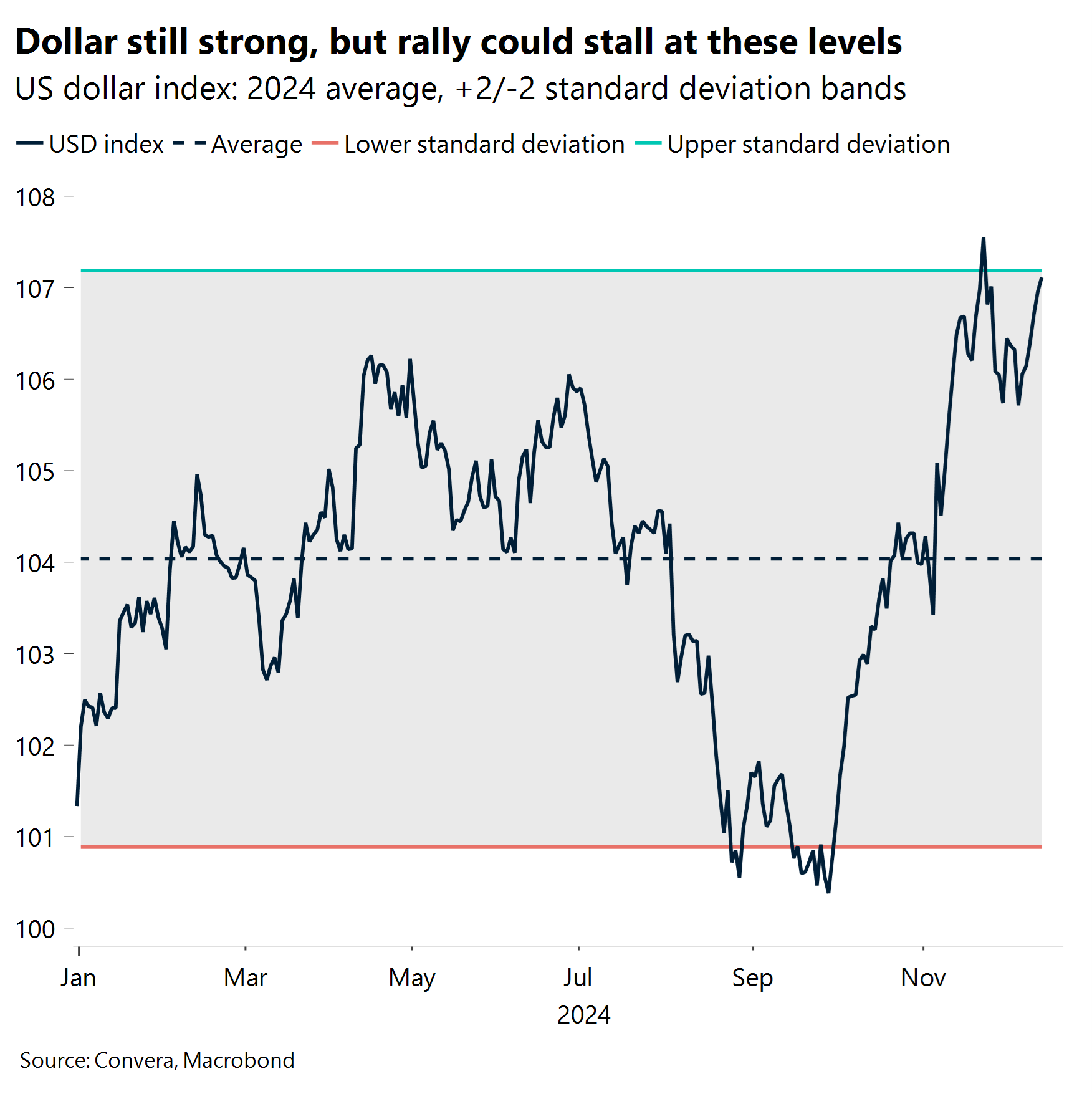

USD Top dog. For now, there is no reason to leave the safety, liquidity and high yield of the US dollar, though more upside looks limited according to technicals. All major currencies have weakened versus the dollar of late, as the world’s reserve currency was buoyed by US inflation data coming in firm and keeping USD rates supported. The US dollar index is on track to gain another week, which would be the 10th gain in the last 11 weeks. December seasonal weakness has so far not come to fruition as was the case back in 2016 when Donald Trump was elected President. Markets are considering the consequences of Trump fuelling global trade tensions next year and thus risk sentiment adds to bullish calls for the dollar. We think a lot is already priced in and the Greenback will find it hard to climb to new highs, especially since it’s run up against its second upper standard deviation barrier of 2024. However, its sustained resilience due to the trade and rates outlook is warranted.

EUR Trapped in downtrend. The euro fell after the ECB cut interest rates by 25bps and dropped the clause about keeping rates “sufficiently restrictive” from its statement. Money markets are fully pricing in five quarter-point reductions for 2025, and a sixth is now up for debate. European yields fell, and EUR/USD slipped back below $1.05, still trapped in a downtrend – over 6% lower than October’s $1.12 peak. It’s dropped for nine weeks out of eleven now and is primed for its worst quarter since Q3 2022. Relative growth and yield differentials continue to weigh, and Trump’s expected inflationary policies and threats of universal trade tariffs gives bears ammunition that could stretch well into 2025 with calls of parity growing louder. There are no shortage of reasons for EUR-bearish bets to rise, which implies more downside for the European currency in the shorter term, despite the scale of its fall already.

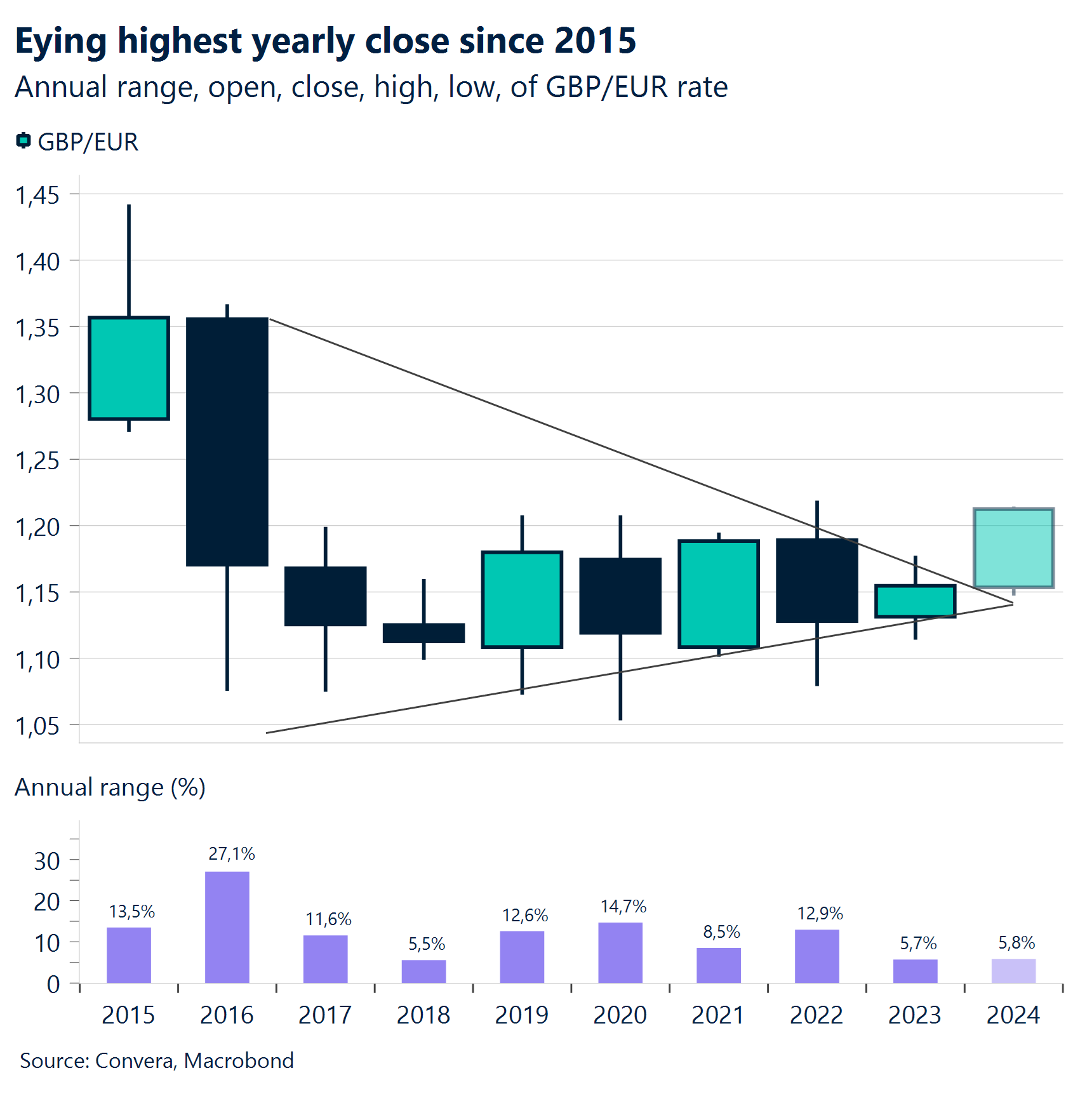

GBP Mighty against the euro. The pound once again failed to overturn the $1.28 handle versus the dollar, bouncing lower from the nearby 200-day and 200-week moving averages. This was mainly due to broad-based USD strength but aggravated by some weak UK data. Although sterling benefits from its advantage of paying the highest deposit rates in the G10 space, this could also be its downfall if the BoE turns more dovish once services inflation cools more meaningfully. For now, though, the key story lies with GBP/EUR, which could be on track to close the year above €1.20 and clock a second successive yearly gain – both firsts since 2015. The pound closed at its highest level versus the euro since 2016 this week but has reversed from stretched levels. An upside bias exists for now due to relatively strong growth and rate differentials as well as more stable politics, and we doubt the BoE will switch up the temp next week. But a key risk looming is a dovish repricing of BoE expectations, particularly given the dismal UK economic growth figures of late.

CHF Caught out by jumbo cut. The Swiss National Bank cut its benchmark rate by more than expected, hence the franc came under selling pressure. More pain could be felt in the short term as traders trimmed their bets on franc appreciation, with options metrics suggesting expectations reached their least bullish level since late July. EUR/CHF scored its biggest daily rise since September and snapped a 5-week losing streak. But given the SNB policy rate now stands at 0.5%, that somewhat limits the scope for further cuts, and perhaps also the potential for serious weakness in the franc. Still, EUR/CHF hasn’t really responded to rate spreads for much of this century anyway, and the franc’s reputation as a safe haven and a huge current account surplus as a percentage of GDP are hard bullish factors to ignore. Moreover, while Switzerland will be exposed to a trade war given its small, open economy, the Eurozone’s reliance on US trade is far greater, so a grind back towards 0.90 in 2025 looks feasible.

CNY Devaluation warning sends USD/CNH back to highs. The Chinese yuan returned to near one-year lows versus the US dollar despite an initial short-term lift on hopes for more stimulus after Chinese policymakers signalled an increase in fiscal and monetary policy in 2025. Following the monthly meeting of the Politburo, a key policy-making body, Chinese state media reported that monetary policy would be “moderately loose” in 2025 while fiscal policy would be “more proactive”. However, the Chinese yuan was later weaker after a news report that China was considering moves to devalue the Chinese yuan. The news report from Reuters indicated that China was considering the move in retaliation to potential new trade tariffs from president-elect Donald Trump. On USD/CNH, topside resistance remains at 7.3000. Looking forward, the focus is on industrial production, retail sales and unemployment, all due on Monday.

JPY Weakens on BoJ headlines. The Japanese yen is the worst performer in the G10 space this week, down around 2% versus the USD as traders reacted to reports that the Bank of Japan sees no need to rush into further rate hikes. The yen slumped to its weakest in level in more than two weeks as expectations for a December rate hike next week plunged to 15% from 62% at the end of last week. Currently, forward points show the market looks for USD/JPY to move towards the mid-140s next year, but part of this assumption rests on the view that the BoJ will raise rates in a world where everyone else is cutting, creating a favourable interest rate convergence story for JPY. Hence, the media coverage this week has weakened this story and resulted in USD/JPY rising back above 153 with 150 acting as a key support level for now. Option volatility is also sliding and bullish bets on the yen rising in a week’s time have been trimmed as we brace for the upcoming Fed and BoJ decisions.

CAD BoC cut sends Loonie lower. The Canadian dollar fell to four-and-a-half year lows against the US dollar over the past week after the Bank of Canada continued to aggressively slash interest rates in the face of slowing growth. The BoC cut rates by 50bps to 3.25% — now down from 5.00% at the start of the year. The BoC’s move followed an unexpected jump from 6.5% to 6.8% in the local unemployment rate report in the previous week. The USD/CAD surged above 1.4200 for the first time since April 2020 but the CAD performed better versus other currencies, climbing versus the Swiss franc and Japanese yen. Technically, the USD/CAD is now stretched to the upside, as measured by momentum indicators like the RSI. Downside targets are to 1.4160 and then 1.4080. Next week, CPI on Tuesday and retail sales on Friday are the major events.

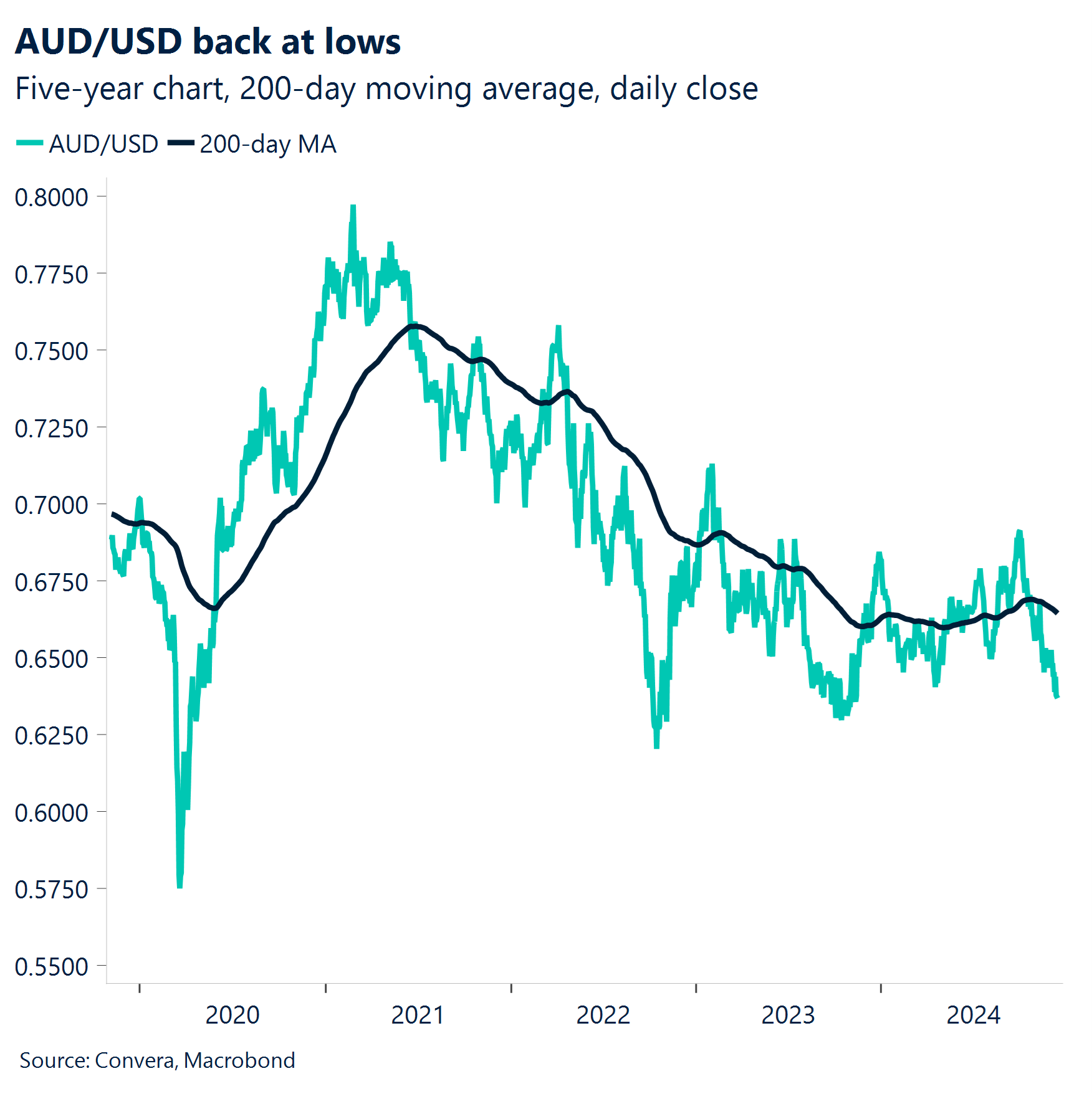

AUD Aussie hits one-year lows. The Australian dollar plunged to one-year lows over the last week as a shift in tone from the local central bank and USD-boosting commentary from China combined to hit the currency. The Reserve Bank of Australia made some significant shifts in its policy statement, most notably saying the central bank is “gaining some confidence that inflation is moving sustainably towards target”. Markets now see a 50% chance of a rate cut in February (source: Bloomberg). On the other hand, the Australian dollar saw a small rebound after a stronger than expected jobs number. The November jobs report found 35.6k new jobs were added versus the 26.0k forecast. The unemployment rate fell from 4.2% to 3.9%. However, the Aussie’s gains were short lived after the jobs number, with the AUD/USD ending the week back near one-year lows. The Aussie remains in a clear downtrend with next support is seen at 0.6270 and then 0.6170, any rebound might target 0.6400 and then 0.6455. In terms of upcoming data. manufacturing and services PMI numbers due on Monday, with the government’s mid-year economic update due Wednesday.

All times are in GMT

Have a question? [email protected]

*The FX rates published are provided by Convera’s Market Insights team for research purposes only. The rates have a unique source and may not align to any live exchange rates quoted on other sites. They are not an indication of actual buy/sell rates, or a financial offer.