U.S. stocks dipped in early trading, taking a breather after the major stock indexes posted the largest daily percentage gain since Nov. 6 since Nov. 6 on Wednesday, amid cooling inflation and strong bank earnings.

Investors mostly shrugged off a weaker-than-expected gain in December retail sales and a higher-than-expected jump in weekly unemployment claims. The Commerce Department said December retail sales rose 0.4%, smaller than Reuters’ average economist forecast for a 0.6% jump, while weekly jobless claims rose 14,000 to a seasonally adjusted 217,000. Economists polled by Reuters had forecast 210,000 claims for the latest week.

At 10:10 A.M. ET, the broad S&P 500 index was down 0.04% at 5,947.71; the blue-chip Dow was down 0.2% at 43,134.09; and the tech-laden Nasdaq was down 0.03% at 19,505.46. The benchmark 10-year yield inched up to 4.659%.

Banks rise again on earnings

Bank shares continued to gain as more strong earnings reports roll in.

Bank of America and Morgan Stanley each reported fourth-quarter results that topped analysts’ forecast with help from their respective investment banking units. Those came on the heels of strong quarterly results reports on Wednesday from JP Morgan, Goldman Sachs, Wells Fargo and Citigroup.

Banks’ strong earnings reports, for now, are providing optimism “about the ability of companies and the U.S. economy to adapt to a higher interest rate environment,” said Samer Hasn, senior market analyst at global broker XS.com.

Other stocks to watch

- UnitedHealthcare shares fell after the company missed quarterly revenue forecasts in its first earnings report since the killing of executive Brian Thompson.

- TSMC had a record quarter, driven by AI, and said it expects growth to continue. TSMC shares rose and boosted other semiconductor shares like Nvidia and Broadcom.

- BP said it will cut 4,700 internal and 3,000 contractor roles across its business as it trims costs.

- Target shares slipped despite raising its fourth-quarter sales guidance.

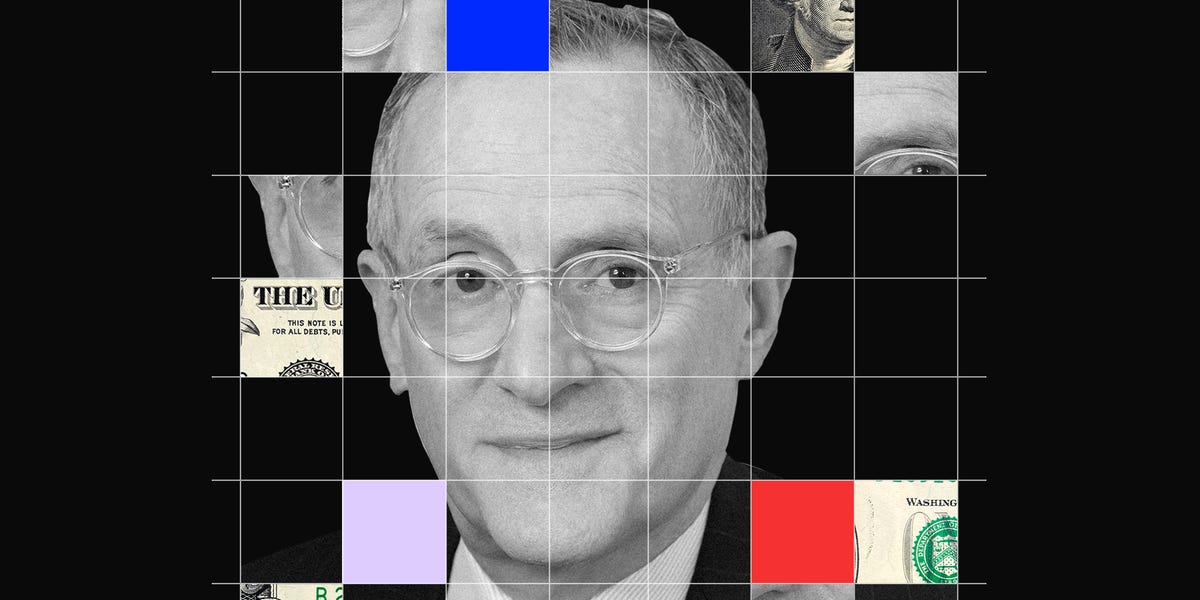

Trump’s Treasury pick

Scott Bessent, President-elect Donald Trump’s pick for Treasury secretary, is set for a grilling in the Senate starting at 10:30 a.m. ET. Tariffs, tax policy and budget deficits are expected to dominate discussions.

Medora Lee is a money, markets, and personal finance reporter at USA TODAY. You can reach her at mjlee@usatoday.com and subscribe to our free Daily Money newsletter for personal finance tips and business news every Monday through Friday morning.