(Bloomberg) — What was supposed to be a comeback year for Boeing Co (BA). has turned into its worst stock-market plunge since 2008, and if Wall Street is right, the plane-maker’s shares may have only a modest recovery in store in 2025.

Most Read from Bloomberg

The stock is down 35% this year, placing it among the 20 biggest decliners in the S&P 500 Index (^SPX). The shares have stabilized over the past month, but investors remain wary. They point to the string of crises in 2024 that shook their confidence in Boeing’s prospects and the risk that it will suffer should trade friction build anew under President-elect Donald Trump.

“Just staying out of the news would be a win for Boeing at this point,” said Eric Clark, portfolio manager of the Rational Dynamic Brands Fund.

Coming into 2024, the company seemed to be emerging from the aftermath of two fatal crashes of its jets in 2018 and 2019 and the collapse of global travel during the pandemic. Boeing had taken a big step toward thawing its strained relations with China, jet orders were surging and shares were the highest in nearly two years. Wall Street was overwhelmingly optimistic, without a single sell recommendation on the stock.

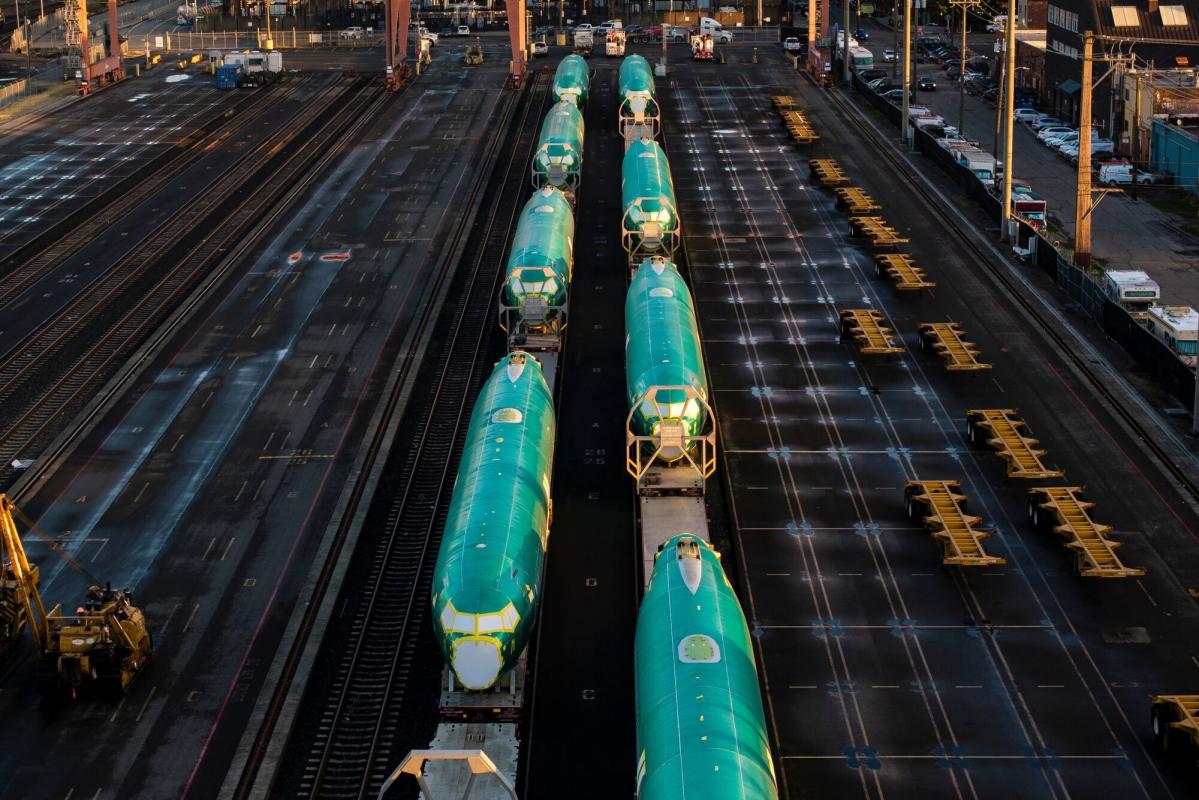

Things started to unravel in January, when a door plug on a Boeing aircraft blew off mid-air during an Alaska Air flight. Then came a public outcry and intense scrutiny of Boeing’s corporate practices and its culture, a management overhaul leading to the exit of the chief executive officer, serious allegations from whistle-blowers, a debilitating labor strike and a massive cash burn that the company says will continue in 2025.

The chain of events pummeled Wall Street’s profit expectations. Twelve months ago analysts on average expected Boeing to earn $4.18 a share this year, after four straight annual losses, data compiled by Bloomberg show. They now anticipate a loss of $15.89 per share, the worst since 2020. At the same time, estimates for 2025, 2026 and 2027 have collapsed by roughly 50% or more from year-ago levels.

It all explains why analysts have dim expectations that the recent recovery in the jet-maker’s shares will extend much further. Their average 12-month price target suggests potential for a roughly 7% gain from Friday’s close of $169.65.

Boeing, which is based in Arlington, Virginia, declined to comment.

A major worry entering 2025 is that the company’s sprawling global supply chain leaves it exposed should Trump follow through on his tariff proposals. Boeing, along with American manufacturing behemoths like Caterpillar Inc. and Deere & Co., is widely seen as being on the front lines of any trade war that might ensue.