On January 20, President-elect Donald Trump will take back the White House, and a second term could have far-reaching consequences for businesses and the economy, including Amazon. “Trump’s policies are a mixed bag for Amazon,” according to Steven Wang, founder and CEO at dub.

The Trump Economy Begins: 4 Money Moves Boomers Should Make Before Inauguration Day

Learn More: 3 Major Retailers Who Will Raise Prices Immediately Under Trump — Tariffs Play Key Role

“Trump’s tax reforms could supercharge Amazon’s growth,” per Wang. “But challenges loom: tariffs and trade disruptions could raise costs, while stricter immigration policies might make it harder for Amazon to hire the world’s top tech talent.”

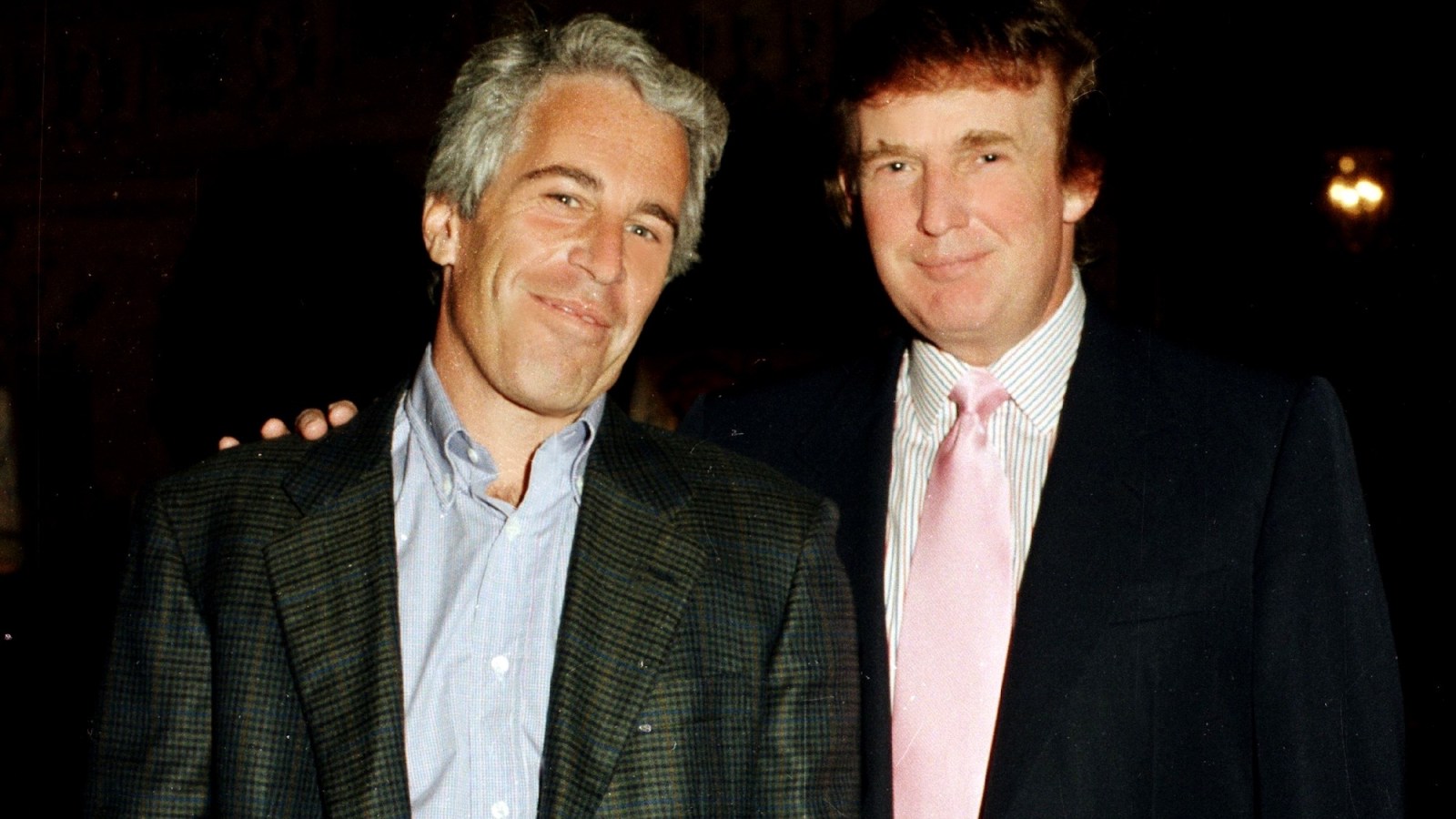

While the company’s founder, Jeff Bezos, has had a rocky relationship with Trump in the past, he’s now “hopeful” about the president returning. “I’m very hopeful — he seems to have a lot of energy around reducing regulation,” Bezos said on stage during the New York Times’ DealBook Summit. He added, “And my point of view is, if I can help him do that, I’m going to help him because we do have too much regulation in this country.”

With Inauguration Day impending, finance experts sound off on how Trump’s presidency could affect Bezos and Amazon stock.

Amazon’s Influence on the Stock Market

If Trump implements some of the policies he touted on the campaign trail, he could shake things up with Amazon, impacting stocks.

The S&P 500 is currently heavily influenced by seven major technology companies, including Amazon, constituting nearly one-third of the index’s total value,” Antwyne DeLonde, founder and CEO at VisionX, explained. “This concentration means that any policy changes affecting these companies could significantly impact the broader market.”

He added, “Policies such as corporate tax reforms and regulatory adjustments could influence Amazon’s operational costs and profitability. For instance, proposed changes to research and development (R&D) expenditure policies could allow companies to immediately deduct domestic R&D expenses, potentially improving cash flow for firms like Amazon.”

With the Seattle-based company playing a significant role in the S&P 500, DeLonde noted, “any fluctuations in its stock price due to these policies could have broader implications for the stock market and investors.”

Find Out: How President-Elect Trump’s Win Could Change Gas Prices

How Amazon and Bezos Could Benefit from Trump

With Trump preparing for his second go-around in the White House, DeLonde stated that Amazon could see positive outcomes by the new administration.

“Amazon could benefit from policies aimed at reducing corporate taxes and easing regulations, which may enhance profitability and support expansion efforts,” he stated. “For example, the administration’s focus on deregulation could facilitate Amazon’s growth initiatives, including its expansion into international markets like India. Additionally, favorable tax policies could provide Amazon with increased capital for investment and development.”

The Negative Impact on Amazon

While Amazon can benefit from some of Trump’s policies, Bezos could face difficulties, as well.

“Potential challenges include heightened regulatory scrutiny of large technology companies,” per DeLonde. “The appointment of officials with a focus on antitrust enforcement suggests that companies like Amazon may face increased examination of their business practices.”

He added,” Furthermore, trade policies, such as tariffs on imports, could affect Amazon’s supply chain and international operations, potentially impacting itsglobal marketstrategy.”

Final Thoughts

Nobody can predict what Trump will do once in office, but he has repeatedly promised a sharp tariff increase, which will undoubtedly impact the economy and businesses.

DeLonde noted, “Given the significant influence of major technology companies on the S&P 500, investors should closely monitor policy developments and their potential effects on both Amazon and the broader market.”

Meanwhile, Wang stated, “History favors Amazon. During Trump’s first term, its stock nearly quadrupled, defying tensions through dominance in e-commerce and cloud computing. Amazon thrives on disruption — political or otherwise.”

More From GOBankingRates

This article originally appeared on GOBankingRates.com: How Could Trump’s Presidency Affect Jeff Bezos and Amazon Stock?

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

Source link