(Bloomberg) — Chinese shares underperformed the region on Thursday amid a report the US is considering fresh sanctions to curtail Beijing’s access to crucial semiconductors. The yen pared gains from its previous session.

Most Read from Bloomberg

Benchmarks in Hong Kong and mainland China fell as the Biden administration was said to be preparing to unveil the restrictions as early as next week, according to people familiar with the matter. Japanese stocks gained on the back of yen weakness, while semiconductor-related companies jumped on the reported curbs. US equity futures climbed.

The prospect of fresh sanctions underscored the persistent threat to already fragile trade relations between the US and China, weighing on the region. Asian equities were on pace for their first back-to-back monthly drawdown this year following the dollar’s recent rampage and concerns over escalating trade tensions.

Despite optimism on the potential for further stimulus from Beijing, “there are increased concerns and frustrations,” from investors, Winnie Wu, China equity strategist for Bank of America Securities, said on Bloomberg Television. The potential for further support and the prospect of US tariffs on China mean even long-term investors “are focusing on the next three to six months, or even three to six weeks,” she said.

Australian and New Zealand yields fell Thursday, tracking moves in Treasuries on Wednesday. Investors had sought the safety of US government debt, pushing 10-year yields lower. Asian trading of Treasuries will be closed on Thursday to observe the Thanksgiving holiday.

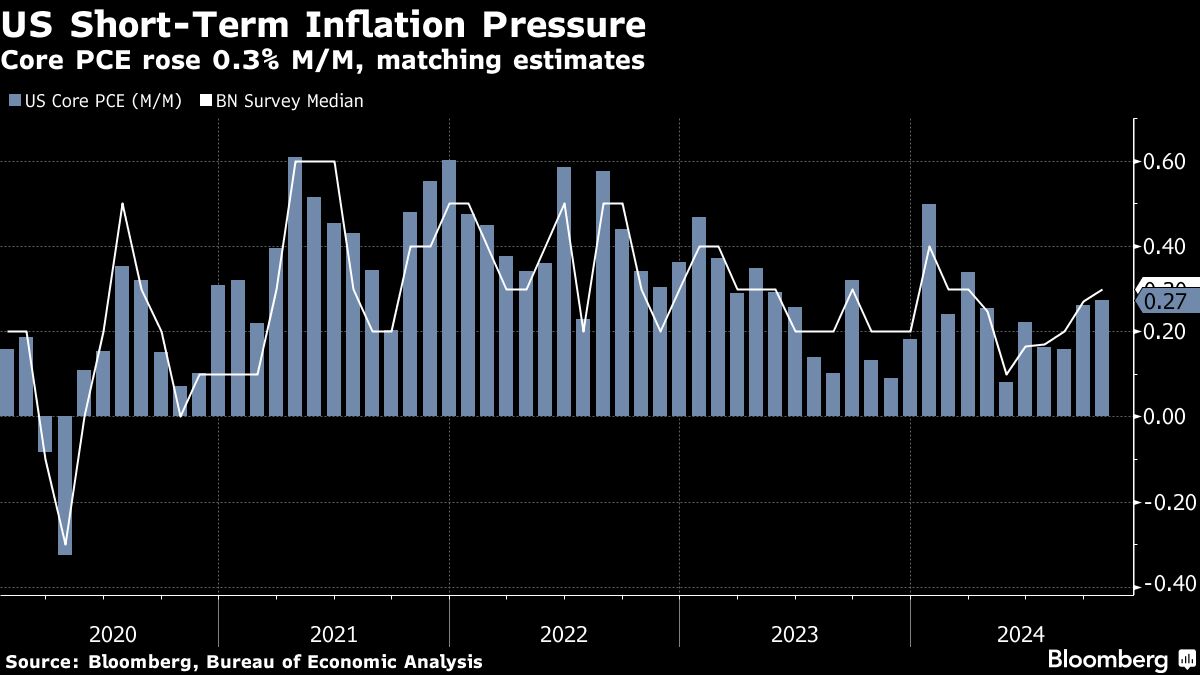

A pick-up in the Federal Reserve’s preferred gauge of underlying inflation is reinforcing the case for policymakers to proceed gradually with further interest-rate cuts. Traders are also weighing the expected impact of Donald Trump’s administration picks, with the US president elect’s policies expected to reinforce price pressures.

In currencies, the yen weakened Thursday, moderating a Wednesday gain of more than 1% against the greenback which drove it to the strongest since late October. The move came amid views that the Bank of Japan may raise interest rates at its December meeting.

The Japanese currency is “unlikely to trade below 150 for any significant amount of time given still-wide interest rate differentials that continue to favor the dollar,” Win Thin, global head of markets strategy at Brown Brothers Harriman & Co., wrote in a note.