Tesla (TLSA) stock soared above 300 on Friday, reclaiming a $1 trillion market capitalization. The EV giant has been on a tear since President-elect Donald Trump defeated Vice President Kamala Harris for the White House earlier this week.

↑

X

Donald Trump Wins 2024 Election: What It Means For Market Trends, Tesla Stock And Cryptocurrency Prices

Wedbush Securities analyst Dan Ives, a longtime Tesla bull, wrote Wednesday that a Trump presidency could be an “overall negative for the EV industry,” with the potential for EV rebates and tax incentives to be repealed. However, Ives added that for Tesla “we see this as a huge positive.”

“Tesla has the scale and scope that is unmatched in the EV industry and this dynamic could give Musk and Tesla a clear competitive advantage in a non-EV subsidy environment, coupled by likely higher China tariffs that would continue to push away cheaper Chinese EV players,” Ives wrote.

Tesla CEO Elon Musk was a huge supporter of Trump’s presidential campaign.

Rivian Reports Quarterly Loss; ‘On Track’ For Gross Profit Per Vehicle Delivered

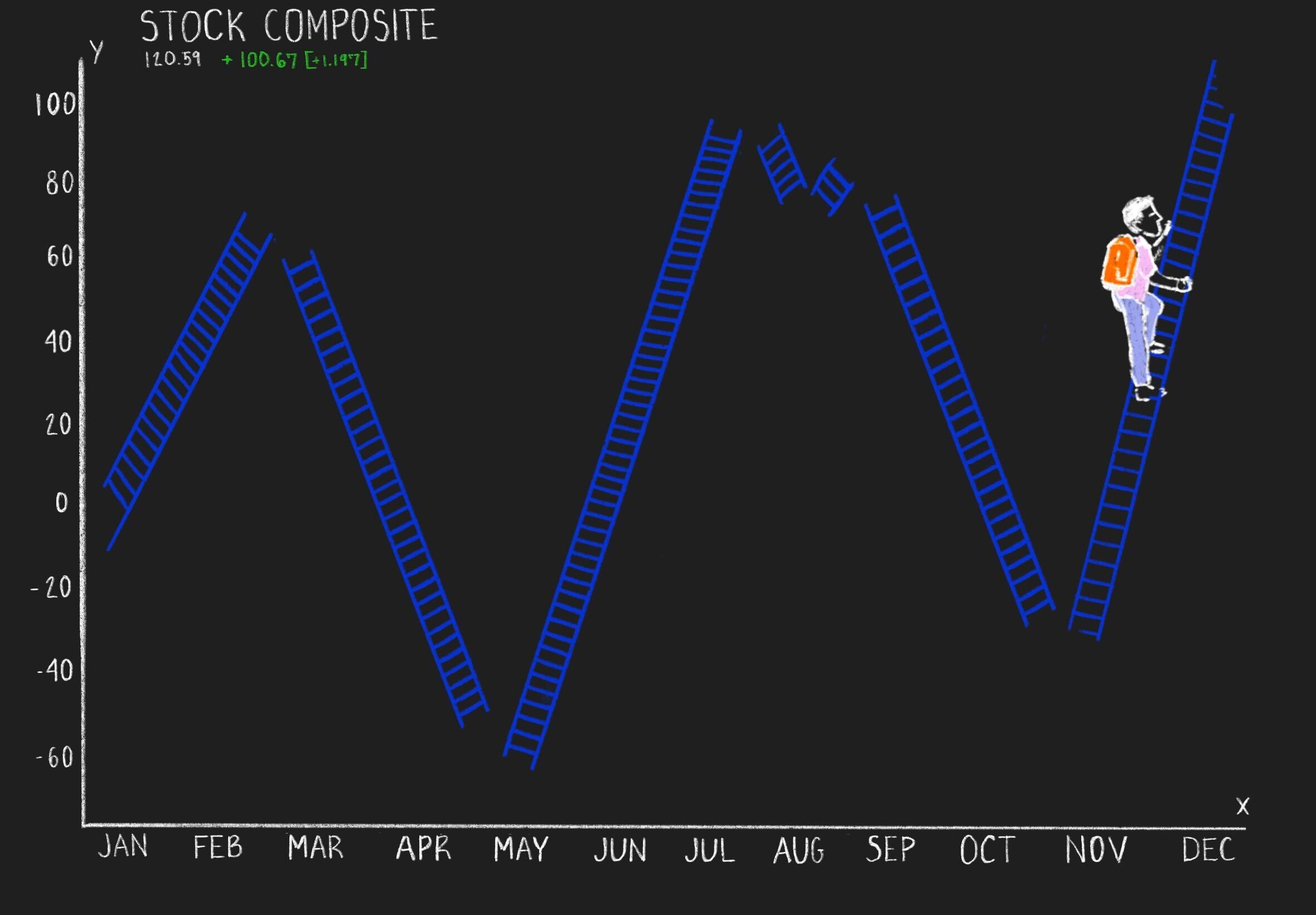

Tesla Stock Performance

TSLA stock surged 8.2% to 321.22 during market trade on Friday, reclaiming a $1 trillion market cap for the first time since September 2022.

Shares soared 29% this week, the best weekly performance since the week ended Jan. 27, 2023, when TSLA spiked 33.3%.

On Wednesday, Tesla stock gapped up above an alternate handle buy point of 273.54 but was quickly extended.

Bank of America analysts on Thursday raised the firm’s price target on Tesla to 350 from 265 and maintained a buy rating on the shares. The firm wrote Tesla may benefit from a shift to a federal regulation of autonomous vehicles and full self-driving, or FSD, nationwide.

Tesla China sold 68,280 vehicles in October, including exports, a six-month low, according to China Passenger Car Association data released Monday. Local China sales were sluggish in October, just 40,485. Exports did jump in the month, but have been trending lower.

Cathie Wood Cuts Tesla Stake

Meanwhile, Cathie Wood and her Ark Investment Management firm have sold Tesla stock repeatedly since Oct. 28 when Ark Invest unloaded more than 120,000 shares, according to the company’s daily trade disclosure. Over this stretch, Wood has sold more than 330,000 shares, including selling 85,019 TSLA shares on Thursday.

As of Nov. 8, Tesla stock is the top holding in the ARK Innovation ETF (ARKK) with a 14.21% weight. Tesla ranks second in ARK Next Generation Internet (ARKW) with a weight of 9.66%. The EV company is also the top stock in ARK Autonomous Tech (ARKQ) with weight of 14.87%.

Tesla Robotaxi Event: Cybercab, Robovan Unveiled; Musk Sees Self-Driving ‘Next Year’

Tesla stock ranks second in the 35-member IBD Auto Manufacturers industry group. The stock has an 85 Composite Rating out of a best-possible 99. Shares also have a 93 Relative Strength Rating and a 77 EPS Rating.

Please follow Kit Norton on X @KitNorton for more coverage.

YOU MAY ALSO LIKE:

Is Tesla Stock A Buy Or A Sell?

Get Full Access To IBD Stock Lists And Ratings

Learning How To Pick Great Stocks? Read Investor’s Corner

AI Is Fueling A ‘Nuclear Renaissance.’ Bill Gates And Jeff Bezos Are In The Mix.

Market Roars, Tesla Tops $1 Trillion; Five Stocks Still In Range