Dividend growth investing isn’t about maximizing current income. Nor should it be confused with traditional growth investing. In fact, the Morningstar US Dividend Growth Index currently falls on the value side of the US stock market.

What exactly is a dividend growth strategy, then? You might hear it pitched as a “quality”-focused investment approach, with “defensive” characteristics. Companies growing their payouts to shareholders are, in theory, financially secure. Their competitive positions are generally strong, even strengthening. By reputation, dividend growth stocks are less volatile than the broad market. These attributes have attracted billions in investor capital to funds with “dividend growth” in their names.

Yet, dividend growth stocks have underperformed the broad US equity market over the past decade or so. Granted, they have not lagged as far behind as the high-yield section of the market. But, as a group, they’ve failed to keep up.

What’s behind their struggles? And what can an analysis of the Morningstar US Dividend Growth Index and its near 400 constituents tell investors—both about dividend growth investing specifically and the changing nature of today’s equity market?

Not Everything You Hear About Dividend Growth Stocks Is True

The Morningstar US Dividend Growth Index includes large-, mid-, and small-cap companies with a five-year history of increasing their cash payouts to shareholders. Five years isn’t as long a history as required by some other dividend growth indexes, but the emphasis is on future dividend growth. To be part of the index, companies must display positive consensus earnings forecasts and must not have a payout ratio exceeding 75%. As of July 2025, 397 US companies met the index criteria.

You might be surprised to hear that the Morningstar US Dividend Growth Index, and other dividend growth strategies as well, score below the broad stock market on measures of corporate “quality” today. Dividend growth stocks currently fall short of the Morningstar US Market Index in terms of profitability, financial strength, and returns on capital. The Morningstar US Dividend Growth Index also has less exposure to “wide moat” businesses, though it also has less exposure to “no moat” companies and more exposure to “narrow moat.”

How can this be? Compare the top 10 constituents of the Morningstar US Dividend Growth Index to those of the broad equity market as represented by the Morningstar US Market Index. You’ll see how concentrated the “broad” market has become in key technology and tech-adjacent companies—only a few of which are dividend growers.

The dividend growth index does not include phenomenally profitable, wide-moat stocks Nvidia NVDA, Amazon.com AMZN, Alphabet GOOGL, and Meta META. It contains Microsoft MSFT but at less than half the market weight. These lighter exposures help explain the “quality” gap.

They also help explain the underperformance. The biggest factor in the dividend growth index’s lagging returns is its below-market weight to technology stocks. The second-biggest factor is not including Alphabet and Meta among its constituents, both of which were reclassified to the communication services sector in 2018.

Despite underperformance, the Morningstar US Dividend Growth Index lives up to the strategy’s reputation for defensiveness. It has been notably less volatile than the market. During selloffs in 2018, 2022, and mid-February through early April 2025, it lost less than the Morningstar US Market Index. In this case, not including some of the Magnificent Seven (Alphabet, Amazon.com, Apple AAPL, Meta Platforms, Microsoft, Nvidia, and Tesla TSLA) was an advantage. The market’s highest flyers have fallen furthest in several recent shifts from “risk on” to “risk off.” Being less concentrated by constituent has also mitigated volatility. The dividend growth index has less “stock-specific risk” than the market overall.

How Has the Market’s Dividend Growth Profile Changed?

There’s no question that paying a dividend is a sign of maturation. When Meta and Alphabet initiated quarterly payouts to shareholders in 2024, it was taken as a sign they were entering a new life stage. Of the largest 10 stocks in today’s market, only Amazon, Berkshire Hathaway BRK.B, and Tesla do not pay dividends. Companies growing dividends signal balance sheet strength and a shareholder focus.

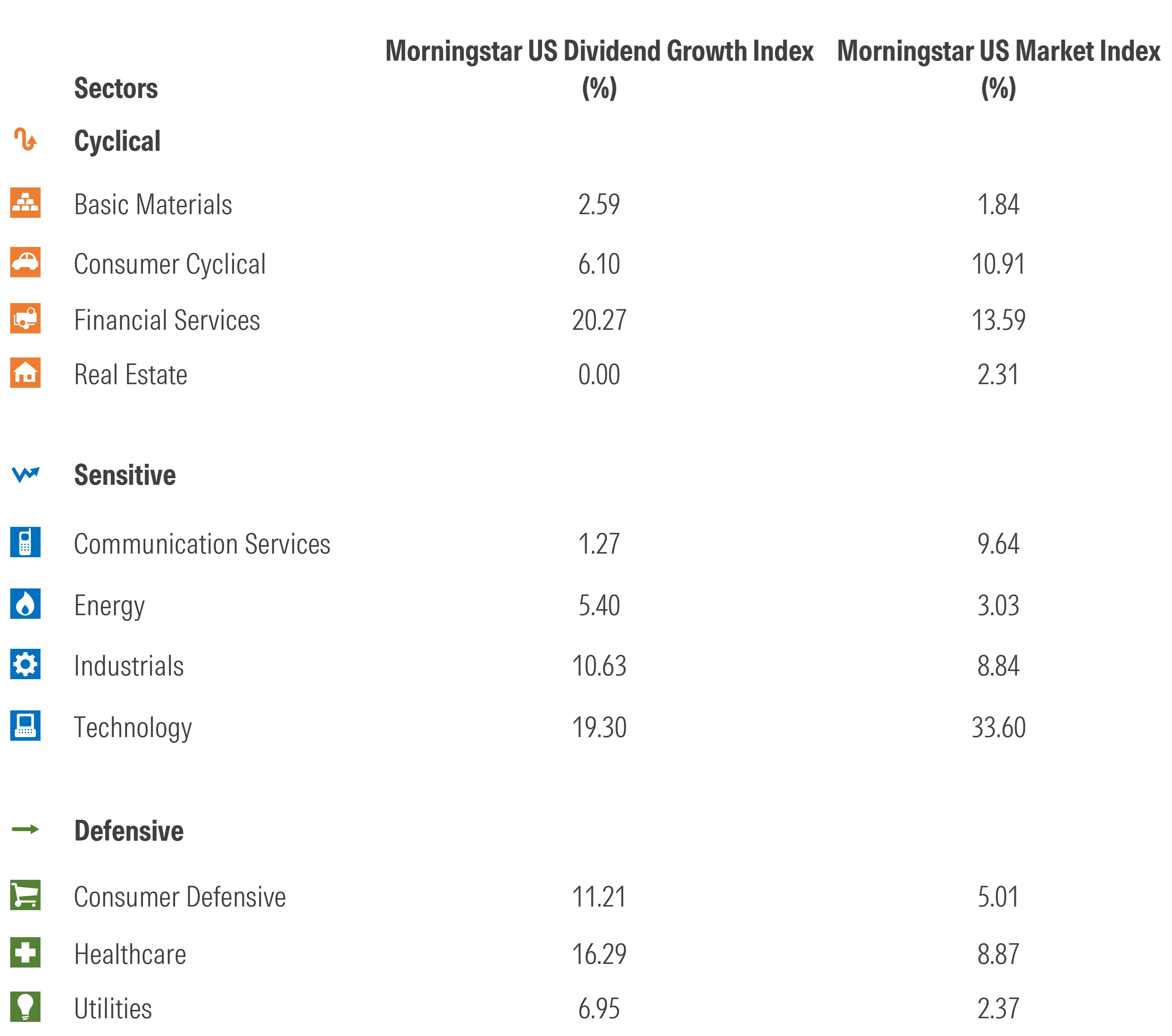

So, what sections of the market are strongest in dividend growth? From a sector perspective, the Morningstar US Dividend Growth Index is lighter on technology and communication services than the overall market. That said, tech stocks are growing dividends more than in the past, with Microsoft as the index’s top constituent. Ten years ago, tech stocks were roughly 12% of the dividend growth index, whereas they now approach 20%. That’s still well behind their share of the broad US stock market, which surpasses one third. Clearly, many technology businesses prefer to reinvest cash and repurchase shares.

Financial services and healthcare are also sectors that have grown richer in dividend growth. Top constituents include JPMorgan Chase JPM, Bank of America BAC, Morgan Stanley MS, Citigroup C, Goldman Sachs GS, and Visa V. Insurers and financial data providers are also a big chunk of the dividend growth universe. Within healthcare, dividend growers span Big Pharma, medical devices, and health insurers.

What areas of the US market have become less fertile for dividend growth? While industrials stocks still represent above-market exposure for the index, its share of the dividend growth universe has fallen over time (with the aerospace and defense industry an important exception). Consumer-related stocks also represent a smaller part of the universe than they once did, though Procter & Gamble PG and Home Depot HD remain top 10 constituents, and both Coke KO and Pepsi PEP make the top 20.

Sectors like utilities, energy, and basic materials remain an important part of the dividend growth universe. These traditional high-yield equity sectors boost the Morningstar US Dividend Growth Index’s yield and push it to the value side of the market. But that’s not to say there’s no earnings growth coming from these areas. For instance, utilities are benefiting from artificial-intelligence-driven power demand. Materials companies supply minerals critical to renewables, as well as key agricultural inputs. Traditional oil and gas-related businesses are continuing to rake in cash, even as an energy transition is underway.

What Does This Mean for Dividend Growth Investors?

As a group, dividend growers currently fall short of the overall market on measures of “quality.” It has been hard to keep up with the Magnificent Seven when it comes to both profitability and performance.

But that doesn’t mean dividend growers aren’t healthy businesses. What’s more, they’re trading at lower multiples than dividend-light growth stocks. Like any bet against the market, dividend growth will go through periods of outperformance and underperformance. If technology stocks stumble, and sectors like healthcare, financials, and consumer defensives perk up, dividend growth’s relative returns will improve.

What’s encouraging is that dividend growth has delivered a smoother ride than the broad market. Even if it doesn’t always live up to its reputation for “quality,” dividend growth investing can stake a valid claim at being a “defensive” strategy. Companies growing their dividends remain a perfectly reasonable route to equity market participation, especially for risk-averse investors.

Morningstar, Inc., licenses indexes to financial institutions as the tracking indexes for investable products, such as exchange-traded funds, sponsored by the financial institution. The license fee for such use is paid by the sponsoring financial institution based mainly on the total assets of the investable product. A list of ETFs that track a Morningstar index is available via the Capabilities section at indexes.morningstar.com. A list of other investable products linked to a Morningstar index is available upon request. Morningstar, Inc., does not market, sell, or make any representations regarding the advisability of investing in any investable product that tracks a Morningstar index.