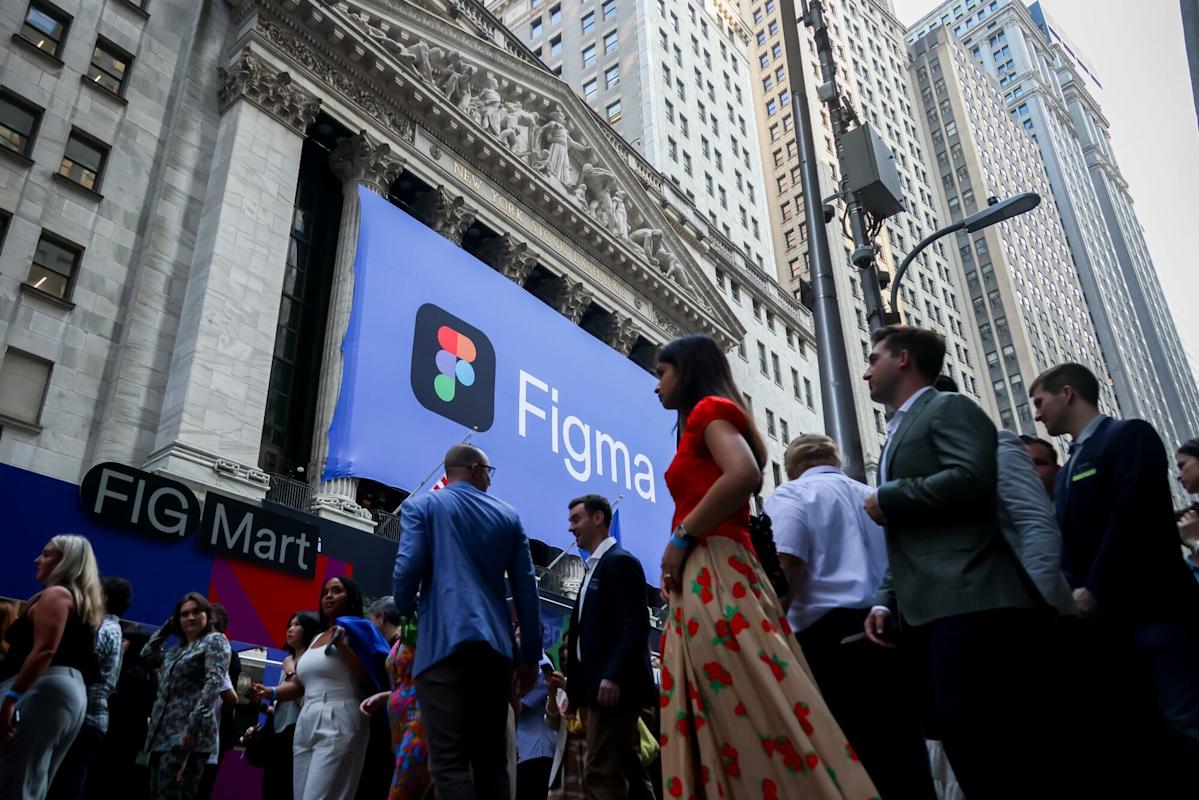

(Bloomberg) — Figma Inc. has taken investors who pounced on the year’s hottest initial public offering for a wild ride, shedding $21 billion from a peak in the days following its record-breaking IPO.

Most Read from Bloomberg

The San Francisco-based company’s shares have been trading on-and-off all week below the $85 level, where they opened on July 31, their first day in the market. Despite modest rebounds, the design software firm’s stock has given back much of the increase that briefly mesmerized Wall Street.

Figma’s 250% first-day pop was the largest in at least three decades for a US-listed company that raised more than $1 billion, data compiled by Bloomberg show. After further gains last week that lifted the stock to more than quadruple the price IPO buyers paid, Figma is now trading at around $80, down from a peak of $142.92 on Aug. 1.

“Figma was a testimony to the speculative nature of this market, abetted by some of the peculiarities of the IPO process,” said Steve Sosnick, chief strategist at Interactive Brokers. “Folks will probably lose interest and move onto the next situation if the stock persists below its opening print, even with the stock still up more than double over its IPO price.”

Part of the raucous debut can be credited to a tiny pool of available shares to trade — just 7% of the outstanding stock is in the public domain — meaning it was partly a product of an imbalance in demand and supply.

While recent debutants like Circle Internet Group Inc. have seen eye-popping returns, the drop off in trading volume and chatter on social media platforms that cater to individual investors show the group moved on after a few days as activity stalled. Recent IPOs including CoreWeave Inc. and Circle have more than tripled from their IPO prices, though both have wiped out more than 30% of their value from closing highs.

Figma’s market value currently stands at roughly $39 billion, down from a closing peak of almost $60 billion. However, the current price is still well above the range investors had been pitched in meetings before the IPO. The stock now trades at a price-to-sales ratio of roughly 37, vastly outstripping comparable firms like Adobe Inc., which attempted to buy Figma in 2023 and trades at a less than six times sales.