Meta is set to report earnings after the U.S. market closes on July 30, bringing the “Magnificent Seven” tech earnings season to its peak.

As a front-runner in AI applications, Meta’s stock has surged nearly 20% this year—well ahead of the S&P 500 and leading all peers among the Magnificent Seven.

The market expects Meta to post Q2 revenue of $44.71 billion, up 14% year-over-year, with adjusted net income of $19.92 billion, up 10%. Earnings per share are expected to come in at $5.85. Analysts’ average price target stands at $750.

Meta’s most critical businesses remain its Family of Apps and advertising.

According to research by Deutsche Bank, Meta’s Q2 ad revenue growth showed a 1% sequential acceleration, with further improvement expected in Q3—well above Wall Street consensus. The key driver of this strong performance is Meta’s Advantage+ ad platform, which significantly improves return on ad spend (ROAS) and is expected to be a lasting source of revenue growth.

While retaliatory tariffs in April caused a sharp drop in ad spending by Chinese e-commerce clients, the overall industry demand remained solid. Moreover, since mid-May, ad revenue has started to rebound as tensions between China and the U.S. eased.

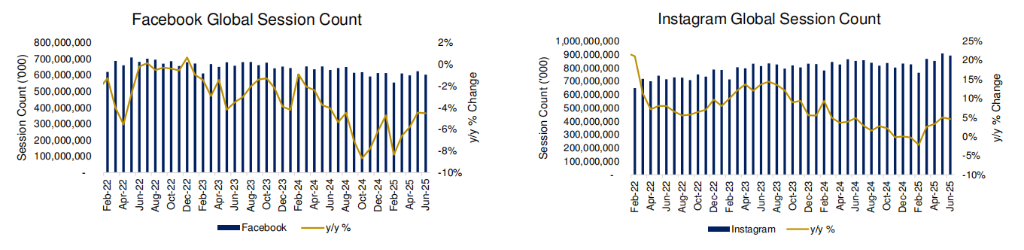

Moving on to Meta’s Family of Apps, Deutsche Bank expects both Facebook and Instagram global session counts to exceed expectations in Q2.

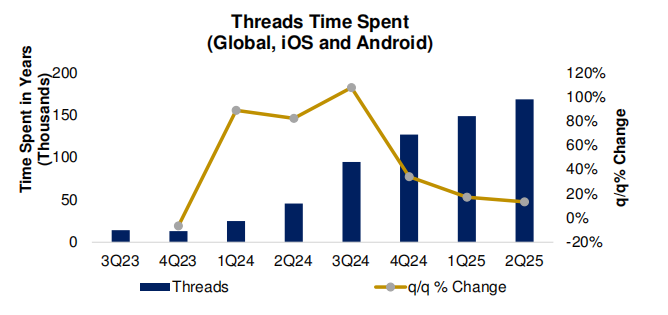

Threads also saw a 13% increase in user time spent quarter-over-quarter.

Additionally, this quarter Meta began monetizing WhatsApp through paid ads. Evercore estimates that under conservative assumptions, this initiative could generate over $10 billion in annual ad revenue and $5 billion in operating profit by fiscal year 2028.

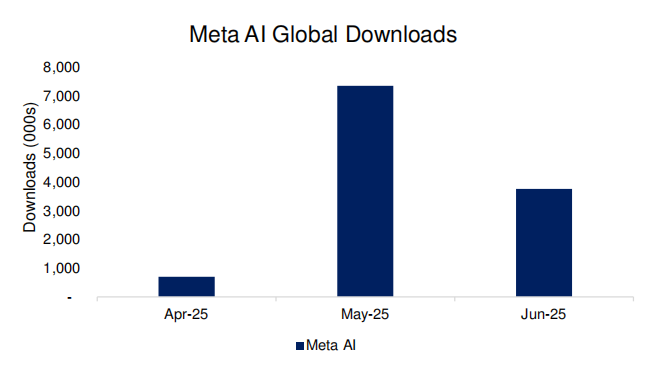

Meta also launched its standalone Meta AI app in late April. The app has already surpassed 11 million downloads globally, with enthusiastic early feedback from users.

Outside its core ad business, Meta also maintains its metaverse segment(Reality Labs)—a division that prompted the company’s name change from Facebook to Meta. Although the metaverse was a hot topic in 2021, its public attention has significantly faded in recent years. This unit continues to post losses and contributes very little to overall revenue.

Still, its AI-powered smart glasses have become leaders in the global VR market, receiving far greater market acceptance than Apple’s Vision Pro. If this product line delivers strong performance, it will be another highlight worth watching.

In terms of capital expenditure, Meta recently announced plans to invest hundreds of billions of dollars to build massive AI data centers and committed $14 billion to Scale AI. At the same time, CEO Mark Zuckerberg is reportedly spending hundreds of millions to recruit top-tier AI engineers.

With the AI race heating up, there’s only one direction for capital expenditure: up. One thing is certain—Nvidia’s earnings will likely exceed expectations again.