The deposit protection limit for savers if their bank or building society fails could be raised from £85,000 to £110,000 under new proposals from the Bank of England.

The Financial Services Compensation Scheme deposit protection limit is to rise by £25,000, or 29 per cent, to reflect inflation over the past eight years and better protect savers. The Bank’s Prudential Regulation Authority suggested that the increase, the first in the FSCS limit since 2017, could be introduced between December and next May if the proposals are approved by the Treasury.

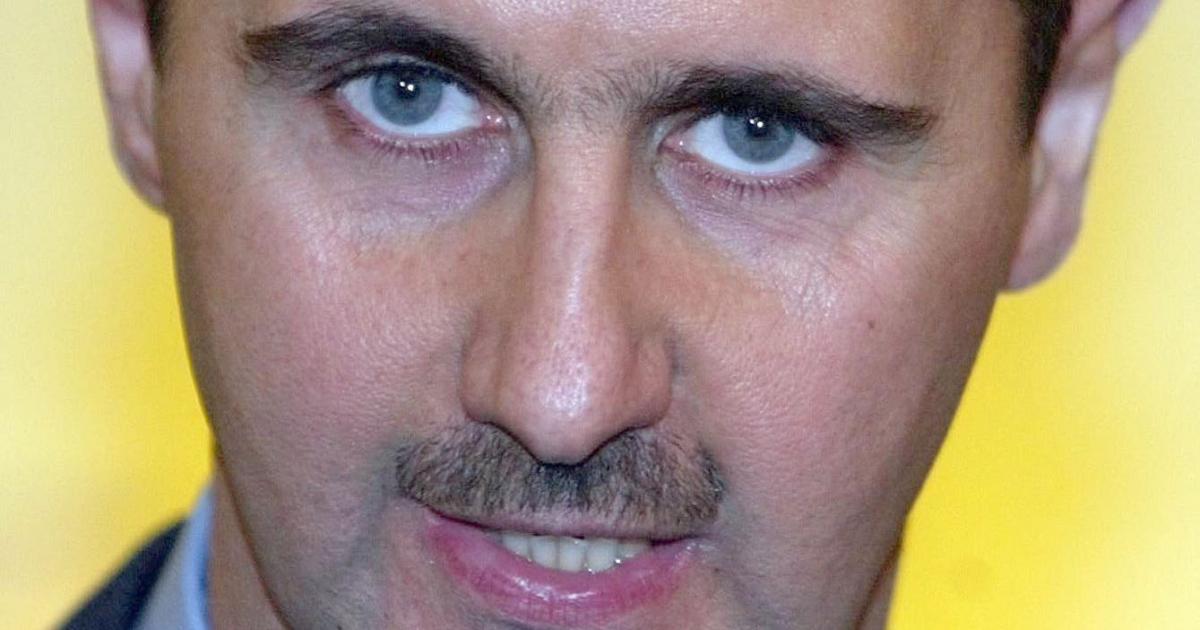

Sam Woods, deputy governor for prudential regulation and chief executive of the PRA, said: “Confidence in our financial system is an essential foundation for economic growth.

“We want to support confidence in our banks, building