(Bloomberg) — The price of China’s mainstay fuel, powering millions of homes and factories, has hit the lowest level in over a year, as the government’s efforts to boost the economy fail to revive tepid demand.

Most Read from Bloomberg

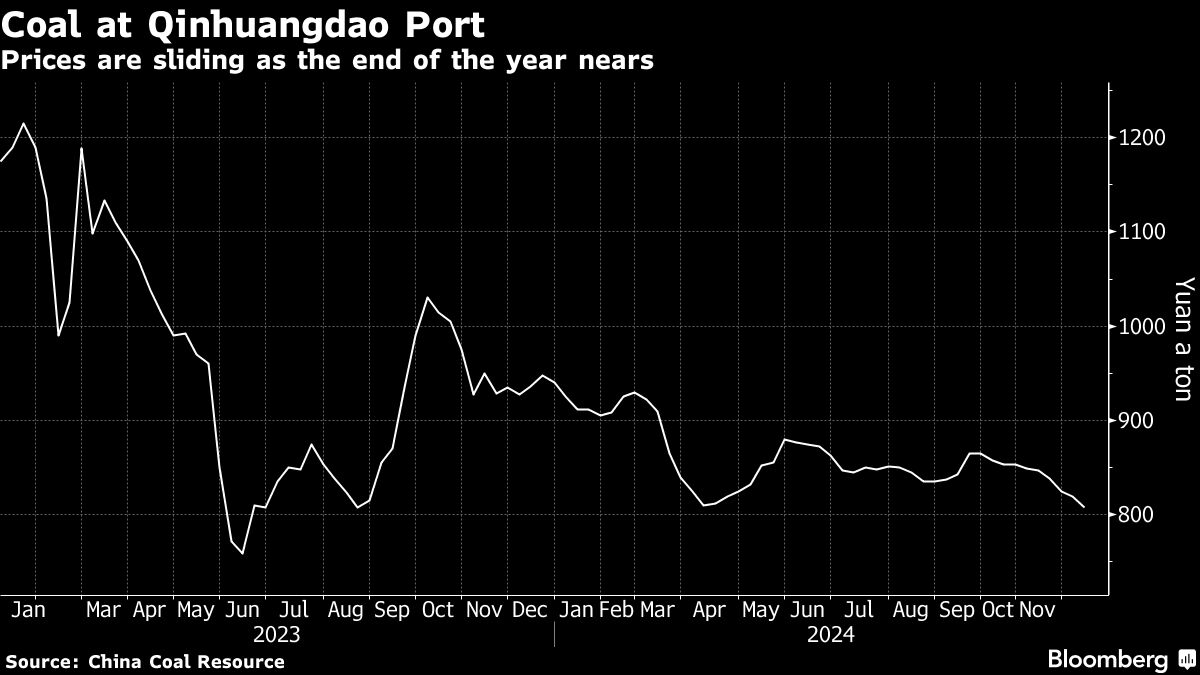

The benchmark coal price at Qinhuangdao port slipped to 803 yuan ($110) a ton on Thursday, according to Chinese news outlet Thermal Group, which is close to the break-even level for cargoes traveling from remote mines in western China. It’s also the lowest since June last year, when prices briefly dropped below 800 yuan.

China’s coal market has been in steady decline since late September and has shed 14% from its high near the start of the year. Utilities are sitting on record inventory, which is deterring purchases, while industrial demand remains weak, according to a market report on Thursday on the Erdos trading platform. The slide is likely to be exacerbated by a lull in economic activity over Chinese New Year, which falls at the end of January.

China has flipped to a surplus of the fuel after Beijing pushed domestic production and imports to record levels to safeguard energy security following shortages earlier in the decade. The country’s surfeit of coal has only expanded after its exit from the pandemic failed to deliver the expected boost to the economy, while the government’s recent efforts to stimulate growth are yet to have a marked impact on demand.

China’s production capacity is expected to keep growing next year, although imports could slow, according to a report from Morgan Stanley last month. Weak prices are testing miners’ profitability, and 45% were loss-making in the year through October, the China National Coal Association said Friday. Over the same period last year, the figure was 42%.

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.